UBS: AI Mania Has More Fuel, Dubs GenAI The “Steam Engine Of The Mind”

As chatter about an AI-driven market bubble grows louder across Wall Street, with nearly half of BofA’s Fund Manager Survey respondents calling the AI/data-center boom a bubble, UBS analysts are out with a note insisting there is plenty more bubble-blowing ahead.

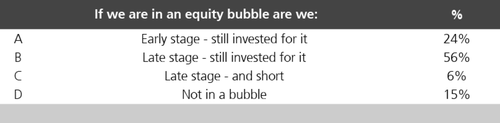

UBS analyst Andrew Garthwaite wrote that his bullish target for the MSCI AC World is 1,090 by end-2026 (+11%). But he noted that if GenAI delivers even half the productivity surge that late-1990s Tech was believed to produce, the S&P 500 could “easily” justify 7,000.

“We think Gen AI – ‘the steam engine of the mind’ – will increase productivity more than TMT did back in the late 1990s,” Garthwaite told clients.

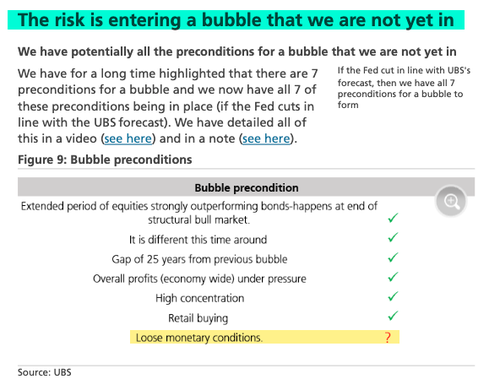

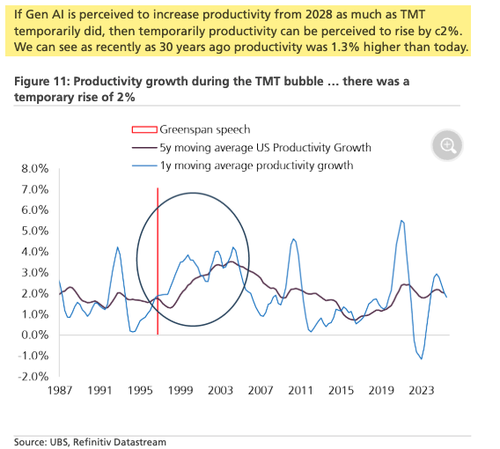

He continued, “We also now have all 7 preconditions for a bubble that we are not yet in (historically, the P/E at a bubble peak has been 45x-72x on 12-month trailing earnings for 30-43% of global market cap versus Mag 6 today on 33x).”

Garthwaite pointed to a previous analysis in the UBS Global Economics and Strategy Outlook that shows today’s market performance patterns are similar to those in March 1998.

“We also highlight that we believe we are far removed from any of the major catalysts that mark a bubble peak,” he said.

The analyst continued:

We think there is more justification for a bubble (which we are not yet in) to form than any of the many others we have seen owing to the uniquely quick adoption rate of Gen AI and the threat of monetisation of government debt (which would lead to a move from nominal to real assets). We see at least a 35% chance of a bubble fully forming, and that would justify 1090 MSCI AC World.

Other factors that are supportive for equities: i) The well-behaved nature of US wage growth (this allows the Fed to be proactive if necessary); ii) the historical performance of equities when we just miss a bear market (2 years later up 43% on average versus 34.6% so far) or when the Fed cut and there is no recession (up 17% a year later); and iii) it is too early to call an end to AI or Tech+ outperformance. The P/E of Tech+ relative to the market is close to its norm, earnings growth is expected to be better than the market until Q2 27, and earnings revisions are better than the market. There are many other supports such as hyperscalers being able to increase capex by c40% before capex is above 2025 operating cash flow, with ICT investment as a % of GDP still at average levels.

Near term, there is a risk of ongoing consolidation continuing. In early November, UBS Risk Appetite had been at a 5-year high and CTA positioning at an 8-year high. These indicators are normalising but are still above average; however, we would be surprised if the sell-off extended by another 5%.

Most important charts from Garthwaite’s note:

Bubble preconditions are all in place … the only missing ingredient is looser monetary policy.

The audience at the UBS European conference held on November 11 was asked: “Are we in a bubble?”

Here’s how they responded…

“In my opinion, the justification for a bubble to form is better than any of the many other bubbles that I have seen during the past 38 years doing global strategy,” Garthwaite said.

Far removed from the peak of a bubble in terms of valuation or catalysts…

ZeroHedge Pro subs can read the full UBS note in the usual place. Notably, the bank’s position contrasts sharply with our earlier reporting:

-

The Stunning Math Behind The AI Vendor Financing “Circle Jerk”

-

Oracle Is First AI Domino To Fall After Barclays Downgrades Its Debt To Sell

-

AI Megacaps Throw Off New Warning Lights — Or New Fuel — Depending on Your Religion

Meanwhile…

In short, it depends on which institutional desk you read – there’s clearly a gap in views about where we are in the bubble cycle. UBS believes the current phase could extend for a few years, a bullish scenario that would coincide with President Trump’s affordability push for low- to middle-income households during the midterm election cycle, while higher-income households continue to benefit from market gains: a perfect scenario.

Tyler Durden

Wed, 11/26/2025 – 10:25ZeroHedge NewsRead More

R1

R1

T1

T1