Cocoa Prices Face Worst Annual Collapse In Six Decades As Goldman Sees “Tailwinds” For Hershey

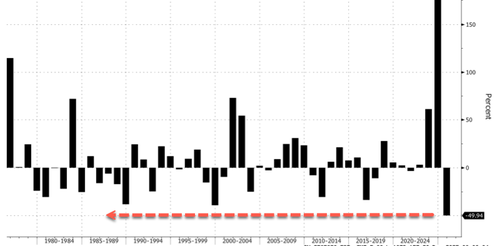

After nearly tripling last year and soaring to a record $13,000 a ton, cocoa futures are on track for their worst-ever annual decline, based on data going back more than six decades.

Cocoa futures in New York are set for a 50% decline if losses persist through the end of the year.

Prices are currently trading around $5,845 as of Friday’s close, a stark difference from the $12,000 to $13,000 range in late 2024 and early 2025.

The cocoa surge sparked a price shock and crushed margins for major food companies that relied heavily on chocolate production. Those companies include Nestlé, Hershey, and many others.

In return, supermarket prices for chocolate rose, but now Wall Street analysts don’t expect the latest declines to translate into cheaper candy until the second half of 2026.

“The prices that the chocolate industry is currently working with are very high and painful,” said Jonathan Parkman, head of agricultural sales at commodities brokerage Marex Group in London, as quoted by Bloomberg. “It’s going to take us quite a while to work through that.”

Swiss-Belgian cocoa processor Barry Callebaut has noted that supply risks in West Africa, the world’s top-growing region, persist due to underinvestment, climate stress, and disease. The processor said chocolate was “far too cheap for far too long.”

Lambertz, one of Germany’s oldest confectioners, has enough cocoa supplies to last through the midpoint of 2026, after securing them when prices were high, said owner Hermann Bühlbecker. “As far as I can remember, there has never been such a price explosion,” he said.

To cope with the price shock, many brands have responded with shrinkflation and reformulation, such as lighter bars or reduced cocoa content. Companies like Mondelez have made significant adjustments to formulation.

Last week, Bonnie Herzog, managing director and senior consumer analyst at Goldman Sachs, highlighted easing pressures in the cocoa market that could produce “tailwinds” for candy and junk food companies:

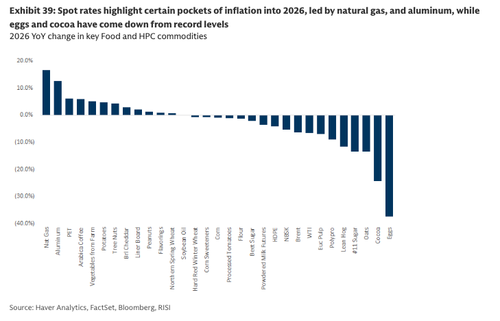

Pockets of easing commodity pressure to aid earnings growth for some. While input cost inflation has meaningfully moderated for Staples at large over the past couple of years, certain pockets (e.g., cocoa, proteins) were still inflationary and weighed on earnings. As prices continue to come down meaningfully from peak levels, we would expect benefits from an easing cost environment to aid earnings growth. However, spot rates suggest aluminum will likely see the highest inflation in 2026. Moreover, oil/natural gas prices remain volatile owing to ongoing geopolitical tensions, which, along with pressure from tariffs, could further limit the extent of gross margin expansion ahead. Ultimately, we believe the input cost environment will be much more accommodative for our Staples universe next year, which along with an increased focus on productivity (as supply chains and service levels have normalized), should support continued margin expansion and reinvestments ahead. We highlight HSY as best placed to benefit from this dynamic, where we expect gross margin expansion to drive EPS growth in 2026. We also highlight potential tailwinds for MDLZ, HRL, and SFD.

Herzog noted where inflation and deflation trends linger in the commodity market this year:

Hershey versus cocoa futures (inverted)…

Conversations so far are that any price relief for chocolate at the supermarket won’t show up until the 2H26. We’re watching Hershey next year…

Herzog also told clients to buy nicotine, energy drink, candy, and beauty stocks heading into 2026 as a stronger consumer backdrop emerges.

Tyler Durden

Mon, 12/22/2025 – 05:45ZeroHedge NewsRead More

R1

R1

T1

T1