Nvidia Preview: The Most Important Earnings Report Of The Quarter

The moment of truth is almost here.

At 4:20pm ET, the most important earnings report in the world will hit, when Nvidia reports another blowout quarter and smashes guidance. The question, as always, is whether the “blowout” and the “smash” will be big enough to impress a market that has already priced in perfection, and beyond, for the GPU maker, which is also the opposite side of all that capex spending by the hyperscalers.

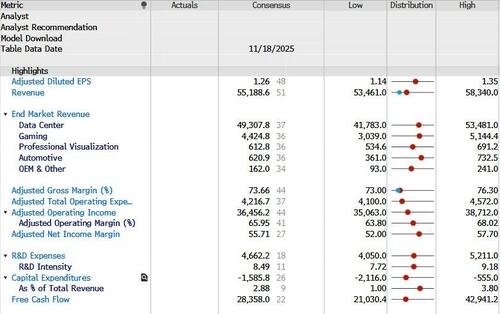

Here is a snapshot of what Wall Street expects for Q3 (earnings report ~4:20pm ET, call 5pm)

- Revenue $55.189BN, guidance $54BN

- Diluted EPS $1.26

- Adjusted operating margin 66%

- Free Cash Flow $28.4BN

And visually

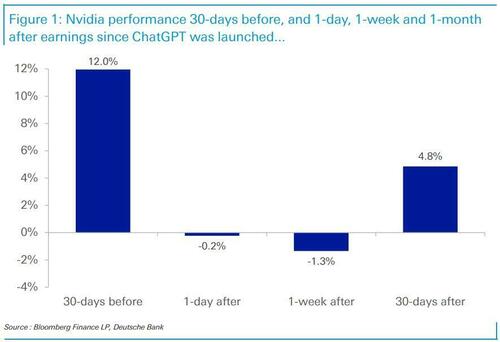

Taking a more detailed look, JPMorgan strategists see room for Nvidia to zoom higher on a beat-and-raise and recommend buying call spreads. Barclays strategists, meanwhile, note the stock has posted negative one-week returns following four of the last five earnings releases. In fact, as the following chart from Deutsche shows, since ChatGPT was launched both the 1-day and 1-week return after earnings have been negative.

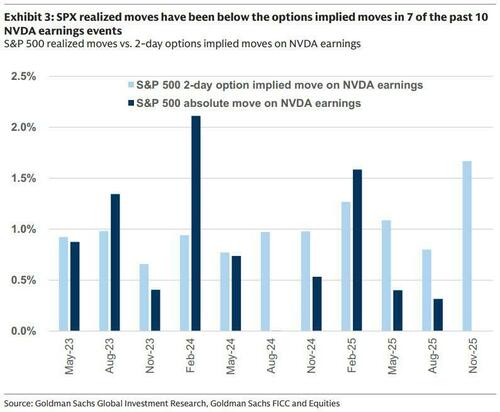

As noted earlier, NVDA’s straddles imply a move of +/-7.3% over the next two days, significantly higher than the average realized move of +/-6.0% on the past 8 earnings reports.

UBS preview

The bank’s strategist Tim Arcuri expects Q3 revenue at $56 billion vs. the $54 billion company guidance as Nvidia beat by $2 bn over the past few quarters preceding the China ban, along with a forecast of $63-64 bn, while flagging upside room.

- Investors have been concerned about the impact of higher memory and other component costs on gross margin, but Tim is comfortable with 73.5% for Q3 and 74.5-75% for Q4.

- He expects the company to indicate it can maintain mid-70% gross margin in 2026 as well.

- The ‘surprise’ factor for 2026 EPS is muted following the backlog disclosure at the GPU Technology Conference (GTC), which Tim believes indicates EPS near $9 for next year, but notes upside potential if Nvidia can find more chip-on-wafer-on-substrate (CoWoS).

- Even a big guidance for Q4 wouldn’t be new information for most investors given the backlog.

- Tim retains his Buy rating on the stock and maintains his 2026/27 EPS estimates of $7.75/$9.50.

Goldman preview:

Goldman’s research analysts expect Nvidia to deliver a beat-and-raise quarter, with the stock reaction likely hinging on the level of upside to guidance. Some more details from the preview by Goldman’s James Schneider (full note available to pro subs).

Setup heading into the print: expectations are high and investors are long into the print given recent AI infrastructure announcements and improved visibility into CY26 revenue trends.

Goldman’s view on key metrics and our estimates: The bank raises its Datacenter segment revenue estimates by ~13% to account for recent management commentary, positive revisions to hyperscaler CapEx, and other intra-quarter datapoints. Our 3Q/4Q EPS estimates of $1.28 / $1.49 are 3% / 5% above the Street.

Items on the call that could move the stock:

- Incremental details on $500bn datacenter revenue forecast – Expect investors to focus on any incremental details (cadence, customer profile, compute/networking mix) on the $500bn GPU+Networking revenue outlook that Nvidia highlighted on Oct. 28;

- Details on OpenAI deployments – Believe investors will look for more details on timelines, industry preparedness and revenue contribution from OpenAI’s deployments in CY26;

- Rubin ramp in CY26 – Expect investors to focus on product mix and trajectory in CY26 following the introduction of Rubin.

Coming out of the print: Expect the debate around: (1) the magnitude of upside to hyperscaler CapEx; (2) contribution from non-traditional customers in CY26 to dictate stock price action into year end. We expect the stock to continue to trade on quantitative datapoints that provide visibility to CY26 estimates.

Estimate changes: We raise our revenue and non-GAAP EPS estimates by 12% on average throughout our forecast period (FY26-28) to factor in management commentary and upward revision to GS hyperscaler CapEx forecasts. Our updated FY27/FY28 EPS estimates are 22%/28% above Street (VA) estimates.

Goldman expects four focal points on the call:

- (1) incremental details on Nvidia’s $500bn Datacenter revenue forecast;

- (2) OpenAI’s planned deployments in CY26;

- (3) Rubin ramp in CY26;

- (4) potential for resumption of business in China

Goldman trading desk

According to Goldman’s John Flood, positioning among the buyside community is 8 out of 10. Stock has been consolidating for the better part of ~4-months with the stock at the same levels it was before print in August as investors digest rapidly evolving AI newsflow, with an uptick in caution around the theme in recent weeks … which points to somewhat cleaner positioning into these set of numbers.

- The stock is back at the same levels it was at before it’s print back in late- August as investors digest rapidly evolving AI newsflow …

- Investors likely looking for another beat/raise print vs consensus Eevenues of ~$55bn in Oct and ~$62bn in January – for context, Nvidia has delivered more “normalized” beat sizes lately (e.g. beat topline by ~1-3% the last few qtrs).

- Some investor debate on the likely “incrementality” of this print given recent commentary from NVDA at GTC (e.g. ~$500bn) — on this point, the stock has only moved +/- ~1-3% (t+1) on 3 of 4 print.

JPMorgan preview

Finally, here is what JPMorgan’s Josh Meyers says, who unlike Goldman has buyside positioning even higher, at 9.

SENTIMENT: The bottom line: survey says $56.32b & $63.02b. After the last few months of “AI bubble” & circular financing talk, recent momentum unwinds and an increasing focus on debt and CDS markets, if feels increasingly like the weight of the world is on NVDA. The setup into earnings is confusing for everyone.

- The stark divergence between very high positioning (it’s one of our most crowded tech longs – and has crept up) & investor optimism on the one hand and the clear stock de-rating versus all peers on the other is confounding.

- JPM’s own survey (below) suggests a $2.3BN revenue beat versus the guide (~$1.7b ahead of consensus), and expectations for a ~$1.5b beat of consensus for the guide.

- If realized, this would mean astonishing sequential revenue growth of $9.65b for the Oct-Q and $6.7b for the Jan-Q. (Meyers also surveyed F26, 27 and 28, and expectations are high!).

Are people too optimistic?

On the one hand, people seem to be positioned for a beat and raise. We’ve all done the math from the $500b slide (giving visibility on $11 in F28 EPS), and we’ve dissected every aspect of his recent Taiwan visit. Everyone’s Asia checks are strong (Gokul just raised his NVDA CoWoS data once again to reflect better visibility on strength in the next 12 months, and optimism beyond). Plus, rack-level standardization works in the company’s favor as economics already accrue mainly to chip-makers. To me, capacity bottlenecks probably also generally work in NVDA’s favor.

Yet the stock has substantially de-rated, and completely round-tripped the $500b slide from GTC DC. Folks worry that NVDA will become a share donor, and that outperformance becomes harder as the stock becomes larger. Then there’s circular investments (OpenAI monetization would be helpful here…) and some worry about what Jensen is going to do with the cash (“We’re always looking for great startups to invest in”). It should be noted that NVDA has been holding up better into earnings.

Implied Move: 6.5%

Tyler Durden

Wed, 11/19/2025 – 15:45ZeroHedge NewsRead More

R1

R1

T1

T1