Economic Reacceleration: A Contrarian View

Authored by Lance Roberts via RealInvestmentAdvice.com,

Over the past two weeks, we’ve addressed a persistent question: if the data signals weakness, why hasn’t the recession arrived? In “Slowdown Signals: Are Leading Indicators Flashing Red?” we examined the cracks forming beneath the economy’s surface. From deteriorating leading indicators to credit stress and cooling employment metrics, the evidence supported a cautious stance. In the follow-up, “Promised Recession … So Where Is It?”, we explored the tension between these bearish signals and the market’s resilience. Economic risk has not disappeared, but the timeline for a downturn has stretched further than most expected.

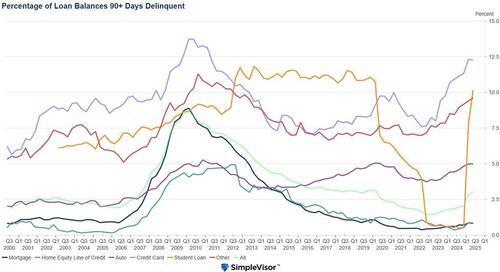

Both articles’ tone was analytical but precise: the economy has not escaped danger. Leading economic indicators flash warning signs, from the Conference Board’s LEI to the ISM Manufacturing Index. Credit conditions remain tight with delinquencies on the rise, and employment trends, while stable on the surface, have started to weaken in rate-sensitive areas.

The consumer, long the backbone of the post-pandemic recovery, shows signs of fatigue. Excess savings have dwindled, credit card usage is climbing, and real wage gains have slowed. These are not signals of strength, but of late-cycle fragility.

Yet, despite these risks, the economy has not broken. The recession expected by most economists, strategists, and market commentators has yet to arrive. The S&P 500 continues to grind higher. Volatility remains muted. Consumer spending, while uneven, has not collapsed. And corporate earnings, though pressured in some sectors, have not cratered.

This divergence between bearish data and market behavior raises an important question: could the consensus be wrong? More specifically, what if the economy is not headed for contraction, but toward a renewed phase of expansion? That’s the contrarian view, an economic reacceleration, and it’s worth considering, not because it is guaranteed, but because few are prepared for it. In markets, surprises matter more than forecasts. If the surprise is upside growth, the implications for asset prices, portfolio strategy, and risk management could be substantial.

Let’s dig into it.

The Case for Economic Reacceleration

While consensus remains cautious, there is a case, however tenuous, for economic reacceleration. This isn’t about ignoring risks. It’s about acknowledging that conditions aligning could drive a shift from stagnation to renewed growth.

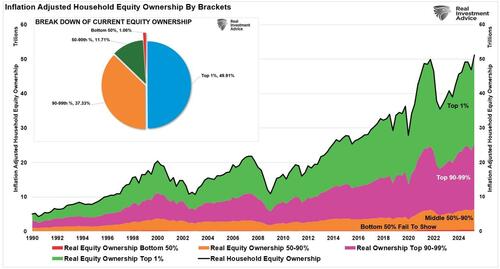

First, financial conditions have eased substantially since late last year. Despite the Fed maintaining higher policy rates, markets have pushed bond yields lower and credit spreads tighter. Equities have rallied, creating a wealth effect that supports consumption, at least within the top 10% of the population that owns 87% of the equity market. Furthermore, the top 40% of income earners currently account for 60% of total consumption.

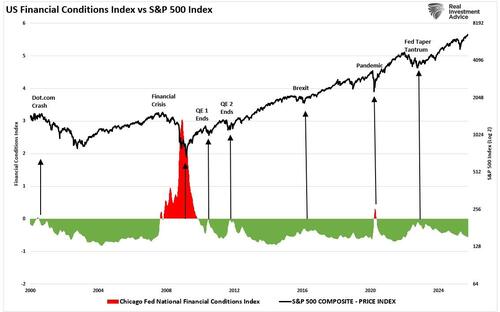

Adding to that backdrop, the Chicago Fed National Financial Conditions Index has turned increasingly accommodative, suggesting that monetary policy’s grip on the economy is slipping. This eases the burden on consumers and businesses, setting the stage for renewed activity.

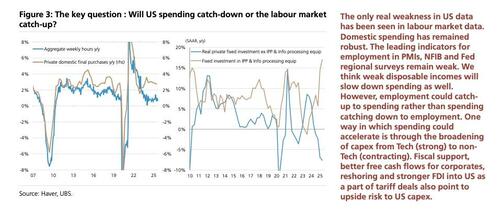

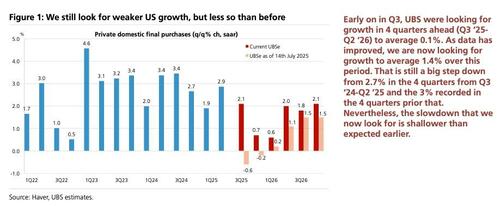

Third, fiscal support remains more robust than many acknowledge. Federal spending continues at a high level, with infrastructure outlays and industrial policy subsidies supporting investment in energy, manufacturing, and technology. These initiatives feed directly into corporate capital expenditures. The AI investment boom is a clear example of spending accelerating not just in “big tech,” but across the industrial supply chain. UBS has flagged this emerging capex cycle as a significant tailwind for mid-cycle expansion, which could offset a slowdown in consumer spending.

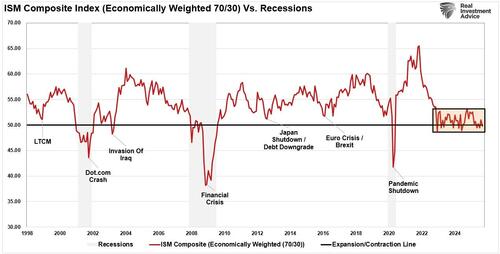

Fourth, labor market dynamics are more stable than the headlines suggest. While job openings have declined, layoffs remain low. Real disposable income has started to recover, supported by moderating inflation. This income stability allows consumers to maintain spending despite rising debt levels. Goldman Sachs has emphasized that consumption trends, particularly in services, remain strong enough to support growth in the near term. In the economically weighted ISM surveys, services (70% of the economy) are keeping the composite index in expansion territory.

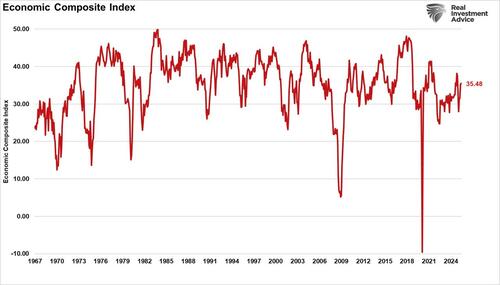

Finally, there is the issue of data distortion. In recent months, significant revisions have been made to payrolls and GDP. Preliminary reports painted a picture of sharp deceleration, only for final data to show much more resilience. Goldman has warned that headline data may be underestimating actual activity. If that’s true, the economy may not need to rebound; it may already be stronger than it appears. We also see improvement in the Economic Composite Index, which comprises more than 100 data points, including manufacturing, services, leading indicators, and other economic factors.

Combined, these factors do not guarantee a reacceleration but offer a plausible case. They suggest the economy may be more resilient, supported, and responsive to easing conditions than the bearish narrative implies.

Supporting the Bull Market: Earnings and Valuation

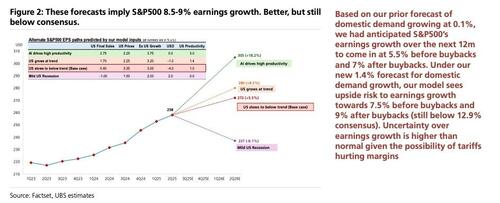

If reacceleration gains traction, it becomes a fundamental driver of earnings growth. That’s the critical link. The equity rally has run ahead of fundamentals in some sectors. Valuations, particularly in technology and discretionary names, are stretched. Without earnings growth, they cannot be sustained. However, an economic reacceleration changes that dynamic. A pickup in nominal GDP would lift revenues. Stabilizing costs and improving operating leverage could support margins. As top-line growth returns, analysts would raise forward earnings estimates.

As UBS notes, they expect stronger earnings growth going into 2026, supported by stronger economic growth.

This path is especially relevant given the current market structure. Much of this year’s performance has been driven by a handful of mega-cap names; therefore, a broader earnings recovery, driven by an economic reacceleration, would allow the rally to widen. This is the theory, at least, and as breadth improves, volatility drops, and price-to-earnings multiples become more sustainable.

However, as we have noted previously, we had booming economic growth in 2020 and 2021, but the earnings growth remained confined to the largest companies. As shown in the chart above, earnings growth for the 493 remained weak. However, the expectation is that an improvement in economic growth, but not strong growth, will somehow allow the bottom 493 stocks to generate earnings growth as the Capex cycle for artificial intelligence engages. Maybe that is the case, but it remains a risk to investors. Nonetheless, the hope is that the economic reacceleration thesis, not a call for explosive expansion, will allow for durability in the current cycle, allowing the earnings tailwind to extend the bull market further than most expect.

Final Thoughts

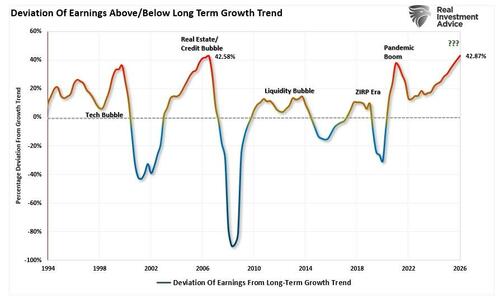

For us, risk management remains essential. The case for economic reacceleration is certainly plausible, but it is also based on much “hope.” Hope that consumers will continue to consume at a strong pace, that AI Capex will offset declining savings risk, and that earnings will continue to sustain themselves well above long-term growth trends indefinitely to support current valuations. That seems to be a significant risk.

While there is certainly risk that “hopes” are disappointed, as investors, we must consider the possibility that an economic reacceleration comes to fruition. Such could leave overly defensive investors underexposed to equities, creating significant opportunity costs. Currently, many investors remain positioned for stagnation or slow deterioration. While that positioning aligns with the data, the yield curve, and historical patterns, the markets rarely reward consensus thinking. If reacceleration unfolds, it will catch many investors with an underweighted risk exposure.

Positioning for this shift does not require full conviction. But it does require readiness. Watch leading indicators for signs of stabilization. Monitor earnings revisions and forward guidance. Track credit spreads and yield curve behavior. These are the tells.

The opportunity lies in being early but not reckless. If growth is turning, earnings will follow, and earnings ultimately sustain bull markets.

Just something to consider.

Tyler Durden

Fri, 11/14/2025 – 14:20ZeroHedge NewsRead More

R1

R1

T1

T1