FOMC Minutes Expose Fractured Fed On More Rate-Cuts; “Many” See No Tariff Inflation

Since the last FOMC meeting (Oct 29th), gold is the best performing asset (along with the dollar) as bonds, stocks, and oil are all down notably…

Source: Bloomberg

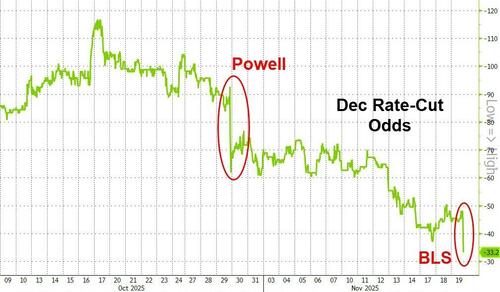

Rate-cut odds for the December meeting continued to tumble after Powell’s hawkish comments (and the follow-up FedSpeak). Today saw BLS confirm no more payrolls data before the next Fed meeting and that pushed expectations even more hawkishly lower…

Source: Bloomberg

As a reminder, The Fed cut rates by 25bps in the October meeting to 3.75-4.00%, with two dissenters: 1 hawkish (Schmid) and 1 dovish (Miran). Other non-voters have been out recently suggesting they did not support a cut.

While markets have made up their minds on the rate-cut decision, as we noted earlier, we’ll be watching for color on the hawk/dove split; but, most eyes will be on discussions around The Fed’s balance sheet (the end of QT) and the level of reserves being somewhere between ‘abundant’ and ‘ample’.

So, what does The Fed want us to know it was thinking during the meeting?

Key headlines from the Minutes:

On the rate-cut decision, there is a hawkish bias (‘Several’ is less than ‘many’)

-

*FED: `SEVERAL‘ SAID DECEMBER CUT `COULD WELL BE’ APPROPRIATE

-

Several participants said another cut in December “could well be appropriate in December if the economy evolved about as they expected” before the next meeting.

-

-

*FED: `MANY‘ SAW DECEMBER RATE CUT AS LIKELY NOT APPROPRIATE

- “Many participants suggested that, under their economic outlooks, it would likely be appropriate to keep the target range unchanged for the rest of the year,” the minutes said.

On the labor market:

“Most participants suggested that, in moving to a more neutral policy stance, the Committee was helping forestall the possibility of a major deterioration in labor market conditions.”

But… the hawks are here too:

“Most participants noted that, against a backdrop of elevated inflation readings and a very gradual cooling of labor market conditions, further policy rate reductions could add to the risk of higher inflation becoming entrenched or could be misinterpreted as implying a lack of policymaker commitment to the 2 percent inflation objective.“

Fed Balance Sheet/QT:

The minutes also showed that “almost all participants” thought it appropriate to halt the runoff of securities from the Fed’s balance sheet on Dec. 1, or could support that decision.

Officials have been shrinking the balance sheet since mid-2022 and decided at the October meeting to end that process next month.

Some market participants have worried the Fed is waiting too long to stop the runoff, allowing liquidity pressures to create volatility in overnight funding rates.

Treasury/Reserves:

Many participants indicated that a greater share of Treasury bills could provide the Federal Reserve with more flexibility to accommodate changes in the demand for reserves or changes in nonreserve liabilities and thereby help to maintain an ample level of reserves

Several participants noted that a greater share of Treasury bills could increase flexibility for future monetary policy accommodation without having to raise the level of reserves.

The majority of participants indicated that a larger share of Treasury bills would also reduce Federal Reserve income volatility.

On AI/Valuations:

Some participants commented on stretched asset valuations in financial markets, with several of these participants highlighting the possibility of a disorderly fall in equity prices, especially in the event of an abrupt reassessment of the possibilities of AI-related technology.

A couple of participants cited risks associated with high levels of corporate borrowing.

Finally, and perhaps the most notable line was with regard to inflation:

Simply put, the Minutes suggest that tariff inflation is no longer a pressing concern…

“Many of these participants also judged that, with more evidence having accumulated that the effect on overall inflation of this year’s higher tariffs would likely be limited, it was appropriate for the Committee to ease its policy stance in response to downside risks to employment.”

…which helps explain why so “many” of The Fed are increasingly focused on jobs.

Read the full Minutes below:

Tyler Durden

Wed, 11/19/2025 – 14:05ZeroHedge NewsRead More

R1

R1

T1

T1