Key Events This Holiday-Shortened Week: PPI, Retail Sales, Jobless Claims, And Ukraine Ultimatum

It should be another busy, holiday-shortened, week after a volatile one last week as markets whipsawed around big moves in Fed pricing and AI bubble risk fears. Before we get to Thanksgiving, DB’s Jim Reid writes that in the US, delayed post-shutdown data will be compressed into the first three days because of the holiday. Tomorrow brings September’s retail sales and PPI, followed on Wednesday by jobless claims and durable goods orders. The claims data will be particularly important as they cover the November survey week, and the Federal Reserve is expected to lean heavily on these figures and other alternative indicators ahead of its December meeting, given there’ll be no more payroll data prior to the FOMC.

Globally, attention will turn to inflation reports from Europe and Japan, as well as the long-awaited UK Budget, which could prove pivotal for the country’s fragile fiscal outlook. Perhaps the most significant geopolitical development will be Ukraine’s response to the US ultimatum to accept the 28-point peace plan agreed with Russia, with an ultimatum set for before Thanksgiving on Thursday, although the US seem to have indicated over the weekend that there is some room for negotiation.

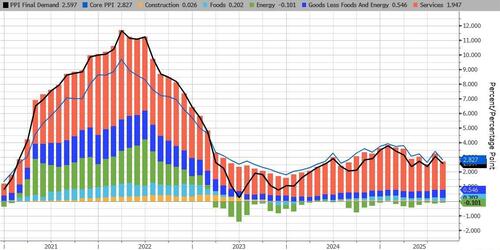

Let’s start with the US, and for tomorrow’s September PPI data, benign prints are expected by DB economists for headline (+0.2% vs -0.1% last) and core (+0.2% vs -0.1%), echoing recent CPI trends. Categories feeding into core PCE will be in focus, with forecasts pointing to a 0.26% monthly gain, keeping the annual rate near 2.9%. This will be the last inflation update before the Fed’s December decision, as October CPI and November CPI have been pushed back to mid-December.

Retail sales are forecast by DB economists to show modest gains after strong summer spending: headline +0.1% (vs +0.6% last), ex-auto +0.2% (vs +0.7%), while retail control may dip slightly (-0.1% vs +0.7%). Even so, Q3 retail control growth is tracking at 6.8% annualized —the strongest since early 2023—supporting expectations for robust goods spending once GDP data is published. Factory sector updates arrive Wednesday with durable goods orders for September and the Chicago PMI for November (45.0 vs 43.8). Headline orders are expected to fall (-2.4% vs +2.9%), but ex-transportation (+0.2% vs +0.4%) and core orders (+0.2% vs +0.6%) should post moderate gains, implying a solid 5.3% annualised increase for Q3. Don’t forget Black Friday where we will start to see early evidence of how strong consumer spending is into the important Christmas period.

No Fed speakers are scheduled at this stage. The blackout period begins on Saturday ahead of the December meeting but with Thanksgiving on Thursday, it will start a lot earlier than it normally would.

European data highlights include preliminary November CPI prints for Germany (2.6% YoY expected), France (0.92%) and Italy (1.23%) on Friday, alongside Q3 GDP releases for Norway, Sweden and Switzerland. Germany’s Ifo survey kicks off the week today, followed by consumer confidence on Thursday and retail sales Friday. France will also report confidence and spending data that day. In the UK, the Autumn Budget on Wednesday will be the main event. Expectations point to roughly £35bn in fiscal consolidation, marking a second historic tax-raising budget under Chancellor Reeves. See our economist Sanjay Raja’s preview here in what is one of the most hotly anticipated UK budgets in recent memory. Sanjay may need a lie down in a dark room after Wednesday as it’s fair to say he’s been in high demand of late.

From central banks, the ECB will publish its October meeting account on Thursday and its consumer expectations survey Friday. In New Zealand, the RBNZ meets Wednesday, with a 25bps rate cut anticipated. Elsewhere, Australia reports October CPI (Wednesday), Canada releases Q3 GDP, and China publishes October industrial profits. Japan’s focus will be on November Tokyo CPI and October activity data (Friday).

With Q3 earnings season winding down, results from Alibaba, Meituan, Analog Devices, Dell and HP will draw attention.

Day-by-day calendar of events, courtesy of DB

Monday November 24

- Data: US October Chicago Fed national activity index, November Dallas Fed manufacturing activity, Germany November Ifo survey

- Central banks: ECB’s Lagarde and Nagel speak

- Auctions: US 2-yr Notes ($69bn)

Tuesday November 25

- Data: US November Conference Board consumer confidence index, Richmond Fed manufacturing index, business conditions, Philadelphia Fed non-manufacturing activity, Dallas Fed services activity, October pending home sales, September retail sales, PPI, FHFA house price index, Q3 house price purchase index, August business inventories, Japan October PPI services, EU27 October new car registrations

- Central banks: ECB’s Villeroy, Makhlouf, Sleijpen and Cipollone speak

- Earnings: Alibaba, Analog Devices, Dell, HP, Workday, Zscaler, Nio

- Auctions: US 2-yr FRN (reopening, $28bn), 5-yr Notes ($70bn)

Wednesday November 26

- Data: US November MNI Chicago PMI, September durable goods orders, initial jobless claims, Australia October CPI, Norway Q3 GDP

- Central banks: RBNZ decision, Fed’s Beige Book, ECB’s financial stability review, ECB’s Muller, Vujcic and Lane speak

- Auctions: US 7-yr Notes ($44bn)

- Other: UK autumn budget

Thursday November 27

- Data: China October industrial profits, Japan November Tokyo CPI, October jobless rate, job-to-applicant ratio, retail sales, industrial production, Germany December GfK consumer confidence, Italy November economic sentiment, September industrial sales, Eurozone October M3, November economic confidence, Canada Q3 current account balance

- Central banks: ECB’s account of October meeting, BoJ’s Noguchi speaks, BoE’s Greene speaks

- Other: US Thanksgiving Day holiday

Friday November 28

- Data: UK November Lloyds Business Barometer, Japan October housing starts, Germany November CPI, unemployment claims rate, October retail sales, import price index, France November CPI, consumer confidence, October PPI, consumer spending, Q3 total payrolls, Italy November CPI, Canada Q3 GDP, Sweden Q3 GDP, Switzerland Q3 GDP

- Central banks: ECB October consumer expectations survey, ECB’s Nagel speaks

- Earnings: Meituan

Looking at just the US, Goldman writes that the key economic data releases this week are the September retail sales report on Tuesday and the September advanced durable goods report on Wednesday. There are no speaking engagements by Fed officials this week, with the FOMC’s blackout period scheduled to start on November 29.

Monday, November 24

- There are no major data releases scheduled.

Tuesday, November 25

- 08:30 AM Retail sales, September (GS +0.3%, consensus +0.4%, last +0.6%); Retail sales ex-auto, September (GS +0.2%, consensus +0.3%, last +0.7%); Retail sales ex-auto & gas, September (GS +0.2%, consensus +0.3%, last +0.7%); Core retail sales, September (GS +0.1%, consensus +0.3%, last +0.7%): We estimate core retail sales increased 0.1% in September (ex-autos, gasoline, and building materials; month-over-month SA), reflecting mean reversion after an outsized increase in the prior month and a slight headwind from potential residual seasonality. We estimate headline retail sales increased 0.3%, reflecting a boost from an increase in gasoline prices.

- 08:30 AM PPI final demand, September (GS +0.2%, consensus +0.3%, last -0.1%);PPI ex-food and energy, September (GS +0.1%, consensus +0.2%, last -0.1%); PPI ex-food, energy, and trade, September (GS +0.1%, consensus +0.3%, last +0.3%)

- 09:00 AM S&P Case-Shiller home price index, August (GS flat, consensus +0.1%, last +0.2%)

- 10:00 AM Conference Board consumer confidence, November (GS 93.0, consensus 93.3, last 94.6)

- 10:00 AM Pending home sales, October (GS +3.0%, consensus +0.1%, last flat)

Wednesday, November 26

- 08:30 AM Initial jobless claims, week ended November 22 (GS 230k, consensus 230k, 220k); Continuing jobless claims, week ended November 15 (last 1,936k)

- 08:30 AM Durable goods orders, September preliminary (GS +1.5%, consensus +0.5%, last +2.9%); Durable goods orders ex-transportation, September preliminary (GS +0.2%, consensus +0.2%, last +0.4%); Core capital goods orders, September preliminary (GS +0.1%, consensus +0.3%, last +0.6%); Core capital goods shipments, September preliminary (GS +0.2%, last -0.3%): We estimate that durable goods orders increased 1.5% in the preliminary September report (month-over-month, seasonally adjusted), reflecting an increase in commercial aircraft orders. We forecast a 0.1% increase in core capital goods orders—reflecting an improvement in the new orders components of manufacturing surveys but potential payback for the outsized increase in the prior month—and a 0.2% increase in core capital goods shipments—reflecting the increase in orders in the prior month.

- 02:00 PM Fed Releases Beige Book, December meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the September FOMC meeting period noted that three districts had reported modest activity growth, while five districts had reported no change and four districts noted a slight softening, and that uncertainty remained elevated, weighing down activity. In this month’s Beige Book, we look for anecdotes related to the evolution of labor demand and firms’ expectations of activity growth for the remainder of the year.

Thursday, November 27

- There are no major data releases scheduled.

Friday, November 28

- There are no major data releases scheduled.

Source: DB, Goldman

Tyler Durden

Mon, 11/24/2025 – 10:35ZeroHedge NewsRead More

R1

R1

T1

T1