‘Got Gold’ For The Coming Reckoning?

Authored by Jim Quinn via The Burning Platform blog,

“China has been understating its gold reserves by possibly a factor of 10. I believe this is the biggest story in world finance. The West is either asleep at the wheel or ignoring it.”

– Dominic Frisby

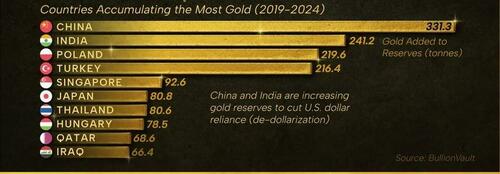

The Financial Times reported that China is under-reporting their gold reserves, subversively hiding the fact they have accumulated 10 times as much gold as they have officially reported. The charts and data below from Visual Capitalist are based on “officially” reported numbers. Even these fake numbers show China accumulating gold at a rapid pace over the last five years. According to these charts, The U.S. supposedly has 8,133 tons of gold, but Trump’s unfulfilled promise to audit Fort Knox puts that figure in doubt. Officially, China has the sixth largest amount of gold at 2,280 tons. Unofficially, China’s reserves are at least 5,000 tons, with some estimates exceeding the U.S. levels.

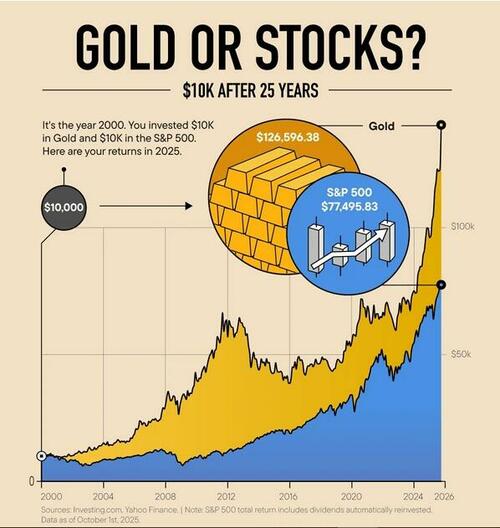

The 140% increase in the price of gold over the last three years is telling a story the legacy media propaganda outlets don’t want told. The decline of the dollar and western civilization are a reflection of the soaring price of gold. And this isn’t a recent development. The beginning of the end began at the start of this century. The shills and bimbos on CNBC will blather endlessly about stocks for the long-run without ever revealing these facts:

-

The price of gold on January 1, 2000 was $289 per ounce. The current price is $4,256 per ounce. So, gold has gone up by a factor of 14.7 in the first quarter of this century.

-

The S&P 500 was 1,469 on January 1, 2000. The S&P 500 is currently 6,849. Therefore, it is up by a factor of 4.7 in the first quarter of this century.

-

The NASDAQ was 4,131 on January 1, 2000. The NASDAQ is currently 23,365. So, even with an AI bubble driving the NASDAQ to all-time highs, it is only up by a factor of 5.7.

Stocks have done pretty well, but gold has been the asset class of the century, without question. This increase in value is really related to the 47% decline in the purchasing power of the USD, according to the bullshit BLS CPI. In reality, the USD has declined in value by at least 70% since 2000. I’m sure the 14.7 fold increase in the price of gold has nothing to do with the 6.7 fold increase in the national debt ($5.7 trillion to $38.3 trillion) or the 11.1 fold increase in the Federal Reserve balance sheet ($592 billion to $6.58 trillion). The price of gold is a true reflection of a profligate empire of debt hurtling towards its rendezvous with the destiny all empires eventually meet – collapse.

China, Russia and the rest of the BRICS countries are positioning themselves for the final economic battle with the American empire. They have been rapidly selling U.S. Treasuries and replacing them with gold and now silver. The top two gold mining producing countries in the world are China and Russia, accounting for approximately 20% of worldwide production. The American empire of debt is in its death throes, threatening, bullying and making blustering proclamations towards countries not toeing the line of USD dominance. The central bankers across the globe see the writing on the wall and that is why they are accumulating gold.

Those running the show (aka invisible government) have used every derivative manipulation trick their Wall Street cabal partners could muster for the last fifteen years to try and suppress the price of gold and silver. But reality is beginning to overwhelm their false narratives and their fraudulent market schemes. The shit has begun hitting the fan and those in control are growing desperate. They can’t deliver the metal, because they don’t have it.

The question all holders of gold and silver want answered is: WHAT HAPPENS NEXT?

In the short-term (1 to 2 years) it is anyone’s guess what will happen, but over the longer term (3 to 8 years) it is a certainty an economic catastrophe caused by the hundreds of trillions in unpayable global debt will engulf the world. Trump and his neo-con handlers are looking to abscond with Venezuela’s 300 billion barrels of oil reserves under the guise of fighting drug traffickers, in order to keep this teetering jenga tower of debt from collapsing in the next year.

All options are on the table for desperate oligarchs, including: World War 3; civil war; engineered stock market collapse; new fake pandemic; or a myriad of other options designed to strike fear into the hearts of the ignorant masses. Gold’s price rise has pulled back the curtain on the wizards of Wall Street, revealing their weakness and vulnerability. The oligarchs need to create an enormous false flag event in order to implement their Great Reset, with mandatory use of CBDCs, creating a digital gulag with no escape for the terrified masses. Your savings accounts and 401ks would be bailed in (aka absconded) to save Wall Street. Possession of physical gold and silver would be declared illegal, just as gold was in 1933 by FDR. Government jackboots would be tasked with confiscation.

Their debt based world is tumbling down. A final catastrophe for the USD is a certainty, unless the ruling elite can use their fear tactics to achieve their goal of creating a global digital gulag. There are several world leaders who could derail their plans and millions of critical thinking, liberty loving patriots who will refuse to bend the knee to these psychopaths in suits.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

– Ludwig von Mises

Nothing can stop the financial collapse baked into this catastrophe cake, but what comes after the collapse is still in question. If or when a new country arises from the ashes of this empire, having gold and silver in your possession would probably be a beneficial step for your future.

Tyler Durden

Tue, 12/02/2025 – 17:00ZeroHedge NewsRead More

R1

R1

T1

T1