Futures Flat With Fed Rate Cut, Oracle Earnings On Deck

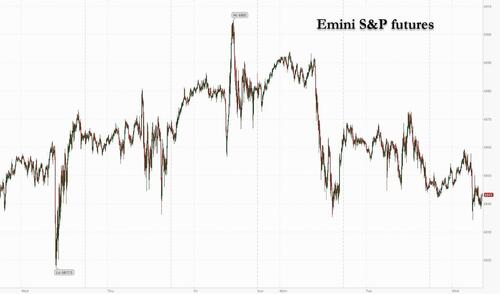

US equity futures are flat ahead of a Fed meeting where a rate cut is assured (the only question is whether it will be hawkish or dovish) and Oracle results later. As of 8:00am ET, S&P and Nasdaq 100 futures are unchanged, with Mag 7 stocks mixed in premarket trading (TSLA +0.5%, META -0.5%, AAPL -0.3%, NVDA -0.2%). Bond yields are mostly unchanged and the USD is flat ahead of the Fed. Commodities are mixed: oil added 0.2%; base metals are lower (copper -1.1%); silver added 0.6% this morning. It’s a big day for capital markets, with SpaceX said to be moving ahead with plans for potentially the biggest IPO of all time and South Korean chipmaker SK Hynix exploring a possible New York share listing. US economic calendar includes 3Q employment cost index at 8:30am and the FOMC decision at 2:00pm.

In premarket trading, Mag 7 stocks are mixed (Tesla +0.3%, Nvidia +0.1%, Amazon -0.01%, Apple +0.08%, Microsoft -1.6%, Alphabet -0.7%, Meta -0.8%)

- Aegon ADRs (AEG) fall 7% following the insurer’s capital markets day statement. Morgan Stanley says group operating profit and capital generation targets look a little underwhelming.

- AeroVironment (AVAV) drops 4% after the maker of drones cut its fiscal year adjusted earnings-per-share outlook.

- Biogen (BIIB) dips 3% after HSBC cut the drugmaker to reduce — its lone sell-equivalent rating — from hold, citing limited near-term earnings improvement as well as a risk to long-term earnings power.

- Cracker Barrel Old Country Store (CBRL) declines 6% as it expects sales to fall faster than it previously forecast, showing the country-themed restaurant chain is still struggling following a backlash to its failed logo change earlier this year.

- EchoStar (SATS) is up 4% after Morgan Stanley upgraded the stock to overweight from equal-weight, noting that the satellite company stands to benefit from rising competition among US wireless carriers.

- GameStop (GME) slides 6% after the video-game retailer reported net sales for the third quarter that declined nearly 5% year-over-year.

- GE Vernova (GEV) rallies 11% after the electric power company boosted its buyback to $10 billion, doubled its dividend to 50c, affirmed some aspects of its 2025 guidance and presented its 2026 financial guidance.

- PepsiCo (PEP) rises 1% after JPMorgan upgrades to overweight, citing an “accelerated agenda of innovation and marketing spending fueled by strong productivity savings.”

- Photronics (PLAB) gains 15% after the semiconductor supplier forecast revenue for the first quarter that beat the average analyst estimate.

In other corporate news, Aegon, the Netherlands-based insurer which generates the majority of its profit from the US, confirmed that it will move its headquarters there and rename itself Transamerica. Netflix and Paramount Skydance’s battle to buy Warner Bros. Discovery will probably stretch well into 2026. Money manager Mario Gabelli signaled support for Paramount and sees the bidding war as being “in the early rounds.”

Traders are holding off until after the Fed, which as we discussed in our preview, has the tough task of messaging about its next move without all the data and amid deep division among policymakers. Some analysts are betting on as many as four (if not more) dissents, and the Fed has to “walk a fine line,” said Diane Swonk, chief economist at KPMG.

In the US, recent economic data have shown that the economy is cooling in a manner consistent with what the Fed wants, but not weak enough to accelerate rate cuts, wrote Linh Tran, market analyst at XS.com. Inflation is easing but still above target, while the labor market continues to show some resilience.

“This combination provides little incentive for investors to continue buying at elevated valuations, yet does not offer sufficient reason for them to sell aggressively,” Tran said. “What the market needs at this moment is a clearer policy signal from the Fed.” Our full Fed preview note is here.

Oracle’s earnings will also help set the tone for the final few weeks of 2025: The stock is down about 33% in three months, with investors increasingly concerned about its high leverage and an AI bubble. Still, Andrew Cole, head of multi-asset investing at Pictet Asset Management, said he doesn’t think the AI trade is over-owned and that he’s “happy” to be overweight US stocks. Eslewhere, Bloomberg reported that Elon Musk’s SpaceX is said to be pushing on with plans for an IPO that would seek to raise significantly more than $30 billion, targeting a valuation of about $1.5 trillion for the entire company. AI memory chipmaker SK Hynix, meanwhile, could close its valuation gap with Micron via a potential New York listing.

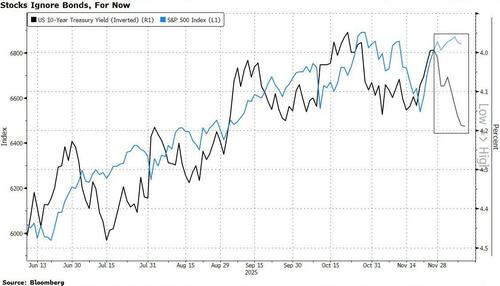

There’s a bit more action in fixed income than stocks, with yields on a Bloomberg gauge of long-dated government bonds at a 16-year high. Traders are now pricing virtually no more rate cuts from the ECB, an all-but-certain hike this month in Japan and two quarter-point increases next year in Australia.

In government news, Trump said he will be looking at a couple of candidates to chair the Fed. The US is proposing that foreign visitors provide their social media history over the last five years to enter the country. Canada’s ambassador to Washington and chief trade negotiator with the US, Kirsten Hillman, will leave office in the new year, and a former BlackRock senior executive is said to be the leading contender for the job.

And in the bigger picture on AI, Oaktree’s Howard Marks cautioned that AI has created a “terrifying” outlook for employment. A Bloomberg Intelligence survey showed that two-thirds of financial services companies will likely see staff numbers rise initially as they adopt AI. The long term is less clear.

European equities are mostly lower with the Stoxx 500 down 1.3%. The FTSE 100 is bucking the trend, higher by 0.2% amid gains in HSBC. The energy sector outperforms, while automakers lag. Here are some of the biggest movers on Wednesday:

- Abivax shares jump as much as 19% to their highest level on record amid speculation around a takeover of the biotechnology company.

- Nordex shares rise as much as 7.1% after the wind turbine maker announced a new conditional order in the US, which analysts at Metzler Capital Markets said represents the firm’s re-entry into the large and important US market.

- Delivery Hero shares climb as much as much as 9% as the firm weighs options to improve its finances and operations, pressured by major shareholders to conduct a strategic review.

- Ocado shares climb as much as 6.3% after a report by consumer intelligence company NielsenIQ showed the online grocer remains the fastest growing food retailer in the UK.

- KAP rises as much as 13% in Johannesburg, the most since August, after the logistics company said the effects of issues affecting group performance have eased.

- Vestas Wind Systems shares rise as much as 5.1% to their highest level since August after Kepler Cheuvreux upgrades the Danish wind turbine maker to buy from reduce and doubles its price target.

- Aegon shares drop as much as 9.7% after sharing group operating profit and capital generation targets which Morgan Stanley says look a little underwhelming.

- Cicor shares slump as much as 29%, the most since 2001, after it cut its guidance, citing lower-than-expected demand in Germany and adverse currency effects.

- Clas Ohlson falls as much as 17%, the most since 2022, after its current trading statement implied a ““modest slowdown from previous exceptionally strong growth,” in DNB Carnegie’s words.

- Mr Price shares slump as much as 12%, the most on record, amid market concerns that the South African clothing chain is overpaying for the retail business of NKD Group to expand in central and eastern Europe.

Earlier in the session, Asian equities edged higher, as investors stay cautious ahead of the Federal Reserve’s final interest rate decision of the year. The MSCI Asia Pacific Index rose as much as 0.3% after trading in a range for most of the session. SK Hynix provided a boost after the Korean chipmaker said it’s exploring the possibility of listing shares in New York. Benchmarks gained in Taiwan, while those in South Korea fell. Sentiment remains muted as traders await policy signals from the Fed for the coming year. Chinese onshore and offshore stocks narrowed earlier losses as property shares gained in the afternoon on speculation of new policy stimulus and bets on progress in China Vanke Co.’s debt-restructuring talks. Widespread deflationary pressures in the world’s second-biggest economy also weighed on China shares despite data showing consumer price growth accelerated in November. China’s stocks have been losing steam after a stellar run earlier this year, dragged by concerns over valuations, weak economic data and lack of stimulus signals from government leaders. The MSCI China Index is now less than 2% away from entering a technical correction.

In FX, the dollar is softer versus all peers-ex the loonie with the BOC expected to hold; traders are expecting a third consecutive Fed rate cut on Wednesday, while the focus will be on the central bank’s latest dot plot, economic projections and comments from Chair Jerome Powell.

In rates, ten-year Treasuries are down but to a lesser extent as traders await a widely-expected 25bps FOMC. European fixed income has remained pressured as traders continued to ramp up ECB interest-rate hike bets amid comments from ECB’s Simkus and Lagarde, with the latter flagging potential upgrades to growth forecasts. A 25bps increase by end-2026 is now seen at around 50%. Bunds are down 20 ticks. OATs are lower by 27 ticks and unable to gain any reprieve from Tuesday’s passage of the French social security bill as lawmakers still need to vote on the full budget. rate cut.

In commodities, there’s diverging fortune for precious metals, with spot gold down 0.4%, spot silver up 0.5% and continuing to eke out all-time highs. WTI oil futures are higher by 0.5%.

US economic calendar includes 3Q employment cost index at 8:30am and the FOMC decision at 2:00pm.

Market Snapshot

- S&P 500 mini -0.1%

- Nasdaq 100 mini -0.2%

- Russell 2000 mini -0.3%

- Stoxx Europe 600 -0.2%

- DAX -0.5%

- CAC 40 -0.3%

- 10-year Treasury yield +2 basis points at 4.21%

- VIX +0.5 points at 17.44

- Bloomberg Dollar Index little changed at 1214.25

- euro little changed at $1.1637

- WTI crude +0.2% at $58.39/barrel

Top Overnight News

- Trump will soon launch a final round of interviews for Fed Reserve chair, pitting White House economic advisor Kevin Hassett against a trio of other candidates to replace Jay Powell. The decision to carry on with the additional interviews shows Hasset’s selection is not guaranteed. FT

- White House Economic Adviser Hassett said as Fed chair, he would be apolitical, according to a Fox Business interview.

- Senate Majority Leader John Thune (R., S.D.) said he would hold a vote later this week on a Republican measure aimed at controlling healthcare costs, amid party division over how best to head off big price increases next year for millions of households. The measure aims to provide an alternative to a Democratic proposal that extends the ACA subsidies for three more years. It is not expected to pass. WSJ, NBC

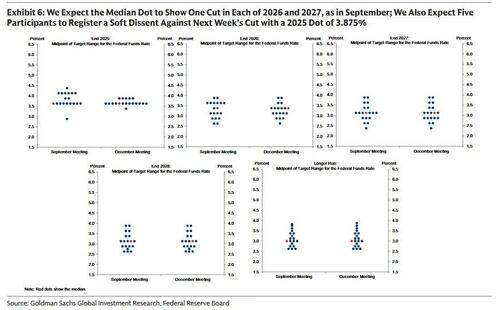

- The FOMC is widely expected to deliver a third consecutive 25bp interest rate cut to 3.5-3.75% at what will likely be a contentious December meeting. Most investors expect a hawkish cut, though this could be interpreted in a number of ways. It is not realistic to expect the FOMC to box itself in too much by signaling a very strong bias toward a pause in January because if the labor market is still actively softening at that point, a cut might be appropriate. In fact, participants will be even more uncertain than usual about what will be appropriate at the next meeting because we are now two employment reports behind schedule. Goldman

- Money markets see a 50% chance of a 25bps ECB rate increase by the end of 2026 as traders continue to price a tightening scenario after hawkish remarks by policymaker Isabel Schnabel earlier this week. BBG

- Ukraine and its European partners will soon present the U.S. with “refined documents” on a peace plan to end the war with Russia, President Volodymyr Zelenskiy said on Tuesday. Kyiv is under pressure from the White House to secure a quick peace but is pushing back on a U.S.-backed plan proposed last month that many see as favorable to Moscow. RTRS

- Chinese property stocks surged on speculation of new policy stimulus and bets on progress in China Vanke Co.’s debt-restructuring talks. BBG

- China’s consumer inflation gained pace in November but was slightly below expectations, benefiting from a low base while factory deflation worsened. CPI for Nov was inline at +0.7% (a sharp jump from +0.2% in Oct) while PPI deflation worsened to -2.2% (vs. the Street -2% and softer than -2.1% in Oct). WSJ

- Indonesia’s trade deal with Washington is in danger of collapsing as US officials become increasingly frustrated at what they view as Jakarta reneging on the terms of the agreement reached in July. FT

- Amazon pledged to invest $35 billion in India over the next five years.

Trade/Tariffs

- US Manufacturers are reportedly pulling back “harder” on orders of parts and raw materials due to uncertainty on the US Administration’s tariff policy and SCOTUS ruling, according to WSJ, citing a survey.

- US President Trump said they have taken in hundreds of billions of dollars from tariffs, but added shortly after that it is actually trillions.

- US-Indonesia trade deal is at risk of collapse as USTR Greer believes Indonesia is backtracking on several commitments it made, while Indonesian officials have told Greer that Jakarta cannot agree to some binding commitments in the deal, according to FT. However, an Indonesian government source said Indonesia’s tariff negotiation with the US is on track as per the leaders’ joint statement, while an official also said that the trade negotiation with the US is still ongoing, with no specific issues arising during the negotiations.

- US Trade Representative Greer said the Trump administration has made it clear to South Africa that they need to address trade barriers if they want a better tariff situation with the US, while he is open to different treatment and possible exclusion of South Africa if the US renews the African Growth and Opportunity Act.

- US Trade Representative Greer said China’s rare earths continue to flow and expects to sign more trade deals over the coming weeks.

- China added domestic AI chips to its official procurement list for the first time, according to FT.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued amid cautiousness ahead of today’s Fed policy decision and dot plots, while the region also digested the latest Chinese inflation data. ASX 200 was flat as weakness in tech, industrials, energy, health care and financials was counterbalanced by resilience in miners, materials and resources. Nikkei 225 initially rallied to above the 51,000 level following recent currency weakness, but then reversed course as yields briefly edged higher on BoJ rate hike risks. Hang Seng and Shanghai Comp retreated following mixed inflation data, which showed CPI Y/Y accelerated to its highest in almost two years, but PPI was softer-than-expected and showed a worsening deflation in factory gate prices. There were also several trade-related dampeners, including reports that China’s US soybean purchases are falling short of targets, while it was also reported that China is set to limit access to NVIDIA’s H200 chips despite export approval from US President Trump, and that chips exported to China will undergo a special security review.

Top Asian News

- Japanese PM Takaichi said they are closely watching market moves when asked about rising yields. Takaichi also commented that it is important for currencies to move in a stable manner reflecting fundamentals and will take appropriate action for excessive and disorderly FX moves, while she added that a weak yen has both merits and demerits. The Government are working closely with the BoJ, expects the BoJ to conduct appropriate monetary policy to achieve a stable 2% price target

- RBNZ Governor Breman said the RBNZ has achieved a great deal towards the delivery of its mandated functions, while she added they are keeping a close look at data, including inflation and GDP. Breman also said there is no preset course for monetary policy and will adjust if they see the outlook for inflation change.

- Japan’s Government is considering expanding the tax bracket for the ultra-rich to increase tax revenues, according to NHK.

European bourses (STOXX 600 -0.1%) slipped at the open, with all major European indices in negative territory amidst a lack of “good” macro news, an unfavourable yield environment and key risk events ahead. European sectors continue to hold the negative bias they opened with. At the top of the pile is Basic resources, as the copper rally, which stalled on Tuesday, gains legs once again. Media also does well with WPP +3.2% extending on recent gains after receiving a significant government contract. To the downside, Autos underperforms with the largest constituent Ferrari -2.5% after being initiated Equal Weight at Morgan Stanley.

Top European News

- ECB’s Villeroy said he is in favour of a 4.8% budget deficit for 2026, but it will not be reached. Suspending pension reforms does not solve of financing pensions issue. The Bank of France will upgrade France’s GDP forecasts. It would be wise to maintain ECB rates at the current level.

- ECB’s Simkus said interest rates do not need to be lowered further, via Bloomberg.

- ECB President Lagarde says we remain in a good place and may upgrade projections again in December.

- UK Chancellor Reeves said she can rule out capital gains tax on primary residences in this parliament. Can rule out scrapping the pension triple lock in this parliament.

- Morgan Stanley no longer expects the BoE to cut rates in March 2026; continues to see a cut in February, April and June to take the terminal rate to 3%.

FX

- DXY has been choppy within a 99.017-99.258 range with focus now on today’s FOMC meeting; the central bank is expected to announce a 25bps rate cut, though dissent from several policymakers is anticipated. A full preview is available in the Newsquawk Research Suite. Overnight attention has centred on trade developments, with CNBC noting that China has resumed purchases of US soybeans, though it remains behind the targets outlined in the Trump trade deal. On the Fed front, the FT reported that President Trump is set to begin the final round of interviews for the next Fed Chair, with senior officials still viewing White House NEC Director Hassett as the leading candidate.

- G10s have been moving in tandem with the USD. EUR was unreactive to earlier remarks from ECB’s Villeroy and Simkus, with Villeroy concentrating on the French economy, while Simkus indicated that further rate cuts are unnecessary — a view echoed by market pricing, which suggests rates will remain unchanged through 2026. Further for the EUR, on Tuesday, the French National Assembly approved the social security budget in a narrow vote, passing by just 13 votes — a close outcome in line with analysts’ expectations. Notably, all of President Macron’s Renaissance lawmakers backed the bill, while Les Républicains showed a more divided stance. For GBP, recent BoE commentary has offered little new for UK rates. EUR/USD is choppy within a 1.1622-1.1658 range, with GBP/USD in a 1.3296-1.3327 band.

- USD/JPY is flat after Tuesday’s rise to just below the 157.00 level, which prompted the usual round of verbal intervention from Japanese officials. Meanwhile, PPI figures overnight came in as expected and had minimal effect on the currency. USD/JPY trades in a narrow 156.56-156.94 range vs Tuesday’s 156.96 high.

- Antipodeans trade in tandem with the USD in a quiet FX session, with overall risk sentiment muted ahead of the Fed decision. Chinese inflation data overnight were mixed — CPI rose to its fastest pace in nearly two years, while a softer-than-expected PPI reading pointed to deeper deflation at the factory gate.

Fixed Income

- USTs started the European session flat, but have since slipped marginally into the red, alongside global peers. Currently trading at the bottom end of a 111-30 to 112-04+ range – the trough marks a new weekly low and is now trading at levels not seen since early September. From a yield perspective, rates are higher across the curve, with the belly leading. Focus overnight has been on trade developments, with CNBC reporting that China is buying US soybeans again, but is reportedly falling short of the goal set by the Trump trade agreement. Turning to the Fed, the FT reported that President Trump will begin the final round of Fed Chair interviews – but senior officials still expect the White House NEC Director Hassett as the frontrunner. Now attention turns to the FOMC later today.

- Bunds are also on the back foot and underperforming vs peers, but nothing really behind the underperformance in EGBs. Bunds Mar’26 is currently trading towards the lower end of a 127.05 to 127.49 range, with the trough marking a contract low. Earlier, there was some commentary via ECB’s Villeroy and Simkus, where the former focused on the French economy, whilst the latter suggested that the policy rate does not need to be lowered further – a move also concurred by market pricing, which sees rates steady through 2026. Elsewhere, Gilts also hold a negative bias and hold at the bottom end of a 90.71 to 91.04 range. Recent BoE speak has been non-incremental for UK paper.

- OATs are also in the red, and to a similar magnitude as peers. French political developments on Tuesday saw the National Assembly approve the social security budget. The bill narrowly passed with 13 votes, with analysts expecting a tight decision; interestingly, all of President Macron’s Renaissance voted in favour, whilst the Les Republicans were a little more mixed. OATs have not really celebrated the approval, with price action near enough following peers, not all too surprising as traders now turn their attention to the state budget.

- UK sells GBP 4.5bln 4.75% 2035 Gilt: b/c 3.05x (prev. 2.84x), average yield 4.613% (prev. 4.608%), tail 0.3bps (prev. 0.6bps)

Commodities

- Crude benchmarks trade in tight ranges as the European session gets underway, following the selloff in Tuesday’s session. WTI and Brent oscillate in a USD 58.08-58.47/bbl and USD 61.76-62.16/bbl band as markets await a clear catalyst to drive oil prices.

- Spot XAU remains mid-range of the wider USD 4163-4265/oz band that has been forming over the past 8 days as markets await a Fed rate decision. A view of price action so far in today’s session shows a peak of USD 4219/oz in the early hours of the APAC session before gradually dipping back below USD 4200/oz as the European session gets underway. Newsflow has been light ahead of the FOMC rate announcement.

- 3M LME Copper started the APAC session on the front foot has continued to hold onto earlier gains as the European session gets underway, despite cooler-than-expected Chinese CPI and PPI. The red metal drove higher straight from the open from USD 11.5k/t to a peak of 11.64k/t, before pulling back to a low of USD 11.58k/t. 3M LME Copper still remains within parameters set earlier in the day but is currently crawling back to session highs.

- Iraq’s Oil Minister said 13mln oil barrels have been exported from Kurdistan region via the Iraqi-Turkish pipeline so far.

Geopolitics: Ukraine

- Ukraine President Zelensky sees leader-level talks with the US next week, and said Ukraine is ready for an energy ceasefire if Russia agrees, while he wants to discuss restoration of Ukraine as part of peace plan preparation with the US. Zelensky also said they are ready to hold elections and ask US and European partners to guarantee security during the process, as well as noted that if security is guaranteed, elections could be held in the next 60-90 days.

- Russia’s Foreign Minister Lavrov said Russia has no intention of fighting a war with Europe, via Al Arabiya; adds that Russia will respond if European forces are deployed in Ukraine. Agree to work on a settlement in Ukraine with the US. The efforts from US President Trump are appreciated to resolve the crisis in Ukraine.

Geopolitics: Other

- US President Trump said he will have to make a call on Wednesday about Thailand and Cambodia, while he commented that the two countries are at it again.

- Japanese Defence Minister Koizumi said there is no truth that Japan also aimed radar at Chinese aircraft, while he added that China did not provide specific details about naval training exercises in communication with Japan’s Maritime Self-Defense Force. Furthermore, he said Japan demands that China prevent the recurrence of dangerous acts which exceed the necessary range for safe aircraft operations.

US Event Calendar

- 7:00 am: Dec 5 MBA Mortgage Applications, prior -1.4%

- 8:30 am: 3Q Employment Cost Index, est. 0.9%, prior 0.9%

- 2:00 pm: Dec 10 FOMC Rate Decision

- 2:00 pm: Nov Federal Budget Balance, est. -195b, prior -366.76b

DB’s Jim Reid concludes the overnight wrap

Markets were in a holding pattern yesterday, with equities posting small moves as investors awaited the FOMC decision and Chair Powell’s press conference tonight. So the S&P 500 (-0.09%) posted a modest decline, and futures for the index (-0.01%) remain flat this morning. However, the bond selloff continued in several places, with 10yr Treasury yields (+2.4bps) drifting up to a three-month high as investors kept dialling back their expectations for rate cuts next year. In fact in Australia overnight, their 10yr yield (+3.7bps) has just hit its highest level since late-2023, so that momentum has shown few signs of letting up. To be fair it wasn’t all bad news, with the Franco-German 10yr spread closing at its tightest since August, shortly before lawmakers went on to back the social security budget. But as investors have pivoted to expect rate hikes next year for many countries, sovereign bonds have struggled across the board.

When it comes to the Fed’s decision tonight, it’s widely expected that they’ll deliver another 25bp rate cut, which would be the third consecutive rate cut since the September meeting. At their last meeting in late-October, Chair Powell had said that a December cut was “not a foregone conclusion – far from it.” But since then, the subsequent jobs report for September showed a further uptick in the unemployment rate, to 4.4%, which strengthened the dovish arguments and led markets to price back in another cut for today. So futures are pricing in a 90% chance of a cut as we go to press.

Beyond the immediate policy decision, our US economists also expect there to be dissents in both a hawkish and dovish direction. So to forge a consensus behind a rate cut today, they anticipate the statement and press conference will signal that the hurdle is relatively high for another cut in early 2026. Remember as well that we’ll also get the latest Summary of Economic Projections, containing the dot plot for where officials expect rates to move in the years ahead. Our economists think the median dots will stay unchanged, consistent with one further 25bp cut in each of 2026 and 2027. See their full preview here for more details.

Beyond today however, there’s been mounting speculation more broadly that central banks are increasingly finished with their rate cutting cycles. Indeed, those moves got further support after the latest batch of US data, which showed that job openings rose to a 5-month high of 7.670m in October (vs. 7.117m expected). So that pushed back against fears of a deteriorating labour market and helped push front-end Treasury yields higher. Admittedly, there were some less positive details, and the quits rate of those voluntarily leaving their job fell to a 5-year low of 1.8%. But overall, investors were reassured by the rise in openings, with the amount of Fed cuts priced by December 2026 down by -5.7bps to 72bps. And in turn, the 2yr Treasury yield (+3.8bps) moved up to 3.61%, whilst the 10yr yield (+2.4bps) rose to 4.19%.

Staying on the Fed, the FT reported yesterday that Trump would soon conduct a final round of interviews with the candidates for Fed Chair. The article said that officials thought NEC Director Kevin Hassett was still “in pole position”, and Trump separately said to reporters on Air Force One that “I have a pretty good idea of who I want”. Interestingly though, the article floated that there had been discussion about Hassett serving a shorter term, potentially by moving into Powell’s seat on the Board of Governors, which expires in January 2028. So that would leave the option of nominating a different Fed Chair later in Trump’s term. We did hear from Hassett as well yesterday, who said there was “plenty of room” for more cuts, although markets didn’t have too much reaction given that was in line with his previous comments for more easing. However, the FT report saw Hassett’s odds of becoming chair move a bit lower on Polymarket, and they currently stand at 71% as we go to press this morning.

In the meantime, equities didn’t see too much of a reaction to all this, with the S&P 500 (-0.09%) posting a marginal decline, whilst the NASDAQ (+0.13%) and small-cap Russell 2000 (+0.21%) both moved higher. In terms of the outperformers, the Magnificent 7 (+0.26%) did see a stronger gain, but traditional blue chip stocks underperformed amid higher rates, leaving the Dow Jones down -0.38%. Meanwhile, JPMorgan (-4.66%) was the third-worst performer in the S&P 500 after warning of higher-than-expected costs.

Over in Europe, the spotlight was on France yesterday, where lawmakers backed the social security budget with a narrow 247-234 margin in the final vote. However, achieving this majority came at the cost of a higher underlying deficit for 2026 because of the pension reform suspension and increased health spending. Nevertheless, the signs of progress were met positively by markets, and the Franco-German 10yr spread reached its tightest since late-August yesterday, at 71bps. However, the political fragmentation is still clear, and attention will now turn to the State budget, which is due to be approved no later than December 23 and where agreement remains distant.

Elsewhere in Europe, sovereign bonds rallied across the board, with yields on 10yr bunds (-1.2bps), OATs (-2.8bps) and BTPs (-1.8bps) all falling back. However, for equities it was more mixed, with the STOXX 600 (-0.10%) narrowly losing ground. That came amidst an outperformance in Germany, with the DAX up +0.49% after Bloomberg reported that lawmakers were set to approve €52bn in defence orders next week. The news saw defence stocks outperform, with the STOXX Aerospace & Defense Index up +0.79%, whilst Rheinmetall was up +3.56%.

Overnight in Asia, we’ve seen losses across the major equity indices before the Fed’s decision. Chinese equities have struggled, with the CSI 300 (-0.88%) and the Shanghai Comp (-0.76%) posting declines, but we’ve also seen losses for the KOSPI (-0.27%) and the Nikkei (-0.44%) as well. Staying on China, the latest data overnight has shown that CPI inflation moved up to +0.7% in November, an increase from +0.2% in October. The move was in line with consensus, but also marks the fastest pace since February 2024. However, PPI inflation remained in deflationary territory for a 38th consecutive month, coming in at -2.2% (vs. -2.0% expected).

To the day ahead, the biggest event will be the FOMC’s decision and Chair Powell’s press conference. Other central bank events will be the Bank of Canada’s decision, and we’ll also hear from ECB President Lagarde. In terms of economic releases, we’ll see the US Q3 employment cost index, and Italy’s industrial production for October. Finally, earnings releases include Oracle and Adobe.

Tyler Durden

Wed, 12/10/2025 – 08:42ZeroHedge NewsRead More

R1

R1

T1

T1