Consumer Strain Moves Beyond Low-Income Into Heart Of Middle Class

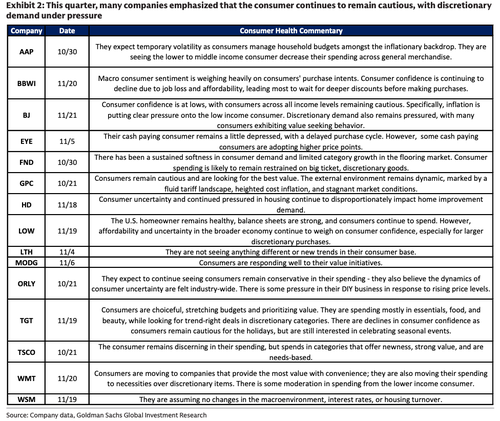

Goldman Sachs Managing Director Kate McShane provided clients with a summary of key takeaways from her meetings with the investor-relations and management teams of Bath & Body Works, BJ’s Wholesale Club, The Home Depot, Lowe’s, Target, Walmart, and Williams-Sonoma.

McShane noted that nearly every retailer warned of weak consumer demand, especially among squeezed lower-income households.

Low to middle-income consumers remain fragile, value-driven, and cautious ahead of the holiday shopping season that begins Friday.

One commentary that stood out the most came from Advance Auto Parts.

She noted, “They’re seeing lower- to middle-income consumers decrease their spending across general merchandise.”

Here’s the breakdown:

McShane’s note reinforces our earlier consumer notes, showing a clear tale of two worlds: one where wealthy households remain healthy, while working-class consumers bear the brunt of financial strain.

-

Early Warning Indicator Signals Sharp Sentiment Deterioration Among Low-Income Consumers, Gen Z

-

“Worst Consumer Sentiment In Decades”: Goldman Goes Defcon 1 On Imploding US Consumer

The Trump administration has moved quickly to counter the downturn facing lower-income households, rolling out Operation Affordability in recent weeks.

ZeroHedge Pro subscribers can read the full note in the usual place, which includes much more commentary on consumer health.

Tyler Durden

Tue, 11/25/2025 – 13:45ZeroHedge NewsRead More

R1

R1

T1

T1