Hassett Odds Soar As Trump Confirms He’s Made Decision On Next Fed Chair

President Donald Trump said on Nov. 30 that he has already decided on his pick to replace Federal Reserve Chair Jerome Powell, adding that an announcement is forthcoming, but declining to identify his nominee.

“I know who I am going to pick, yeah,” Trump told reporters on Air Force One on his way back from Florida to Washington on Sunday.

When asked whether he would nominate National Economic Council Director Kevin Hassett, the current frontrunner to replace Powell according to betting markets, Trump smiled and replied, “I’m not going to tell you, we’ll be announcing it.”

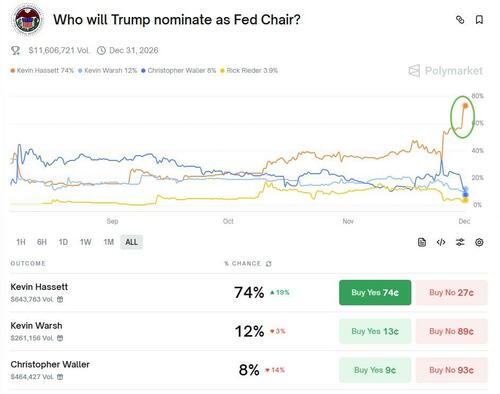

Hassett now has an 75% chance of getting the nomination according to prediction market Polymarket. Former Fed Gov. Kevin Warsh is at 12% with Fed Gov. Christopher Waller down to 8%.

Earlier Sunday, Hassett, on CBS’ “Face The Nation,” said the market’s reaction to reports that Trump was close to a pick is a positive sign.

“Once it became clear that the president’s getting closer to make a decision, the markets really celebrated, interest rates went down, we had one of our best Treasury auctions ever,” Hassett said on Fox.

“I think that the market expects that there’s going to be a new person at the Fed, and they expect that President Trump’s going to pick a new one. And if he picks me, I’d be happy to serve.”

Hassett, who has strongly defended Trump’s economic policies, including tariffs and interest rates, said he would be happy to serve as Fed chief if Trump nominated him.

“I’m really honored to be amongst a group of really great candidates,” Hassett told CBS.

“I think that the American people could expect President Trump to pick somebody who’s going to help them, you know, have cheaper car loans and easier access to mortgages at lower rates.”

We do note that rates are higher this morning after Trump’s comments (and the yield curve is steeper – policy error), but there are a lot of moving parts after the long weekend (from mixed manufacturing data to a hawkish BoJ) impacting markets.

Market-implied odds have soared to fully price in a rate-cut in December…

Finally, we note that Hassett’s financial disclosure reveals at least a seven‑figure Coinbase stake and compensation for serving on the exchange’s Academic and Regulatory Advisory Council, placing him unusually close to the crypto industry for a potential Fed chair.

Still, crypto has been burned before by reading too much into “crypto‑literate” resumes. Gary Gensler arrived at the Securities and Exchange Commission with MIT blockchain courses under his belt, but went on to preside over a wave of high‑profile enforcement actions, some of which critics branded as “Operation Chokepoint 2.0.”

A Hassett-led Fed might be more open to experimentation and less reflexively hostile to bank‑crypto activity. Still, the institution’s mandate on financial stability means markets should not assume a one‑way bet on deregulation.

Tyler Durden

Mon, 12/01/2025 – 12:00ZeroHedge NewsRead More

R1

R1

T1

T1