JP Morgan, Who Had No Issues Banking Epstein, Abruptly Closes Strike CEO Jack Mallers’ Account

JPMorgan Chase abruptly closed Strike CEO Jack Mallers’ personal accounts last month, giving him no warning and offering only a cryptic explanation, according to Yahoo Finance.

Mallers posted on X that “Last month, J.P. Morgan Chase threw me out of the bank,” noting how odd it was given that “My dad has been a private client there for 30+ years.” When he asked why, the bank told him only: “We aren’t allowed to tell you.”

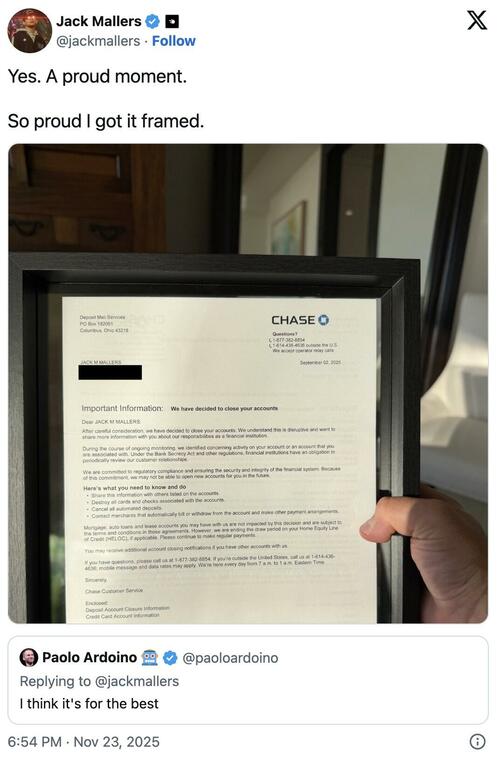

Yahoo writes that he even framed the closure letter, which accused him of unspecified “concerning activity” and warned the bank “may not be able to open new accounts for you in the future.”

The incident reignited concerns that the alleged Biden-era “Operation Chokepoint 2.0” is still lurking in the background, despite Trump’s new executive order aimed at penalizing firms that debank crypto businesses. Critics online immediately connected the dots, suggesting regulators and banks are still quietly squeezing crypto-aligned companies and founders.

JPMorgan’s move sparked a broader backlash from Bitcoin advocates like Grant Cardone, Max Keiser, and others who are already furious over the bank’s perceived hostility toward Bitcoin and its recent push to delist companies with heavy BTC exposure. Many publicly closed their JPMorgan accounts, accusing the bank of targeting the crypto sector while having no trouble maintaining far more questionable clients in the past. (Apparently “concerning activity” was never a problem back when they were happily banking Epstein.)

Tether CEO Paolo Ardoino replied to Mallers that the whole ordeal is “for the best,” later adding that organizations trying to undermine Bitcoin “will fail and become dust.” Meanwhile, JPMorgan insists it’s just protecting the “security and integrity of the financial system”—a claim that might land better if the bank’s compliance radar didn’t seem to activate only when the customer is a crypto CEO rather than, say, a notorious sex-trafficking financier.

Recall just days ago we wrote that the bank is now under fire from Florida officials over its cooperation with the Biden DOJ’s anti-Trump investigation known as “Arctic Frost,” – providing sensitive banking information to Biden prosecutor Jack Smith.

Also we noted US regulators are examining whether JPMorgan Chase has denied customers fair access to banking, as pressure grows over debanking decisions that were made against conservative figures, according to reporting from Financial Times and the company’s 10-Q filing.

In its quarterly filing, the bank noted it was “responding to requests from government authorities and other external parties regarding, among other things, the firm’s policies and processes and the provision of services to customers and potential customers”.

JPMorgan linked the scrutiny to an August executive order from Donald Trump directing regulators to review possible “politicised or unlawful debanking”. The bank said related inquiries include “reviews, investigations and legal proceedings,” without identifying the agencies involved.

Tyler Durden

Mon, 11/24/2025 – 22:10ZeroHedge NewsRead More

R1

R1

T1

T1