Surprise Crude Draw Stabilizes Oil Prices After Early Plunge On Russia Peace Talk Headlines

Oil prices tumbled overnight following API’s report suggesting a large build in crude inventories, , which would take oil stored in commercial tanks to the highest level in more than five months, if confirmed by official data this morning.

The supply buildup may help cushion the impact of US sanctions against Russian producers Rosneft PJSC and Lukoil PJSC that are set to kick in within days, part of efforts to raise the pressure against Moscow to end the war in Ukraine.

An Axios report that Washington has been working in consultation with the Kremlin to draft a new plan also eased supply concerns, though Moscow denied any talks.

Additionally, Politico reported that the White House is expecting a new peace agreement with Russia by the end of November, which could bring the war with Ukraine to an end.

While on the topic of Russia, Deputy Prime Minister Alexander Novak told journalists that while the country has under-utilized its OPEC+ allocation recently, within the coming months, Russia will be able to increase oil production to the level permitted under the OPEC+ agreement, he said.

“I think within the next few months, perhaps by the end of the year, maybe at the beginning of next year, we will see how the companies [respond],” he said.

“In November, production will be higher than in October. I cannot say exactly by how much right now, but there is an increase.”

So will the official data confirm API’s report?

API

-

Crude +4.4mm

-

Cushing -800k

-

Gasoline +1.5mm

-

Distillates +600k

DOE

-

Crude -3.426mm

-

Cushing -698k

-

Gasoline +2.327mm – first build in seven weeks

-

Distillates +171k

Shocker: while API reported a big build, the official data showed a large crude inventory drawdown last week. Additionally, Gasoline stocks rose for the first time in seven weeks…

Source: Bloomberg

Cushing stocks are hovering near ‘tank bottoms’ – so much for the SPR rebuild?

Source: Bloomberg

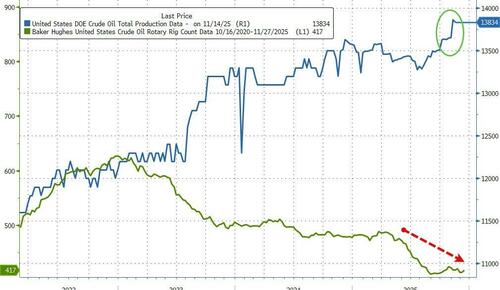

US Crude production remains near record highs…

Source: Bloomberg

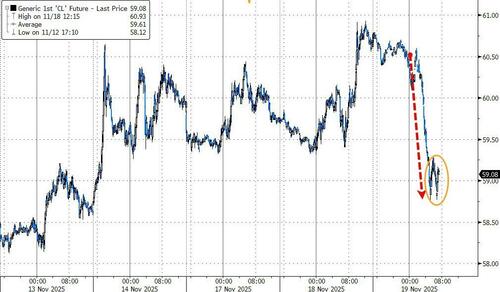

WTI fell to around $59 overnight and is stabilizing there after the official data report…

Source: Bloomberg

Finally, Prices were also pressured after failure to break past their 50-day moving average in recent days.

The global benchmark came within two cents of that marker on Tuesday, before retreating sharply on Wednesday.

Tyler Durden

Wed, 11/19/2025 – 10:38ZeroHedge NewsRead More

R1

R1

T1

T1