Stocks Slide After Amazon Shocks With Another Massive Bond Offering, But Rebound On News Boaz Weinsten Selling Hyperscaler CDS

Just when it seemed that risk was about to stabilize, this morning Amazon decided to add more supply to the biggest trade of 2026 – which, as BofA’s Michael Hartnett, laid out over the weekend is shorting hyperscaler bonds – when it announced that it was planning to raise about $12 billion through a bond sale – its first such deal in US dollars in about three years – adding to a wave of massive technology debt offerings as companies race to fund AI datacenters.

The investment-grade offering will be in six parts, with initial price talk for the longest portion of the deal, a 40-year bond, said to be at 1.15% above Treasuries.

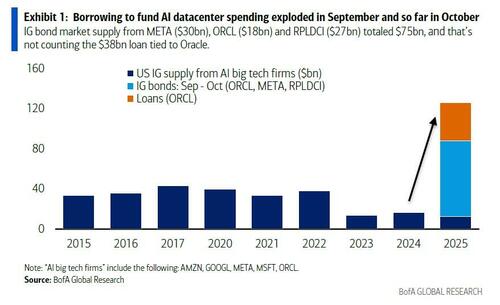

As discussed extensively here – we were first to note that the AI bubble is now also in bonds as well as stocks – Monday’s sale comes after Google parent Alphabet earlier this month sold $25 billion of debt in the US and Europe; meanwhile, Meta issued $30 billion of corporate bonds last month, the biggest such offering of the year, while Oracle raised $18 billion through high-grade notes in September, eventually sending the CDS of the cash flow negative company (whose cash level may turn negative according to Barclays) to multi-year highs. It means that the already ridiculous chart of 2025 outlier AI debt is about to become even more ridiculous.

Proceeds from AMZN’s offering may be used for everything from acquisitions and capital expenditures to share buybacks, according to people with knowledge of the matter. Goldman Sachs Group Inc. JPMorgan and Morgan Stanley, both firms who have recently warned about the aggressive buildout of the AI cycle (here and here) are managing the bond sale.

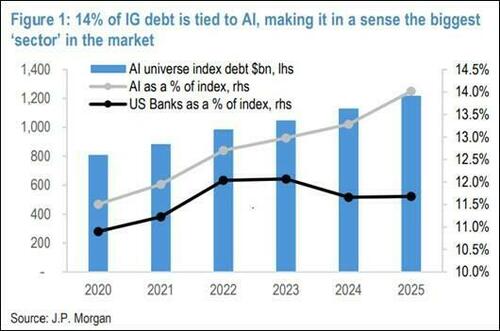

The debt issuance spree from the tech giants has helped push global issuance to a record of more than $6 trillion this year. JPMorgan expects the fresh wave of spending to finance investments in artificial intelligence to drive issuance in the US high-grade-grade market to a record $1.81 trillion next year, which is why CDS across the entire sector started moving wider the moment Amazon’s news hit.

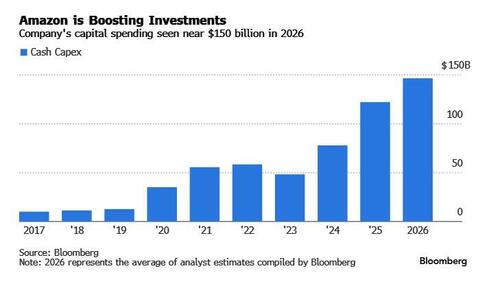

Amazon’s capital expenditures are expected to top $147 billion next year, roughly three times the level seen as recently as 2023 — according to the average of analyst estimates compiled by Bloomberg. This is an “opportune” time for Amazon, which has so far relied primarily on its own cash flow to fund investments, to incorporate debt into its capital structure to expand funding flexibility, JPMorgan wrote in a note last week. Amazon is the world’s largest seller of rented computing, and like its biggest rivals, the company has been investing heavily in data centers and chips to build and run AI models capable of generating text or images and automating processes.

“Amazon could also look to private credit markets to structure financing around its extensive data center footprint,” JPMorgan added, citing the potential for sale-leaseback or joint-venture-style vehicles.

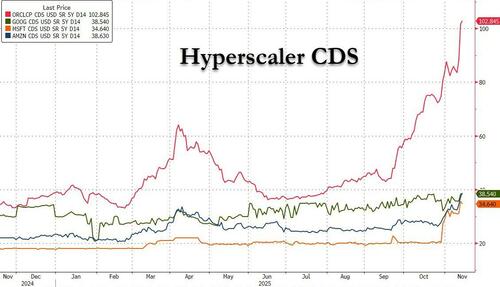

But while the Amazon news spooked markets, shellshocked by the dramatic ramp up in debt issuance which is a confirmation of just how rapidly cash from operations was used up (amid expectations the Federal government will have to step in and backstop the debt and/or companies), sending stocks to a session lows, we got offsetting news just before the European close, when Reuters reported that Boaz Weinstein’s Saba Capital Management had sold credit derivatives in recent months to lenders seeking protection on big tech names like Oracle and Microsoft.

In what appears to have been a temporary “all clear” on the sector, Saba sold banks CDS on ORCL, MSFT, META, AMZN, GOOGL, at a time when large asset managers, including a private credit fund, were also keen to buy the default swaps (which are basically a bond short) due to concerns over a debt-financed AI investment frenzy, and following the recent Barclays downgrade of ORCL debt.

The development highlights a scramble to hedge against an explosion in the value of AI companies and their growing debt burdens, described in our article that “Oracle Is First AI Domino To Fall After Barclays Downgrades Its Debt To Sell.”

What makes his move especially notable – and curious – is that historically Weinstein and SABA have been best known for taking the short risk side of the trade, i.e., going long CDS (shorting bonds and by extension equity), so for a legacy CDS bear to be bullish indicates that recent fears may have been overblown.

The Reuters source said this was the first time Saba has sold hedging protection on some of the companies and the first time banks had asked for this kind of trade from the hedge fund. The finance firms, the source said, were seeking protection against the debt accumulating on companies’ balance sheets as they borrow heavily to fund their multi-billion-dollar AI projects.

“Some of this is concern about AI corporate bond supply over the next few quarters after a surprise surge in recent weeks,” Deutsche Bank’s Jim Reid said in a note on Monday speaking in general about the tech-related CDS market.

“However, it seems that they are also being used as a general hedge for all sorts of positive AI positions.”

Effectively what SABA is doing is buying bonds – synthetically – on the Mag 7, and since the most liquid CDS have a 5 year tenor, his bet is that even in a downside case, there will be no event of default before 2030. Whether that is a vote of confidence in the Trump admin coming to the rescue of the AI sector and backstopping the bonds, remains to be seen.

SABA’s sales of credit protection come at a time when Oracle and Alphabet CDSs are trading at their widest levels in two years, with Meta and Microsoft also jumped in recent weeks. CDS five-year spreads for Oracle reached over 105 basis points last week, while Alphabet and Amazon traded around 38 bps and Microsoft traded around 34 bps, according to S&P data.

As we first discussed a month ago, and refreshed above, borrowing by so-called hyperscalers – essentially large AI tech firms – has ballooned in recent weeks. Meta raised $30 billion of debt last month. Oracle raised $18 billion in September. And Google owner Alphabet has also tapped the market. In fact, more than double the sector’s average annual IG bond issuance hit the market in September and October alone, BofA data showed, while JPM showed that the AI sector has now surpassed all banks to become the largest sector in the bond market.

While some remain bullish on the sector, notably Societe Generale said on Tuesday that AI bond yield spreads are still below the aggregate investment-grade credit, while others such as Citi flag the hyperscalers’ healthy balance sheets., in his weekly “flow show” report on Friday, Bank of America chief investment strategist Michael Hartnett said: the “Best short is AI hyperscaler corporate bonds.”

Tyler Durden

Mon, 11/17/2025 – 12:29ZeroHedge NewsRead More

R1

R1

T1

T1