Is A Bear Market A Good Thing?

Authored by Lance Roberts via RealInvestmentAdvice.com,

One of my favorite writers for the WSJ is Spencer Jakab, who recently penned an article explaining why a bear market is not necessarily a bad thing. He starts with a quote from “The Godfather.”

““These things gotta happen every five years or so, ten years. Helps to get rid of the bad blood…been ten years since the last one.”

In today’s markets, mentioning the “B-word” will get you thrown into the “permabear” camp, and everyone immediately assumes you mean the end of the world: death, disaster, and destruction. Unfortunately, even the Federal Reserve and the Government also believe bear markets “are bad.” As such, they have gone to great lengths to avoid bear markets and recessions through massive interventions and zero-interest-rate policies.

Yes, bear markets are indeed destructive, as they reverse the “wealth effect.” People lose their jobs as economic demand declines, weak companies go out of business, and consumer sentiment declines. However, sometimes destruction is a “healthy” thing, and there are many examples we can look to, such as “wildfires.” Like a bear market, wildfires are a natural part of the environmental cycle. They are nature’s way of clearing out the dead litter on forest floors, allowing essential nutrients to return to the soil. As the soil enriches, it enables a new, healthy beginning for plants and animals. Fires also play a vital role in the reproduction of some plants.

However, just as the Federal Reserve has tried to stop bear markets, California has had similar negative results from trying to prevent wildfires, as noted by MIT:

“Decades of rushing to stamp out flames that naturally clear out small trees and undergrowth have had disastrous unintended consequences. This approach means that when fires do occur, there’s often far more fuel to burn, and it acts as a ladder, allowing the flames to climb into the crowns and takedown otherwise resistant mature trees.

Yes, bear markets have terrible short-term impacts, but they also allow the system to reset for healthier growth in the future.

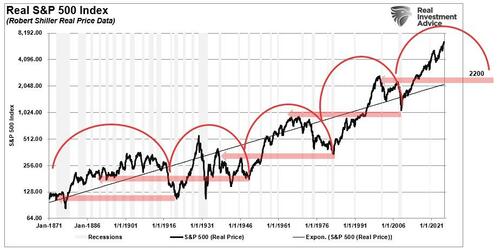

As we discussed in “Full Market Cycles,” markets thrive on cycles of expansion and contraction.

“Throughout history, bull market cycles are only one-half of the ‘full market’ cycle. This is because during every ‘bull market’ cycle the markets and economy build up excesses that are then ‘reverted’ during the following ‘bear market.’

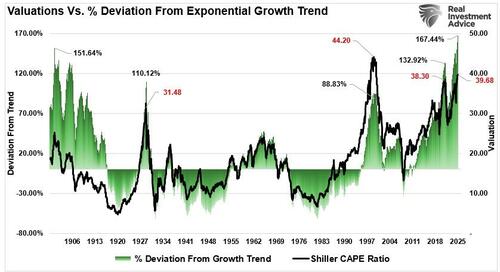

In other words, just as wildfires restore the balance to the forest, a bear market reverses the buildup of excesses from the previous bull market phase. When valuations accelerate unchecked, speculative excess proliferates. As shown in the chart below, when valuations rise unchecked, the market grossly exceeds its long-term exponential growth trend, eventually leading to a reversion.

In the late 1990s, for example, the valuations of technology companies bore little relation to their actual profits, and leverage accumulated in non-bank financial sectors. Without a meaningful contraction, the excesses cumulated and amplified. A proper bear market forces participants to re‑evaluate assumptions, rein in leverage, and ultimately restore alignment between price and fundamentals. It is no coincidence that the most significant financial calamities have followed periods of weak or absent corrections. The Dot‑com Crash (2000‑2002) and the Global Financial Crisis (2007‑2009) both came after long expansion phases with little meaningful reset. The crisis that followed those periods was far more damaging than the corrections themselves.

However, that is why a bear market can be beneficial.

Reducing the Risk of Major Crises

As investors, we should welcome normal bear market corrections (of 20% or more) as they help maintain the health of the market system. Research by Goldman Sachs identifies three kinds of bear markets: event‐driven, cyclical, and structural. Each serves essentially as a purge of excess in different ways. In other words, bear markets are not “accidents” to be feared exclusively, but mechanisms by which markets self‐correct.

More importantly, the Federal Reserve and the Government should NOT intervene during these corrective processes, as bear markets act as a “clearing mechanism” of weak underpinnings. Bear markets ferret out weak companies, capital misallocations, and unsustainable business models. However, when the Federal Reserve or the Government intervenes to “bail out” that weakness, it fosters an environment that leads to a more substantial crisis in the future. As legendary investor Warren Buffett said, “The stock market is designed to transfer money from the active to the patient.” That patient capital works best when the speculative froth is stripped away.

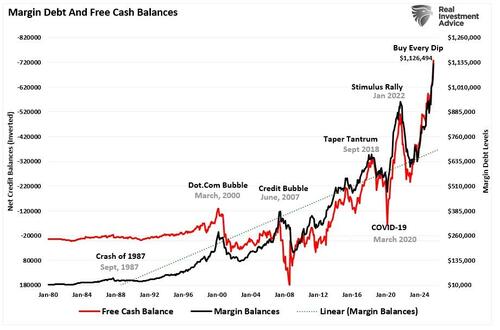

In short, bear markets serve as a form of market hygiene. They remove the buildup of risk, correct structural mispricings, and pave the way for healthier expansions. In this way, they reduce the chances of a runaway boom and subsequent catastrophic bust. As noted above, the problem with letting expansions run unchecked is that risk accumulates, leverage becomes excessive, valuations become detached from earnings, and investor psychology becomes euphoric. We can see this now, given the amount of leverage and speculation currently in the market.

Euphoria is dangerous. As Scott Bessent, U.S. Treasury Secretary, observed:

“Corrections are healthy. They’re normal. What’s not healthy is straight up, that you get these euphoric markets.”

Without a meaningful correction, the system grows brittle. Research shows that structural bear markets, the most severe type, tend to follow bull phases characterized by broad-based excess, speculative bubbles, and large-scale private-sector leverage.

A good example was the 2008 Global Financial Crisis. House prices soared, complex derivatives proliferated, and many investors believed that “this time is different”. When the unwind began, the fall was severe, with markets plummeting by over 50% in the U.S. However, had the Federal Reserve taken some action to reduce more speculative lending by hiking reserve requirements or rates, such action would have likely caused a more moderate bear market earlier, which may have deflated the excess, avoided a systemic collapse, or at least reduced the scope of the damage.

By welcoming bear markets (or at least accepting their inevitability), markets allow weaker players to exit, capital to be reallocated, and valuations to reset before the next leg up. In effect, a bear market lowers the “tail‑risk” of a catastrophic event by forcing more minor corrections instead of one massive collapse. Scholars have found evidence of asymmetric causality: bear markets can cause recessions, but recessions do not always cause bear markets.

In practice, this means that the wiser investor should view a bear market not just as a risk, but as a protector of the system over the long term. It reduces the buildup of fragility. It deflates bubbles in a more controlled manner and mitigates the risk of a major meltdown. While such a process would lower equity market returns, the net effect is fewer large‐scale economic dislocations, even if the short term is painful.

Why Investors Should Welcome Bear Markets as an Opportunity

Although bear markets feel uncomfortable, they offer fertile ground for long‐term returns if you’re prepared. Data supports this: bear markets are a normal phase, and historically, investors who remain invested and buy quality assets at discounted prices have achieved outsized returns over time.

“Widespread fear is your friend as an investor because it serves up bargain purchases.” – Warren Buffett

That sums it up. In a deep market correction, quality companies often trade at irrational discounts. The unsophisticated sell in panic; the prepared buy selectively.

Moreover, bear markets deepen your discipline. Many younger investors and even many professionals today lack experience of a complete bear cycle. Shallow corrections have dominated the past decade, depriving markets of real stress testing. Without that testing, many young investors today fundamentally underestimate the risk they carry by chasing fads and misallocating capital. A bear market teaches humility, demands capital preservation, forces a reappraisal of business models and valuation, and separates the durable from the ephemeral.

In effect, bear markets give you two gifts if you play them well:

-

The chance to own high‑quality assets at lower valuations, and

-

The ability to compound from a lower base into more substantial returns over time.

With markets overvalued, speculation elevated, and forward outlooks likely overly optimistic, investors should consider taking some actions today to navigate the current bull market environment.

-

Conduct a portfolio fundamentals review now. Ensure that the companies you hold have durable profitability, competitive moats, and manageable debt.

-

Maintain or build a liquidity buffer. You should have dry powder, cash, or equivalents, ready to deploy when valuations become compelling.

-

Define your “target” valuations or business attributes ahead of time. Know what you’re willing to pay for quality companies when market fear arrives.

-

Resist chasing speculative themes when valuations are elevated. Validate earnings, balance sheets, and business models.

-

Set allocation controls. For example, determine in advance the percentage of your equity exposure you are willing to add in a downturn.

-

Stay invested rather than sell in panic. Exiting during a dramatic decline often locks in losses and misses the early recovery.

-

Be emotionally prepared. Bear markets test your nerve, not your cleverness. Discipline beats market timing.

-

Keep your horizon long‑term. Bear markets are chapters in multi‑decade investment journeys. The compounding value arises from staying engaged through the cycle.

-

Use a watch list of high‑quality names you’d like to own if they drop significantly. Prep the list now so you move from reactive to proactive when the opportunity arises.

-

Monitor macro signals and valuations, but don’t let them paralyze action. The market will not wait for perfect clarity.

By executing the checklist, you position yourself to benefit from a bear market rather than be overwhelmed by it. In the end, market downturns are part of the process of long‑term wealth creation, but you must remain disciplined.

Bear markets are a necessary mechanism for healthy financial markets. They reduce the risk of systemic excess and crises. They enable the wise investor to acquire high-quality assets at attractive valuations and participate more fully in the next growth cycle.

But you must prepare today to take advantage of and welcome the eventual and inevitable “bear market,” which is an opportunity, not a curse.

Tyler Durden

Mon, 12/01/2025 – 14:40ZeroHedge NewsRead More

R1

R1

T1

T1