Global Chaos As CME Outage Halts Futures Trading, Markets Set For Monthly Loss

Normally, this is where we would tell you where US index futures are trading early in the morning, we can’t because at 9:45pm ET on Thursday, the CME experienced a catastrophic “glitch” and all equities, treasuries, FX and commodities futures went dark as a result of a what the Chicago Merc Exchange said was a cooling system malfunction at its Chicago data center operated by CyrusOne. While the CME since restarted its EBS market, a platform used in foreign exchange, at noon London time, its major global futures markets from equities to bonds and commodities are still down. When the cash market opens, both the S&P 500 and Nasdaq 100 will look to extend a four-day winning streak driven by growing confidence that the Fed will cut interest rates next month. Elsewhere, European bourses are mostly flat, with the FTSE 100 (+0.1%) the only major index posting gains. Overall market action is muted amid light news flow, reflecting both Thanksgiving and the CME issues. The Dollar is firmer within a 99.50–99.75 range, having found support at the half-round figure and pushed above Thursday’s 99.71 peak. European bonds are a little softer post-data; the EUR dipped during the releases but has since bounced off lows. Crude oil traded modestly higher, extending the prior session’s gains, although WTI trading was later halted due to the CME outage. Looking ahead, highlights Canadian GDP (Q3), German Nationwide HICP, Credit Review for France. Today is a shortened US session, with markets set to close just after noon ET.

Single stocks traded without incident in the premarket. Alphabet Inc. rose more than 1%, while Amazon.com Inc. also firmed as Black Friday shopping moved into full swing. Individual stocks are trading, and all Mag 7 names are in the green:Alphabet (GOOGL +0.9%, Amazon +0.9%, Microsoft +0.8%, Tesla +0.6%, Meta +0.5%, Nvidia +0.4%, Apple +0.3%). Here are some other notable premarket movers:

- CNH Industrial (CNH) is down 1.2% after JPMorgan analyst Tami Zakaria cut the recommendation on the agricultural equipment maker to underweight from neutral, citing an industry outlook from Deere.

- Tilray Brands (TLRY) is down 13% after the cannabis company announced that it will implement a one-for-ten reverse stock split of its common stock.

- Shares in CME Group Inc. (CME), NYSE owner Intercontinental Exchange Inc. (ICE) and Nasdaq Inc. (NDAQ) are in focus after the CME glitch

In corporate news, a fleet of planes that UPS grounded after a deadly crash isn’t expected to be back in service during the peak holiday season due to inspections and possible repairs.

After a volatile start to November, the S&P 500 narrowed its loss to about 0.4% before the Thanksgiving break. Expectations that the Federal Reserve will cut interest rates faster than first anticipated fueled a late-month rebound. The gauge had been down as much as 4.7% in November barely more than a week ago, as worries over stretched technology valuations rattled traders. Money markets were assigning roughly an 80% chance of a Fed cut in December before the CME disruption hit.

For markets still affected by the outage – which is most of them – the impact was significant. Trading of US Treasury futures remained halted, while cash bonds saw limited activity. European and UK bond markets that trade on a different exchange were unaffected.

“Some market participants will take advantage of possible differences in prices,” said Guillermo Hernandez Sampere, head of trading at asset manager MPPM. “The majority will pause trading for risk reasons until the issues are resolved, otherwise losses are possible.”

For some, the timing of the disruption on Friday could cause particular inconvenience if it lasts, due to the need to roll positions from one contract to another. Friday is the expiry day for gasoline and diesel futures that can be settled with delivery of the actual physical fuel, adding a further potential complication for some traders.

“The spillover from the Thanksgiving holiday and the fact there is no US data may on the face of it lessen the impact,” said Daniel Noorian, head of execution and quantitative services at Liquidnet. “Big concerns will be month-end flows and options expiry today in the weekly products.”

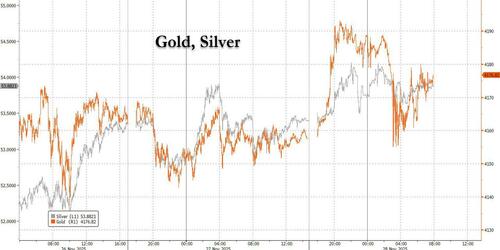

Gold saw erratic moves in early London trading, with the gap between bids and offers about 20 times wider than normal. US crude and palm oil on the Bursa Malaysia exchange were also affected.

According to an update, futures markets should reopen shortly…

- *CME GLOBEX FUTURES & OPTIONS MARKETS TO OPEN 7:30 CENTRAL TIME

Elsewhere, money markets are pricing in a more than 80% chance of a quarter-point rate cut in December, up substantially from about 30% before Williams’ speech last Friday, and leaning toward three more in 2026. That’s helping ease concerns about AI spending and stretched valuations, which sparked a selloff earlier this month. The theme of intensifying AI competition continues to play out. Nvidia has fallen nearly 13% in under a month, while SoftBank – a major investor in OpenAI – is down almost 40% from its October peak. Conversely, tie-ups and new software are helping Google catch up in the global AI race.

Turning to the sad state of the US consumer, this Black Friday, bargains may be tougher to find. Retailers are trying to rein in discounting to mitigate Trump’s tariffs. Stores may struggle to keep shelves stocked with children’s gifts still overwhelmingly made in China as tariff-hit imports fall.

In geopolitics, Putin signaled openness to talks about ending the war in Ukraine, saying Trump’s proposals could be the basis for future agreements. Efforts to end Russia’s war there are weighing on oil prices, set to fall for a fourth month running, the longest monthly losing streak in more than two years, ahead of a meeting of OPEC and its allies this weekend.

Europe Trading: European stocks were little-changed with steady with gains in the FTSE 100 and CAC 40. The Stoxx 600 is little changed as it heads for a 5th monthly gain. Delivery Hero shares rally as it’s said to be facing pressure from investors to sell at least parts of its business. Energy shares outperform, while the travel and leisure sector is among the laggards. Here are some of the biggest movers on Friday:

- Delivery Hero shares rally as much as 8.5% as it is said to be facing pressure from several large shareholders to conduct a strategic review amid increasing consolidation in the food-delivery industry.

- Mowi shares gain as much as 2.8%, the most in more than a month, after Berenberg raised its recommendation to buy from hold.

- Knorr-Bremse shares rise as much as 2.3%, the most since August, after Goldman Sachs initiated coverage with a recommendation of buy.

- EasyJet shares climb as much as 3.1% to a six-week high after Bernstein upgraded the stock to outperform from market-perform.

- Mitchells & Butlers shares gain as much as 8.2% on Friday, the most since May 2024, after the pub operator reported strong full-year results and robust current trading.

- Softwareone shares surge as much as 11% to their highest level in over a year on Friday, after Berenberg initiated coverage with a recommendation of buy.

- Whitbread shares slide as much as 9.2% to a seven-month low after Bernstein double-downgrades the stock following Wednesday’s UK budget.

- Sunrise Communications shares drop as much as 3.4% after JPMorgan cut its recommendation to underweight from neutral.

- Burberry shares fall as much as 4.6% after JPMorgan cut its recommendation to underweight from neutral.

Asian stocks fell for the first time this week, hampered by losses in high-flying South Korean tech names. The MSCI Asia Pacific Index dropped 0.3%, weighed down by the likes

In FX, the dollar is stronger versus major peers with the Bloomberg Dollar Spot Index up 0.2%. Kiwi lags but is on track for a 1.7% weekly gain versus the dollar following a hawkish RBNZ cut earlier in the week. The euro is lower after regional euro-zone inflation metrics.

In commodities, oil was on track for a fourth monthly decline as traders looked ahead to this weekend’s OPEC+ meeting and assessed how a possible Ukraine peace agreement might influence an already oversupplied market. Brent held above $63 a barrel after a modest rise on Thursday. Spot gold is higher but saw a $20 move lower in early European trade, which could be linked to the lack of CME trade.

Market Snapshot

- none as there are no futures actively traded

Top Overnight News

- CME Group (CME) says BrokerTec EU markets are open and trading, all other CME group markets remain halted amid the data center cooling issue at CyrusOne.

- CME announced that CME Globex futures and options markets were halted due to technical issues, and Cboe halted trading on C1 due to ongoing issues at CME. CME later announced that markets were halted due to a cooling issue at CyrusOne data centres, while it is working to resolve the outage issue and will advise clients of pre-open details as soon as available.

- US President Trump said that they may be cutting income tax almost completely because of tariff proceeds.

- US President Trump posted that he will permanently pause migration from all third-world countries to allow the US system to fully recover and will terminate all of the millions of Biden’s illegal admissions, while he will end all federal benefits and subsidies to non-citizens.

- US President Trump ordered a review of all green card holders from countries “of concern” after the attack on National Guards in Washington DC, according to Axios.

Trade/Tariffs

- Nexperia issued an open letter to the leadership of Nexperia’s entities in China and noted that it continues to seek constructive collaboration with its entities in China, and has been requesting an open dialogue to find a path forward. Furthermore, it urged the leadership of Co.’s entities in China to take immediate steps towards structured negotiations to address the restoration of the supply chain, but added that it did not receive any meaningful response.

- Indonesia is reportedly resisting attempts by US President Trump to force it to accept a so-called “poison pill” and other coercive clauses in its “reciprocal tariff” trade deal with the US, according to FT.

- India expects to have a deal with the US before year-end as most issues are resolved, according to the Indian Trade Secretary

- EU Commission receives notifications from Apple (AAPL) under the Digital Market Act: Notifications from Apple (AAPL) indicated that its core platform services like Apple ads and maps meets the digital market thresholds.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were rangebound in the absence of a lead from Wall Street due to Thanksgiving Day and as participants digest a deluge of data at month-end. ASX 200 lacked direction as strength in the tech, mining and the consumer sectors is counterbalanced by losses in financials, real estate and telecoms. Nikkei 225 traded indecisively amid a slew of data in which Industrial Production and Retail Sales topped forecasts, while Unemployment rose and Tokyo CPI printed mostly in line with estimates, aside from the firmer-than-expected core reading. Hang Seng and Shanghai Comp were mixed, albeit with trade confined to within relatively tight parameters, while China Vanke shares and bonds were volatile and initially continued to slump with its H shares hitting a record low amid the ongoing default concerns, before staging a notable recovery.

Top Asian News

- BoJ decided to increase the upper limit on the consecutive-day purchases of the same issue under the Securities Lending Facility (SLF) for 10-year JGBs from Dec 1st.

- Japan finalised JPY 18.3tln extra budget to fund stimulus package

- Samsung Electronics (005930 KS) appoints new CEO, Tae-Moon Roh.

- Meituan (3690 HK) Q3 (CNY): Revenue 95.5bln (exp. 97.5bln), Adj Net -16bln (exp. -13.96bln); sees operating loss trend to continue in Q4; market competition remained overheated recently.

European bourses are mostly flat, with the FTSE 100 (+0.1%) marginally higher this morning. Overall market action is muted amid light news flow, reflecting both Thanksgiving and the CME issues. European sectors are largely in the red. Basic Resources (+0.2%) and Energy (+0.3%) are marginal outperformers, supported by underlying moves in metals and energy. Laggards include Travel & Leisure (-0.7%), Autos (-0.4%) and Insurance (-0.4%). Ongoing Nexperia concerns continue to pressure Autos, as the company warns of imminent production halts.

Top European News

- S&P said UK public finances remain constrained and it expects fiscal pressures in the UK to persist over the medium term despite revenue-raising measures announced in the Autumn Budget, while it added that general government deficits are forecast to moderate through to 2028 and there are risks to the UK’s fiscal consolidation plan, especially toward the end of the forecast horizon.

- Moody’s says UK budget affirms commitment to fiscal consolidation however, they highlight execution risk.

- ECB Consumer Expectations Survey results (October 2025); 12-month inflation expectations raised, 3- and 5-year expectations unchanged.

FX

- DXY is firmer within a 99.50–99.76 range, having found support at the half-round figure and pushed above Thursday’s 99.71 peak. Fresh catalysts have been limited overnight and through the European morning, with FX futures on CME halted due to an exchange issue. Comments from US President Trump noted they may be cutting income tax almost completely using tariff proceeds.

- EUR and GBP are subdued against the USD but flat versus each other, leaving downside in the USD pairs driven by the Dollar rather than EZ- or UK-specific developments.

- JPY is flat and uneventful amid thin conditions and few catalysts, with USD/JPY holding a 155.65–157.18 range, comfortably inside Thursday’s 154.37–157.89 span.

- NZD is pulling back after recent post-RBNZ outperformance, while AUD/NZ D remains near weekly lows (1.1400) after sliding from a 1.1536 pre-RBNZ high.

Fixed Income

- EGBs are ultimately a little softer post-data; the EUR dipped during the releases but has since bounced off lows.

- Bunds briefly pushed above 129.00 on cooler French HICP before fading, slipping back below 129.00 and extending losses to ~128.84 despite broadly softer German state CPI prints.

- Gilts contained overall, but have traversed a relatively wide range of just under 40 ticks as traders digest what appears to be another manifesto U-turn, by PM Starmer; markets now await the verdict from Chancellor Reeves on the matter.

- UK DMO to sell GBP 1bln 4.25% 2039 Gilt via tender on Dec 4th.

Commodities

- WTI and Brent traded with a positive bias overnight, extending the prior session’s gains. WTI trading was later halted due to the CME outage. Since then, Brent Feb ’26 has slipped from its overnight highs and is now moving within a USD 62.72–63.26/bbl range.

- Precious metals are firmer, though with limited catalysts this morning. Spot gold is confined to a narrow USD 4,147.92/oz–4,193.20/oz range, with geopolitics remaining the main focus.

- Base metals retain a strong positive tone, with 3M LME Copper trading near the top of its USD 10,940.56–11,008.40/t range. The current upside looks mainly like a modest rebound from recent pressure.

- Ukraine’s military says it hit Russia’s Saratov oil refinery.

Geopolitics

- Ukrainian President Zelensky said Ukrainian and US delegations will meet this week to work out a formula for peace and security discussed in the Geneva talks.

- Russia’s Kremlin says Russia wants to try move towards peace in Ukraine despite its belief that Ukrainian President Zelensky is not legitimate.

- Ukrainian Presidential top aide said should not count on them giving up territory as long as Zelensky is President.

- Belgium warned that using frozen Russian assets to fund Ukraine will endanger a peace deal, according to FT.

- US President Trump said regarding Venezuela that they will begin to stop drug cartels on land soon.

- Russian President Putin to visit India between December 4th-5th, according to IFX.

- Chinese Foreign Minister Wang Yi to visit Russia between December 1st-2nd.

DB’s Jim Reid concludes the overnight wrap

Morning from Holland which was the last place I wanted to go yesterday after Liverpool were destroyed 4-1 at home to Dutch side PSV the previous evening. Staying with sport, today is the day where I been cleared to putt for 10 minutes a day maximum after recent back surgery. Tough to do that in a hotel room in Amsterdam as I type this so I’ll wait for the weekend where I’ll likely force my kids to spend 3 hours on the putting green with me tomorrow.

Whilst our 2026 outlook might be called “Anything but dull”, the last 24 hours have been “everything dull” with the US out for Thanksgiving, and few headlines elsewhere. Even an overnight outage at the CME, which means many futures contracts (including US equity futures) haven’t traded since around 2.45am London time, hasn’t really been noticed! The problem seems to be a “cooling issue” at a data centre. Given the exponential surge in data centres for other reasons in recent quarters that’s an interesting development!

When there was trading in the last 24 hours, you could just about squint your eyes and argue that the risk-on tone generally continued, with Europe’s STOXX 600 (+0.14%) just about posting a 4th consecutive gain. And to be fair, there were some other signs that sentiment was recovering, with Bitcoin (+1.35%) closing at a one-week high of $91,410. Today some life will be breathed into markets with CPI in Germany, France and Italy and later we’ll start hearing the first snippets of news around Black Friday sales – a key barometer of the health of the consumer and the companies that rely on them.

That pattern of modest equity advances played out across Europe, with little divergence across sectors or countries. Indeed, none of the big sector groups in the STOXX 600 posted any sharp moves yesterday, and the other major indices also posted small advances. So the DAX (+0.18%), the CAC 40 (+0.04%) and the FTSE MIB (+0.21%) each only rose slightly. Similarly for sovereign bonds, there was a modest uptick in yields across Europe, with those on 10yr bunds (+0.8bps), OATs (+1.3bps) and BTPs (+1.2bps) all a bit higher.

Yet despite that modest recovery in sentiment, UK markets struggled after Wednesday’s budget, paring back some of their outperformance immediately after the statement. That was driven by a sense that lots of the structural issues hadn’t gone away, particularly as most of the tax rises had been backloaded into the later years of the forecast. So the FTSE 100 (+0.02%) was one of the weaker performers among the big European indices, and gilt yields rose across the curve, with the 10yr yield (+2.6bps) up to 4.45%. Now admittedly, gilt yields are still beneath their pre-budget levels on Wednesday morning, but the partial reversal fed into wider concerns that the budget had only bought the UK time on its fiscal position, rather than putting things on a permanently sustainable path.

Otherwise, there were a few more headlines on the Ukraine peace talks, although nothing that was particularly market moving. The original Thanksgiving deadline for peace is now looking a touch optimistic with hindsight! However there is progress, but whether this can translate into a deal is a big question. For instance, President Putin commented on the US proposals, saying that “In general, we agree that this can form the basis for future agreements”. However, he also said that “it would be impolite of me to talk about any final versions now. There are none.” So there remains a general scepticism that we’re on the verge of an imminent breakthrough, and the Polymarket odds still only suggest a 27% chance that a Russia-Ukraine ceasefire will be reached by the end of March. Against that backdrop, both oil prices and European defence stocks rose a bit, with Brent crude (+0.33%) up to $63.34/bbl. However, the moves were in line with the broader risk-on tone, rather than obviously driven by any developments on the peace talks.

Meanwhile in the US, both equity and bond markets were closed for Thanksgiving, but the futures markets that were opened showed barely any movement either. So around the time of the European close, futures on the S&P 500 were completely flat, and Treasury futures indicated that yields would only rise by up to a basis point across the curve. On the topic of holidays, remember as well that today will have an earlier close than usual in the US, with the New York Stock Exchange closing at 1pm Eastern time.

Asian equity markets are mostly lower this morning as the rebound in technology shares has lost some momentum. Across the region, the KOSPI (-1.51%) stands out as the largest underperformer, with the index down nearly -4.0% for November, while the Nikkei is flat as a series of robust economic data drummed up expectations that the BOJ will have enough headroom to raise interest rates soon (details below). Elsewhere, Chinese stocks are a little mixed, with the Hang Seng (-0.28%) recording slight losses, whereas the Shanghai Composite (+0.10%) is slightly higher. US equity futures haven’t traded since around 2.45am London time due to the CME glitch discussed at the top. When they last did the S&P 500 (+0.11%) and NASDAQ 100 (+0.18%) were higher.

Turning back to Japan, the core CPI in Tokyo increased by +2.8% year-on-year in November. This figure was slightly above the anticipated 2.7% and remained consistent with the previous month’s reading. Moreover, the headline Tokyo CPI inflation held steady at 2.7% year-on-year. In a separate report, industrial production rose by 1.4% month-on-month in October, contrasting with expectations of a -0.6% decline, and a slowdown from a +2.6% increase in September, thus providing a tentative indication that manufacturing activity is stabilising after several months of inconsistent factory output. Meanwhile, retail sales surged by +1.6% month-on-month in October (compared to the +0.8% expected), rebounding on the anticipation of tax cuts and more expansionary policies under the new administration. 10yr JGBs are up another +2.2bps this morning.

Finally yesterday, the ECB published the account from their last meeting in October, where they kept their deposit rate at 2%. It said that keeping rates “at their current levels would allow for more information to become available to assess the risk factors that the Governing Council had discussed.” Later on however, there was an interesting discussion on “possible strategies for future monetary policy”. It said that one view was expressed “that the rate-cutting cycle had come to an end”, but another view argued “that it was important to remain entirely open-minded on the possible need for a further rate cut”.

To the day ahead now, and data releases include the November flash CPI prints from Germany, France and Italy, as well as German unemployment for November, and Canada’s Q3 GDP. Then from central banks, we’ll hear from Bundesbank President Nagel.

Tyler Durden

Fri, 11/28/2025 – 08:21ZeroHedge NewsRead More

R1

R1

T1

T1