Why This Fear Of Deflation?

Authored by Jeffrey Tucker via The Epoch Times,

Certain myths survive from a period of trauma. They can be wholly incorrect and yet widely believed by nearly all living experts. The myth keeps moving from generation to generation and becomes doctrine, one which we dare not question for fear of contradicting the settled consensus. It so happens that “everyone knows” something that is entirely incorrect.

The myth in this case is that deflation, in the form of falling prices, is always to be avoided at all costs. This myth is global.

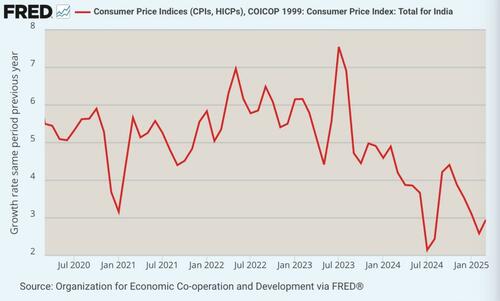

The other day, Bloomberg and Economic Times whipped up a frenzy with an article called “What India can do about its low inflation problem.”

“India’s economy, so often touted for potential to supplant China as a global engine, is having a hard time getting its arms around inflation. Not that it’s too high, but because the pace of price increases is worryingly low.”

The prescription is always the same: loosen the money and pump up the prices, robbing savers and consumers of all production.

How can they say this? Because everyone believes it.

India has had a roaring inflation problem in recent years, same as everyone else. I’m just going to eyeball this and say that the currency has lost 30 percent of its value over five years, again, not an unusual experience. Finally we have inflation tamed to the 2–3 percent realm. That means only that the problem is getting worse more slowly.

This is not deflation. Not even close.

And yet at this very moment, we are told that India has another problem. Inflation is too low! The central bank has to act before it is too late!

Some of this confusion truly results from sloppy use of language. When inflation is falling, that vaguely feels like prices are falling. Not so! It only means that prices are rising more slowly than previously. This is not deflation. This is a lower rate of inflation.

The language problem is coupled with a strange public psychology. For years, I’m convinced, consumers really believed that the inflation was temporary. Maybe you believed this too. I think I did briefly until I remembered that there is no way that the monetary authorities would actually let overall prices fall.

Whatever damage has been done over five years is really done. Nothing can fix it. The price level will never go back to what it was. The monetary unit is permanently devalued. Sorry to be the bearer of bad news.

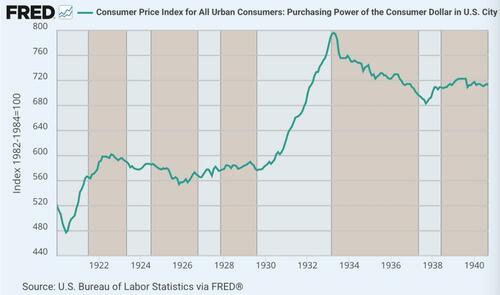

Why this entrenched phobia of deflation? It all traces to a grave confusion over cause and effect that began in 1930 and continued for the length of the Great Depression. During these years, the seemingly impossible happened. The purchasing power of the currency actually increased. This is something to celebrate, not regret, as explained at length in Murray Rothbard’s book America’s Great Depression.

Broadening this out a bit, the purchasing power of the dollar actually gained 66 percent between 1920 and 1933. This was a welcome relief following the 50 percent decline that hit soon after the Federal Reserve was created in 1913.

Imagine sticking dollars in your mattress. You decide to check on them 13 years later. You discover that they have gained in value, without using a bank to pay interest or otherwise investing. You have saved money and made money at the same time. This is absolutely glorious for the public.

It was a one-time thing, sorry to report. It never happened again. After 1933, the valuation of the dollar began to fall because inflation returned. Incredibly, this was the intended policy outcome. The monetary elites intended to create inflation.

Why did they do this? Because the prevailing economic theory at the time preached that the reason for the decline in business activity was the deflation itself. Somehow they decided that the way to fix the problem was to make goods and services more expensive for consumers and businesses.

This was of course the prevailing Keynesian theory. It rejected all historical experience. A mild deflation had characterized the Gilded Age, the greatest period of rising prosperity recorded in any nation in the whole history of mankind. It was only a few decades in the rearview mirror.

Somehow the generation of the 1930s had adopted a fashionable view that everything can and should be reinvented according to an engineering model. This included economics—a discipline dating back many hundreds of years to the late Middle Ages. This generation imagined that they could repeal basic economic laws with power and expertise.

They got to President Herbert Hoover himself, who was panicked about economic conditions following the stock market crash of 1929. He had two years before the election and was worried about the fate of his party. As a result, he listened to the experts who told him that the CAUSE of the decline in business activity was the tendency of prices to decline.

If that is true—which it was not—the only solution is to repump the economy, raise wages, set price floors, and attempt to reflate using the power of the Federal Reserve. Hoover did all these things between 1930 and 1932, all in hopes of boosting his election.

In other words, Hoover had run a test case of the first New Deal. I am profoundly aware that the historians won’t tell you this but he was a huge interventionist, unlike his Republican predecessors who let the business cycle run its course. Using modern parlance, Hoover was a leftist for the totality of this period. FDR merely picked up on his themes and made everything worse.

Arguably, if Hoover had done nothing at all, the economic downturn of 1930 might have run its course in time for the presidential election and he would have won over FDR. Instead, his actions pushed the economy deeper into recession and FDR won in a landslide. FDR had campaigned for balanced budgets and fiscal frugality. He took exactly the opposite path once he had power.

Why did FDR do this? Because he too had listened to the experts who all said that the problem in need of fixing was the deflation. Common sense would have refuted this bogus notion. Prices were falling as a corrective to the previous boom. Production structures desperately needed to be rebalanced by market forces. Savings needed to be encouraged. Business needed to stop higher-order investments.

FDR was much worse even than Hoover. He devalued the money by closing the banks and then forcibly grabbed gold from the people. Then he revalued the dollar by executive order. That was just the beginning. He disabled labor markets, banned teen labor to make the data look better, and massively subsidized industry.

This was the exact opposite of what needed to happen. As for consumers, they were robbed of the one silver lining from the period of 1929 to 1932, namely the existence of lower prices that made products more affordable and rewarded thrift on the part of savers. This was a gift to the public in the midst of economic depression. The government took away that gift.

Even though FDR mysteriously gained the reputation of having solved the Great Depression, he prolonged it all the way to the Second World War. Recovery did not begin until after the war and Truman was president. Somehow, many people still believe that FDR was a great hero who dug the country out of an economic quagmire.

This is how the legend of deflation began. It is the historical imagination that still fuels the myth in people’s brains. Even now, I promise you that the elites fear deflation far more than inflation. Even after having lost 30 percent of purchasing power in the great inflation of our times, and even though prices are still rising 2-3 percent per year, we hear constantly about the danger of letting inflation rates fall to less than zero.

I’m telling you that consumers and wholesalers would right now welcome and cheer a return to 2019 prices. This is what should happen. To be sure, such a thing would put enormous pressure on banks, likely cause stock markets to fall, and be a major issue to all indebted businesses.

So, yes, this would cause pain—it could even risk default unless government tighten its belt—but the pain is the sort that an alcoholic undergoes when he gives up the bottle. It’s a necessary part of sobriety.

I have zero hope that we can get rid of the myths around deflation but I’m letting you know anyway. Sometimes it’s best just to know what’s true, even if the whole of the establishment rejects it.

Tyler Durden

Wed, 11/26/2025 – 17:15ZeroHedge NewsRead More

R1

R1

T1

T1