China Prepares New Property Stimulus Package As Housing Crisis Enters Year Six

The global stimmy train is about to leave the station.

With Japan – which is now in recession – set to announce a massive (for its GDP) $150BN fiscal stimulus any second, it’s (increasingly belligerent) neighbor to the west is also about to make it rain.

China is considering new measures to turn around its zombified property market, about to enter its 6th year of contraction, as concerns mount that a further weakening of the sector will threaten to destabilize its financial system, Bloomberg reports

Policymakers including the housing ministry are considering a slew of options, such as providing new homebuyers mortgage subsidies for the first time nationwide. Other measures being floated include raising income tax rebates for mortgage borrowers and lowering home transaction costs. In the end, however, China will just do what every economy does when it is scrambling to kickstart demand: it will hand out checks straight to its consumers.

The plan to subsidize interest costs on new mortgages is intended to lure back homebuyers, who have been reluctant to enter a free-falling market. While they may give a short-term boost, the steps are “probably not bold enough” to fix the supply-demand imbalance in the property market, Eric Zhu of Bloomberg Economics wrote. “Cheaper mortgages may not help much if people don’t want to borrow.”

The Chinese stimulus plan has been under discussion since at least the third quarter, as the housing market’s slump in sales and prices deepened, said the people, adding that the timing and specific policies to be implemented are still uncertain.

“The relaxation of fiscal policy is in line with our previous expectations, and reducing taxes and fees will moderately boost home buying activities,” said Jeff Zhang, a property equity analyst at Morningstar Inc. “We believe that the confidence of homebuyers still needs further stabilizing property prices to recover.”

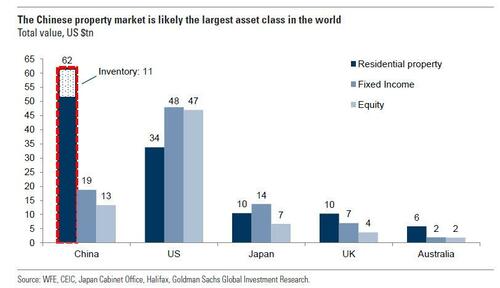

China has been trying to put a floor under its five-year real estate downturn, which has weighed on everything from household wealth to consumption and employment. While the housing sector, which not too long ago was the world’s single biggest asset class…

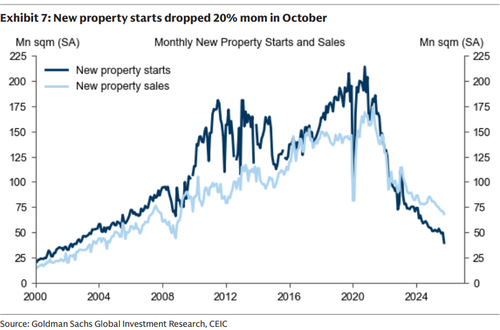

… picked up modestly after the government stepped up support about a year ago, the momentum quickly fizzled. Home sales have been falling since the second quarter and fixed-asset investment collapsed last month.

The dim outlook for the property market, coupled with households’ weakened ability to repay mortgages and other personal loans, means that banks’ asset quality could deteriorate next year, Fitch Ratings analysts warned last month. Chinese banks’ bad loans surged to a record 3.5 trillion yuan ($492 billion) at the end of September.

In a similar move, China in September started offering interest subsidies for consumer loans to boost household spending. Residents can receive a one percentage-point interest rate waiver with a ceiling of relief based on the loan size.

Calls for more forceful policy support for the residential real estate market have grown in recent months after earlier steps including lowering loan thresholds and easing restrictions on multiple purchases failed to stem the downturn.

Last year, China scrapped a nationwide mortgage rate floor for individual homebuyers, seeking to bring down borrowing costs. The central bank then let the local interest rate self-discipline system, a supervisory body it oversees, decide whether a rate floor is still needed in their jurisdictions.

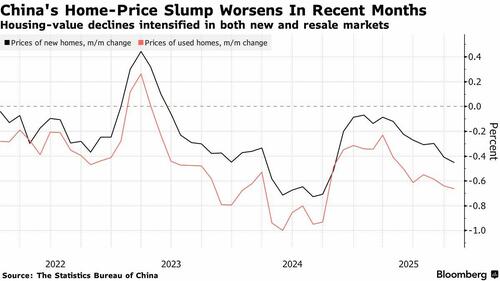

The country’s three biggest cities — Beijing, Shanghai and Shenzhen — eased homebuying requirements, especially in suburban areas, last quarter. Yet both new and resale homes recorded their steepest price declines in October in at least a year.

Meanwhile, Chinese consumers remain firmly in deleveraging mode, hindered by soft income expectations and growing uncertainties in a slowing economy. Outstanding residential mortgages shrank in the second and third quarter to 37.4 trillion yuan and are now down 3.9% from a peak in early 2023.

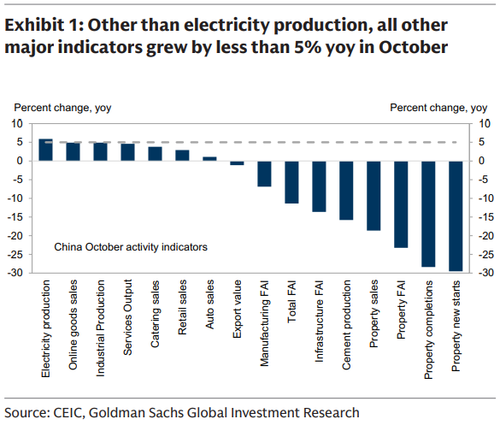

And while China tries to come up with a fix, the October economic data showed widespread weakness, especially in property and investment. Most major indicators grew less than 5% year-on-year, and property new starts declined nearly 30% yoy. We think the government may be reserving policy support for Q1 next year, since this year’s growth target appears broadly achievable.

Property market troubles continue: House prices and property activity fell faster in October. While the direct impact of property investment on GDP is lessening, indirect effects—such as lower confidence, weaker local government

Tyler Durden

Thu, 11/20/2025 – 23:51ZeroHedge NewsRead More

R1

R1

T1

T1