Michael ‘Big Short’ Burry Rage-Quits Market, Liquidates Hedge Fund

We’ll begin with the famous quote from economist John Maynard Keynes: “The market can stay irrational longer than you can stay solvent.”

It’s a reminder that even the smartest traders in the room, the ones who’ve built entire careers calling bubbles and shorting tops, can be steamrolled when markets detach from reality.

Case in point: “Big Short” investor Michael Burry, who periodically disappears into X hibernation, nuking his account every so often, only to reemerge months later with cryptic warnings like his latest: “Sometimes, we see bubbles.”

Sometimes, we see bubbles.

Sometimes, there is something to do about it.

Sometimes, the only winning move is not to play. pic.twitter.com/xNBSvjGgvs— Cassandra Unchained (@michaeljburry) October 31, 2025

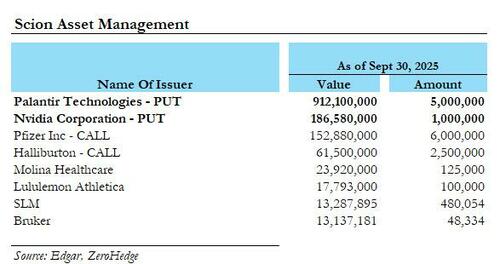

Days after Burry’s bubble post on X, his Scion Asset Management 13F revealed that roughly 80% of his put positions were concentrated in the high-flyers Palantir and Nvidia.

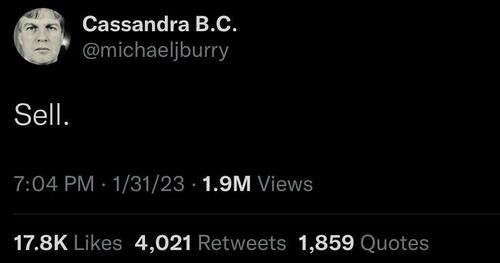

Fast forward one week, and the unthinkable has happened, or perhaps thinkable, given his 2023 “Sell” call…

… Burry’s Scion Asset Management terminated its SEC registration on Monday.

By Thursday night, Burry’s X post clarified details about his recent bearish bet on Palantir, noting he bought 50,000 option contracts at $1.84 each, representing 100 shares per contract, for a total outlay of about $9.2 million, not the $912 million figure circulated online. The contracts give him the right to sell Palantir shares at $50 in 2027.

“That was done last month. On to much better things, Nov. 25,” he wrote.

So, I bought 50,000 of these things for $1.84.

Each of those things is 100 doodads.

So I spent $9,200,000,Not $912,000,000. @CNBC @WSJ @FT

Each of those doodads let me sell $PLTR at $50 in 2027.

That was done last month.

On to much better things Nov 25th. pic.twitter.com/9Voy3nwiTD— Cassandra Unchained (@michaeljburry) November 13, 2025

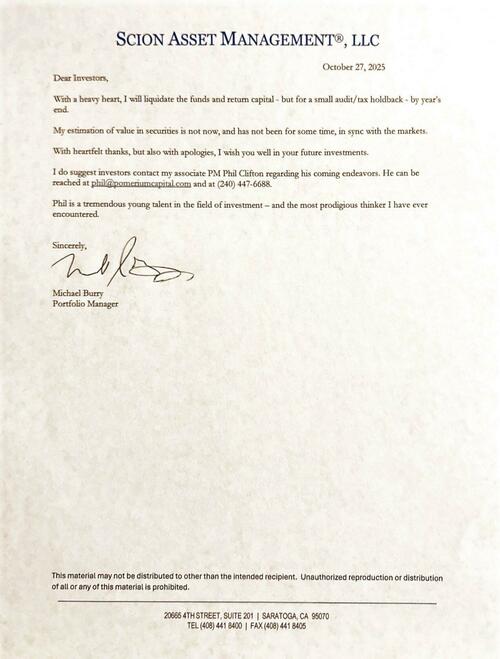

Burry sent a letter to investors late last month, noting: “With a heavy heart, I will liquidate the funds and return capital — but for a small audit/tax holdback — by year’s end.”

Almost admitting he is wrong: “My estimation of value in securities is not now, and has not been for some time, in sync with the markets.”

The letter is circulating on X and has not yet been confirmed.

ZeroHedge commentary on Burry’s 13Fs from last week:

All we know is that Burry appears to once again be swinging for the bubble fences, similar to what he did during the housing bubble, and is shorting the two names that are most synonymous with the current market mania — similar to what he did in 2008 when he was shorting housing using CDS.

We also know that since both names are sharply higher than where they were on Sept. 30 (the date of the 13F), Burry has already suffered substantial losses on his positions, assuming he hasn’t already liquidated them (at a loss).

And while some will declare that Burry putting his money where his bubble-bursting mouth is a sign of the top, we have two words of caution: back in 2005, Burry was early by about two years, and even though he ultimately got the trade right, the carry on the CDS crushed him. Second, the last time Burry tried to top-tick the market was January 2023 when he blasted the one-word “Sell.” The market is up 69% since then.

Bloomberg Intelligence Eric Balchunas’ first take on Burry “taking his ball and going home”:

1. Shows how bears win battles but bulls win wars.

2. Arguable a top signal that this mkt broke him, echoes Ted Aronson closing his value fund in similar existential crisis manner just prior to 2022 value comeback (brutal).

3. NO ONE KNOWS THE FUTURE (even ppl who get portrayed by Christian Bale in a movie, which may be the coolest thing that can happen to someone).

Ouch!

Michael Bury is arguably the worst investor of our generation. Here are 12 of his most smooth brained predictions.

Jan 2017 – Predicted a global financial collapse and WW3 were imminent.

Sep 2019 – Claimed index funds were the next CDOs, ready to implode like 2008.

Dec 2020 –… pic.twitter.com/KyWEyWBe6J

— RJC (@RJCcapital) November 12, 2025

Back to Keynes’ quote about bears being steamrolled in bubbles… What is Burry’s next move?

Tyler Durden

Thu, 11/13/2025 – 08:50ZeroHedge NewsRead More

R1

R1

T1

T1