Spending Slowdown Hits Apple App Store In Major Markets

Apple App Store spending cooled in November, dragged down by weakening demand across several of Apple’s largest global markets, which together account for more than half of all App Store revenue.

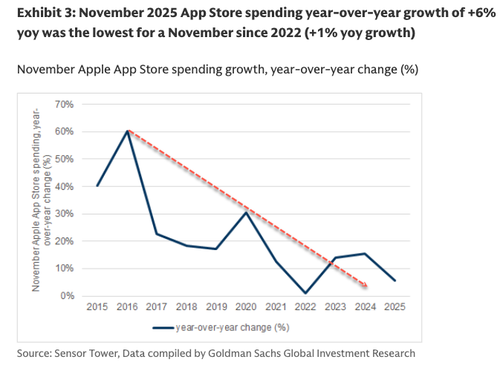

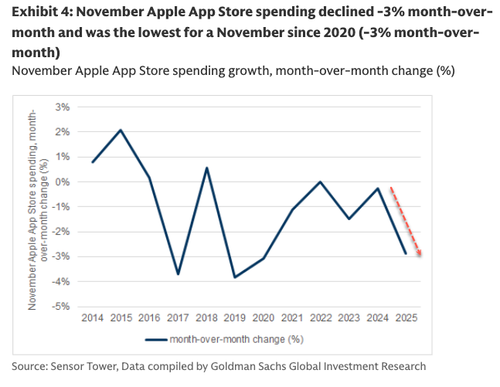

Goldman analysts led by Michael Ng published a note Tuesday citing Sensor Tower data showing Apple App Store spending last month rose just 6% YoY, down from 9% in October and half the growth rate seen in July.

Sensor Tower data showed that Games, the App Store’s largest category (44% of revenue), drove most of the slowdown, falling 2% YoY after growing 3% the previous month.

“Weakening consumer demand for products and services. Apple’s products and services are typically sold to consumers, and any weakness in the macroeconomic environment could reduce demand for Apple products and services,” Ng said.

There was no definitive explanation beyond the softer “macroeconomic environment” for the App Store slowdown.

By geography, four of Apple’s top five markets – the US, Japan, the UK, and Canada – experienced a broad-based slowdown in App Store spending. This raises near-term downside risk and could weigh on App Store revenue.

However, despite slowing App Store spending growth rates, Ng still expects Apple’s F1Q26 Services revenue to meet guidance (14% YoY) because other Service lines – including iCloud+, AppleCare+, Apple Music, Apple Pay, and broader subscriptions – continue to perform well.

Here are the key takeaways from the App Store spending slowdown:

-

November 2025 App Store net revenue grew +6% YoY, decelerating from +9% in October. November marks the slowest month of 2025 and sits below the 2022–2024 average November growth rate of +10% YoY.

-

By category, the slowdown was primarily driven by Games (-2% YoY vs. +3% YoY in October), which represent ~44% of total revenue. Among the next largest categories: Entertainment (15% of total) accelerated to +5% YoY (from +4%), while Photo & Video (8% of total) decelerated slightly to +16% YoY (from +17%).

-

By geography, spending slowed across Apple’s largest markets: the US (36% of total) cooled to +3% YoY (from +8%), Japan (10%) fell to -2% (from +4%), while China (20%) improved slightly to -1% (from -2%).

Notice that the App Store spending slowdown has persisted for much of the year.

Whoops.

Not good.

The question of why consumers are cutting back on gaming apps is a big one. It’s happening across Apple’s major markets, which could point to more financially pressured consumers, smartphone fatigue, or competitive app stores soaking up market share. Whatever the cause, the drop in demand signals Tim Cook will have to take corrective measures heading into 2026.

Tyler Durden

Wed, 12/03/2025 – 13:45ZeroHedge NewsRead More

R1

R1

T1

T1