Goldman Turns “Incrementally Cautious” On Nike As China Sales Plunge

Nike shares tumbled the most in eight months in premarket trading in New York after a mixed third quarter, reigniting concerns that turnaround efforts are being slowed by soft demand trends in China and ongoing problems at Converse.

North America was a bright spot in second-quarter earnings. Citi analyst Paul Lejuez noted that product liquidations contributed to the growth. As those actions expired, underlying sell-through trends softened.

China remained the most challenging sales market for the world’s largest sportswear company in the quarter. This prompted Piper Sandler analysts to cut their price target on the stock due to a lackluster recovery in the world’s second-largest economy.

Sales in China last quarter plunged 17%, while Converse sales imploded by 30%.

Key earnings in the quarter:

-

Top line: Revenue of $12.43 billion rose .6% year over year, beating consensus. Nike brand revenue increased 1.5%, also ahead of expectations.

-

Channel mix: Direct revenue declined 8%, missing estimates, while wholesale revenue rose 8.7% and exceeded consensus, underscoring the ongoing shift toward wholesale.

Here’s a snapshot of regional performance in the second quarter:

-

North America was the standout, with revenue up 8.8% and EBIT slightly ahead of estimates.

-

EMEA delivered modest growth but was roughly in line with expectations, with margins under pressure.

-

China remained the largest drag, with revenue down 17% and EBIT nearly halved versus last year.

-

Asia Pacific and Latin America also declined modestly and missed estimates.

Overall results in the second quarter at the headline level were driven by North America, wholesale, and apparel strength, but the weakness in China, direct-to-consumer, and Converse weighed heavily on the turnaround narrative.

Nike has yet to issue longer-term guidance, which merely reflects its attempts to regain control of its turnaround plan and rebuild ties with retailers and sports teams.

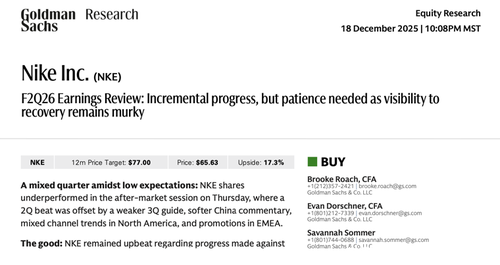

Further Wall Street commentary on the earnings came from Goldman analysts led by Brooke Roach. She penned a note to clients outlining the good, the bad, her initial take on the results, and the key takeaways.

A mixed quarter amidst low expectations: NKE shares underperformed in the after-market session on Thursday, where a 2Q beat was offset by a weaker 3Q guide, softer China commentary, mixed channel trends in North America, and promotions in EMEA.

The good: NKE remained upbeat regarding progress made against its Win Now Strategy and its Sport Offense repositioning, highlighting strong results in Performance product. Running grew >20% for the second consecutive quarter (strength across wholesale, NIKE Direct, and owned stores). Training, Basketball, and Kids also contributed to growth. Order books into spring and summer are improving. Importantly, as the company looks to extend success in Running to other sports, we were encouraged to hear that NKE is seeing stronger growth in Global Football preorders ahead of the World Cup (+40% higher units vs. WC 2022). Franchise management actions are still set to moderate into F2H. On margins, gross margins came in at the high end of the company’s prior guidance range despite incremental obsolescence charges on Nike China inventory, meaning that underlying results were stronger, and SG&A was well-controlled as a result of operational efficiencies.

The bad: We believe this quarter’s results will fuel several key long-term bear concerns regarding the business. The most notable incremental is the significant outperformance in North America wholesale, with the gap vs. DTC widening meaningfully this quarter. While this is technically driven by NKE’s core strategy of putting product in front of the consumer, the magnitude of this outperformance will likely drive investor concerns that NKE could be oversupplying the channel ahead of brand momentum inflection and/or that NKE’s growth next year will need to step back as the company digests this year’s outperformance. In a backdrop where many turnarounds seek to limit distribution to build brand heat, NKE’s strategy is notably different for the total brand. Looking further across the world, Greater China remains the most challenged geography (-16% ex-FX), and management’s commentary here suggests that significant actions will be needed to improve long-term brand health in the region. Timing here is uncertain, though the company did guide F3Q similar to F2Q, and highlighted that they have cut both sell-in for spring and summer orders as a result, with further shifts ahead. EMEA and APAC were also mixed, with EMEA missing Factset consensus and management highlighting elevated promotional activity in Western Europe, while APLA is still undergoing pockets of inventory cleanup. Near-term, we highlight that F3Q was guided below consensus.

Our take: We step away from the quarter incrementally cautious on the timeline and cadence of recovery at NKE. We remain optimistic on the company’s Win Now actions and Sport Offense strategy, and continue to be upbeat on the strength emerging in NKE’s product assortment where actions have had more time to cure (particularly running, but also emerging signs of greenshoots in Global Football). That said, we acknowledge the updates today regarding Greater China are disappointing, and limited disclosure regarding the core drivers of North America wholesale outperformance provides fodder for debate. We believe that trends will remain choppy as the company executes its strategic plan, and thus patience will be needed, but that improvement is ahead. Additionally, we believe the underlying message of an uneven path to revenue and margin improvement is well-appreciated by investors.

The rest of the note is available in full in the usual place.

In markets, Nike shares fell sharply, down about 11% in premarket trading in New York. If those losses carry into the cash session and the stock closes near the lows, it would mark the worst decline since early April. Year to date, shares are down 13.3% as of Thursday’s close. The last time the stock traded in the low $60s was during the Covid crash.

How long until an activist investor leaks a headline to a major financial outlet? A headline yesterday in the WSJ said Elliott Investment Management had built a $1 billion position in another struggling clothing brand, Lululemon.

Tyler Durden

Fri, 12/19/2025 – 08:00ZeroHedge NewsRead More

R1

R1

T1

T1