Goldman Reveals Housing “Affordability Illusion” When Factoring Other Costs

Affordability has surged into the news cycle and is almost certain to dominate the coming midterm election cycle. And when voters talk about “affordability,” they’re most concerned about the basic cost of living. Beyond food and healthcare, nothing hits harder than housing costs.

Goldman analysts led by Arun Manohar have some bad news on the housing affordability front: even with lower mortgage rates and slower home-price growth, it’s largely an “illusion of affordability” once other ownership costs, such as taxes, insurance, and maintenance, are factored in.

Manohar explained more in a recent note to clients:

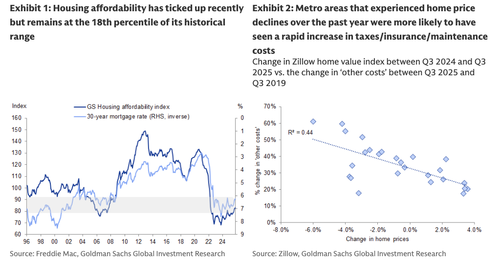

The most important topic of discussion in the housing market remains the challenging affordability situation. The recent decline in mortgage rates and the weak pace of HPA has resulted in housing affordability climbing to the highest level since 2022 (Exhibit 1). However, affordability remains low at the 18th percentile over the past 30 years. Although affordability has climbed, it is important to note that the standard affordability metrics do not capture all the costs of homeownership such as taxes, insurance and maintenance (collectively referred to as ‘other costs’). To capture the effect of ‘other costs,’ we rely on estimates from Zillow for the monthly mortgage payment and total monthly payment on a new home purchased with the average interest rate of the month. The difference between the two series accounts for homeowner’s insurance, property taxes, and maintenance costs. We find that metro areas that have experienced home price declines over the past year have generally witnessed greater increases in the ‘other costs’ over the past few years (Exhibit 2). Although falling home prices would typically make a home more affordable, prospective buyers may experience only partial relief since overall homeownership costs are not decreasing at the same rate as property values. With the median age of the US housing stock being over 40 years old, nationwide insurance premiums and maintenance expenses could increase further.

Mortgage rates are unlikely to decline enough to provide a significant boost to affordability in 2026.

Manohar’s view on President Trump’s newly proposed 50-year mortgage:

50-year mortgages: Short-term affordability boost, but with long-term consequencesRecently, the administration and the FHFA Director have explored the feasibility of introducing a 50-year mortgage product to help improve mortgage affordability. The 30-year fixed rate mortgage available in the US is already among the longest in the developed world. We see four key issues with a 50-year mortgage. First, while monthly payments decline slightly, the increase in the lifetime cost of homeownership can be prohibitive. Using the example of a $400k mortgage at 6.25% interest rates, we note that if the term were to be extended to 50-years, the monthly principal and interest payment would be about 11% lower than that if the term remained at 30-years. However, the total lifetime interest would climb 87% (Exhibit 4). Second, the above calculation assumes mortgage rates are the same for 30-year and 50-year mortgages. In reality though, the longer term will likely translate into higher mortgage rates and hence lower savings in monthly payments. It is quite likely that a 50-year mortgage would receive a rate that is at least 50bp higher than that on a 30-year mortgage (Exhibit 5). Using the same example of a $400k mortgage and the assumption that a 50-year mortgage receives a 50bp higher rate than the 30-year mortgage, the savings in monthly payment drops to just 5%, and the total lifetime interest would more than double. A mortgage rate that is 95bp higher than the prevailing 30-year mortgage rate of 6.25% would result in parity in monthly payments, completely nullifying the benefits of extending the term to 50 years. Third, with a 50-year mortgage, borrowers would build equity at an even slower pace than that with a 30-year mortgage during the initial years, which increases default risks in a housing downturn scenario. Finally, a sudden boost to affordability risks increasing home prices, as potential homebuyers would compete for the same limited inventory. Therefore, any improvement in housing affordability would be short lived.

In a recent Fox News interview, Vice President JD Vance blamed the affordability crisis on lingering effects of failed policies from the Biden-Harris years.

“A lot of young people are saying, housing is way too expensive. Why is that? Because we flooded the country with 30 million illegal immigrants who were taking houses that ought by right go to American citizens,” Vance told Fox News’ Sean Hannity last month. And at the same time, we weren’t building enough new houses to begin with, even for the population that we had.”

ZeroHedge Pro subs can read the full note in the usual place. It’s packed with a lot more housing market charts.

Tyler Durden

Sun, 12/07/2025 – 09:55ZeroHedge NewsRead More

R1

R1

T1

T1