Indonesia Targets Finfluencers In Crackdown After P2P Investment Losses

Indonesia’s financial regulators are stepping up action against social-media investment gurus after a wave of losses tied to risky digital platforms and unverified financial advice. Beginning this week, a new rule issued by the Financial Services Authority (OJK) will force securities firms to vet, supervise and assume legal responsibility for content produced by influencers they pay, according to Nikkei.

Influencers who analyze investments must be licensed advisers, while those promoting products must register as marketing partners and clearly disclose paid endorsements. They will also be required to explain risks, not just potential returns. As the OJK cautioned in an October campaign, “The next time a piece of financial advice blows up on your feed, take a pause. Just because it’s viral doesn’t mean it’s sound.”

The crackdown coincides with mounting complaints against peer-to-peer lending (P2P) apps once hyped by finfluencers. Akseleran, one of the country’s most recognizable platforms, is being sued by at least 19 investors who say they collectively lost around 6 billion rupiah. The company attributes its problems to borrowers defaulting en masse. Several other platforms, including KoinP2P, Crowde and Dana Syariah Indonesia, are under similar scrutiny. The OJK recently revoked Crowde’s license and is coordinating with police to investigate potential criminal activity tied to other platforms.

Nikkei writes that one casualty of that boom-and-bust cycle is 29-year-old Surabaya resident Anita Carolina. Three years ago she was persuaded by a financial influencer to invest 471 million rupiah (about $28,000) in Akseleran. Today she is still trying to recover the money. The experience, she says, changed the way she invests. “Investing should not be marketed as a casual game. Influencers are salespeople, not financial advisers,” she said, adding that she now avoids them “entirely.”

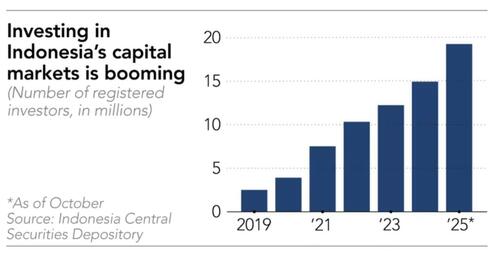

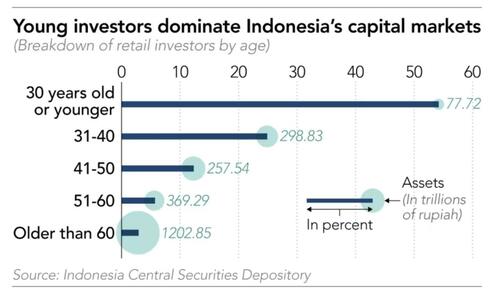

Carolina’s story reflects a broader shift in Indonesia’s financial landscape. Investor participation has exploded, climbing from 2.5 million registered participants in 2019 to 19.2 million in October 2024, fueled by easy-to-use apps and pandemic-era interest in alternative income. Many new retail investors — dominated by millennials and Gen Z — chased high returns through stocks, crypto and P2P lending, often guided not by licensed professionals but by relatable personalities on TikTok, Instagram and YouTube. A 2023 CELIOS survey found that 70% of Indonesians trust finfluencers, nearly equal to the 69.5% who trust certified advisers.

Experts say that reliance has created a fertile market for unqualified “advisers” who blur the line between education and marketing. “It has become easy for individuals to label themselves as finfluencers without a proper background,” said economist Tauhid Ahmad. Many fail to disclose paid partnerships, while others promote products they barely understand. Regulators have also struggled to keep up: from 2017 to September 2024, the OJK says it blocked over 13,000 illegal financial entities, most involving online loans or investment schemes that quickly resurface in new forms.

Some influencers now admit their own role in fueling unsustainable P2P enthusiasm. TikTok creator Felicia Putri Tjiasaka, who has 1.4 million followers, said she also invested in Akseleran but exited in 2023. “In Indonesia, it’s the productive P2P sector that is failing,” she told her followers, citing economic pressures and lax credit screening.

Others argue regulations are long overdue. Educator and influencer Roy Shakti says untrained personalities are “positioning themselves as experts to teach trading,” and supports measures similar to China’s ban on wealth-flaunting. “You won’t find me promising easy money,” he said. “Instead, I teach people how to raise funding and avoid scams.”

Though she continues to invest in mutual funds and bitcoin, Carolina now conducts her own research before committing a single rupiah. “It’s disappointing, as I followed their advice,” she said. “But now, I avoid them entirely.”

Tyler Durden

Thu, 12/11/2025 – 05:45ZeroHedge NewsRead More

R1

R1

T1

T1