Bitcoin Flash-Crashes Below $82,000 As UBS Says A “Flush” Is Needed Before “Turning More Constructive”

As we joked earlier this week about the overnight Bitcoin dump – the “Korean Krypto Kamikazes“ – the selling has continued with no clear catalyst. The largest crypto asset briefly plunged to $81,569 and is now on track for its worst month since 2022.

BTC dropped as much as 6% early Friday to $81,569, while Ether and smaller tokens plunged into the abyss as risk-off sentiment hit both crypto and equity futures (market wrap). Bitcoin is now down roughly 25% for the month.

Nearly $1 billion in positions were liquidated during the overnight flush, stoking fears that the bear market could deepen. This forced selling comes despite a pro-crypto White House and rising institutional adoption.

Testing weekly 200sma

IG Australia analyst Tony Sycamore wrote in a note that the market “may also be seeking to test Strategy’s pain threshold,” referring to Michael Saylor’s Bitcoin hoarding firm.

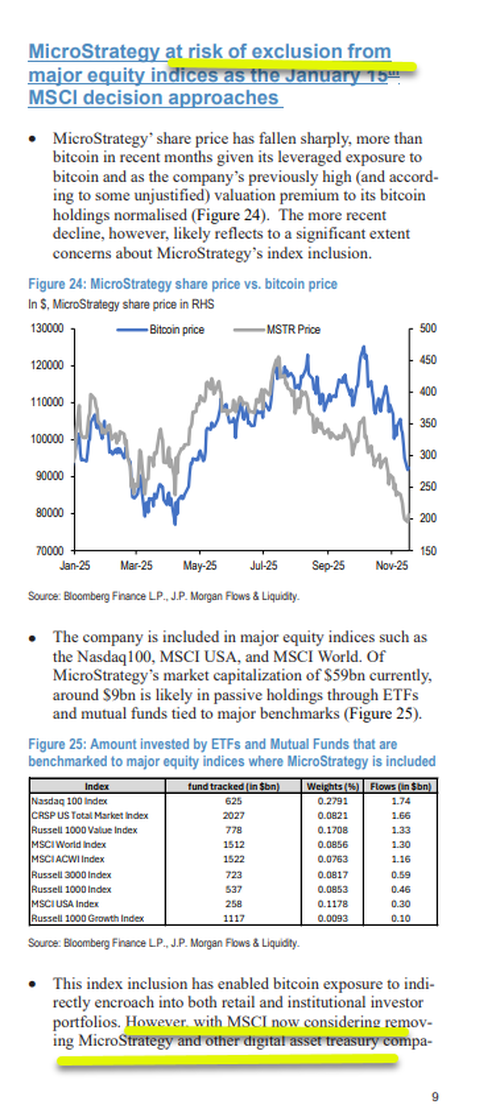

A JPMorgan analyst pointed out to clients the potential exclusion of MSTR from upcoming MSCI and Nasdaq reviews.

Overall, the crypto market is certaintly gripped by forced selling, thin liquidity, and extreme fear – a market environment very similar to the last crypto meltdown in June 2022.

Related:

-

What’s Behind Today’s Brutal Selloff: Goldman’s “Technical Checklist”

-

Bitcoin: Store of Value? More Like You’re Shorting Volatility Without Knowing It

-

Fractured Fed Feeds Hawkish Flows; Bitcoin, Bullion, & Big-Tech Pump’n’Dump

-

ZH On X: The last time bitcoin was here, global liquidity was $7 trillion lower

“The risk now is that continued downside forces retail investors to sell favorites, sidelining dip buyers and triggering systematic supply,” UBS analyst George Redma told clients. He warned that the crypto slump “may amplify risk-off sentiment into year-end.”

Redma continued, “The desk may need to see this flush before turning more constructive into year-end. Given the attention on CTA levels, a meaningful washout could set up a better risk backdrop heading into next year as stimulus returns to focus.”

“For now, uncertainty around this overhang seems to be preventing re-risking despite traditionally strong seasonality,” he concluded in a brief note to clients.

Goldman Sachs trader John Flood told clients, “Sharp reversals in NVDA and Crypto suggestive that an NVDA beat was not the “all clear” for risk that we were hoping for (after what has already been a very difficult 2 week stretch). Plenty of scar tissue out there right now. We remain eerily quiet on our trading desk.”

Goldman analyst Jack McFerran commented on the crypto bear market, saying, “I don’t pretend to be a crypto expert and admittedly the ‘why’ is harder, but the confluence of whale selling seems to be leading risk.”

The question now is whether the slide to $81,569 was the full flush, or if more panic selling lies ahead as we head into the Thanksgiving holiday week.

Tyler Durden

Fri, 11/21/2025 – 07:00ZeroHedge NewsRead More

R1

R1

T1

T1