Corporate Bankruptcies On Pace For 15-Year High As More “Isolated Incidents” To Occur

First came the spectacular implosions of subprime auto lender Tricolor and auto-parts supplier First Brands. Then came the regional-bank fiasco, prompting JPMorgan CEO Jamie Dimon to warn that more late-cycle accidents may be ahead. Add in signs that lower-income consumers are tapped out, frothy valuations across the AI equity sphere, and even Bitcoin sliding below $100,000, and it’s no surprise that many are beginning to wonder whether mounting financial stress signals the early stages of a broader downturn.

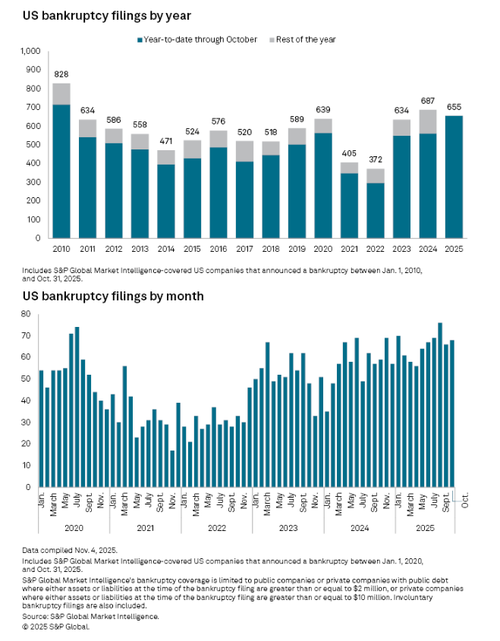

Another flashing red warning sign is new data from S&P Global this past week, showing that through October, 655 companies have filed for bankruptcy, nearly matching the 687 total for all of 2024.

S&P Global data showed that in October alone, there were 68 new corporate bankruptcies filings. In August, there were 76 filings, the highest monthly tally since at least 2020.

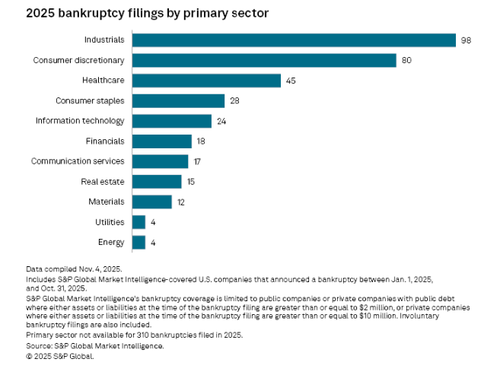

Industrials lead the charge with 98 filings, reflecting the group’s vulnerability to snarled supply chains related to tariffs. Then, consumer discretionary firms followed with 80 bankruptcies so far this year.

At current pace, corporate bankruptcies could reach a 15-year high by year’s end.

The Tricolor and First Brands implosions earlier this fall were certaintly a wake-up call. Regional bank woes and now lower- and middle-income consumers are exhausted, all combined, suggesting softening of the economy in the late year. The record 43-day government shutdown certainly compounded problems.

“I view those few incidents as idiosyncratic but expect more of these ‘isolated incidents’ to occur, potentially in other sectors like software, which has increased leverage in that market while capital flows to AI capex,” Clayton Triick, head of portfolio management of public strategies at Angel Oak Capital Advisors, told S&P Global Market Intelligence.

Here are the notable bankruptcies this year.

In mid-October, JPM CEO Jamie Dimon sparked some controversy in banking and finance circles with this comment: “My antenna goes up when things like that happen. I probably shouldn’t say this, but when you see one cockroach, there are probably more.”

UBS analysts, led by Jonathan Pingle, told clients days ago, “Our base case is that an equity market drawdown is avoided. Households suffer for the next two quarters.”

However, Pingle noted that a $55 billion boost to disposable income in 2Q 2026 from retroactive tax relief in the One Big Beautiful Bill Act (OBBBA) will lift consumer sentiment in the early spring. Plus, all the infrastructure buildouts, reshoring, data center construction, and the list goes on and on, will likely begin to filter into the real economy early next year – all in time for midterms.

So from now until economic tailwinds emerge, the Trump administration has launched Operation Affordability, focusing on lowering prices to lift low-income consumers and improve sentiment ahead of the midterms.

Tyler Durden

Sun, 11/16/2025 – 18:05ZeroHedge NewsRead More

R1

R1

T1

T1