Amid Nike’s Worst Drawdown Since late 70s, UBS Flags Emerging Bullish Signals

Nike was thrust into the news flow earlier this week after Apple CEO Tim Cook placed a buy order for 50,000 Class B shares at a weighted average price of $58.97. The stock has been locked in a four-year bear market, as recent earnings data point to softer demand in China and mixed channel trends in North America.

Looking past all the gloom, UBS analyst Jay Sole told clients Friday about UBS Evidence Lab’s latest global sportswear survey, which points to “bullish” trends for Nike.

Sole said the survey suggests “the brand is improving y/y and remains strong,” and that the turnaround could be just ahead. He has a “neutral” rating on the stock and believes the turnaround will take longer than the market expects. The survey results suggest Nike’s plan to prioritize re-entering the wholesale channel under new CEO Elliott Hill.

For context, Evidence Lab is UBS’s proprietary alternative data and analytics platform used by the bank’s clients to supplement traditional financial analysis. The data include large-scale consumer surveys, web traffic, app usage, geolocation, transaction data, pricing scrapes, and sentiment signals, providing actionable insights into brand health, demand trends, market share shifts, and competitive positioning.

Here is Sole’s complete insight into why “The Global Sportswear Survey Bullish for Nike”…

The survey makes us more constructive on NKE, but our rating is Neutral: UBS Evidence Lab’s 11th global sportswear survey is bullish for Nike, in our view. The survey shows Nike’s brand remains strong and is improving y/y. The survey increases our conviction Nike’s brand strength provides the foundation upon which it can ultimately stage a comeback. We continue to believe Nike’s business will improve. Our rating is Neutral because we think its turnaround will take longer than the market expects.

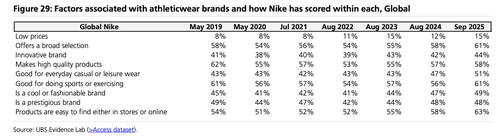

Survey results suggest 2 key elements of Nike’s strategy are working: Since Elliott Hill became CEO, Nike has prioritized re-entering the wholesale channel. In this year’s survey, a higher percentage of global consumers say Nike’s products are easy to find in stores and online. This percentage dropped from 2019 through 2022, but has rebounded to a new peak this year. We believe this is attributable to Mr. Hill’s channel strategy. Under Elliott Hill’s leadership, Nike has also refocused on sports. Likely as a result, the percentage of consumers who say Nike is “good for doing sports” bounced back to its 2019 peak level (Fig. 29).

5 other survey insights showing Nike’s brand strength and gains:

Nike holds the highest Net Promoter Score (NPS) among all brands and its scores are rising. The surprising fact is not only does Nike have the highest NPS globally, but it also has the best score in each of the four geographies studied (US, UK, Germany, China: Figs. 30, 67, 106, 153, 180). Plus, Nike’s NPS in each region are rising (Figs. 31, 68, 107, 144, 181).

Nike retains strong brand attributes. Nike ranks as the #1 or #2 brand globally in the “high-quality products,” “good for doing sports,” “prestigious brand,’ “innovative brand,” and “fashionable or cool brand” categories as well as others (Figs. 18-28).

Global purchase intentions are up y/y. Global consumers plan to buy more footwear as well as more apparel from Nike over the NTM (Figs. 14-15).

Global consumers’ impression of the Nike brand is improving. Plus, the rate of improvement relative to other brands’ looks good (Figs. 35-36). Gains in the US are particularly notable, in our view (Fig. 72).

Nike has the highest loyalty rate globally. Nike also has the highest conversion rate globally (Figs. 39-40).

Two modestly negative survey data points: The survey shows Nike has experienced slight erosion in global aided awareness within the 16-24 year-old age demographic (Fig. 10). This could be a consequence of Nike not being as “hot”of a brand over the last couple years as it was before that. Also, the Converse brand survey results are lackluster, in our view.

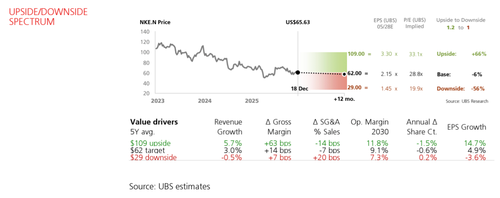

Valuation: Our $62 PT is based on 29x our $2.15 FY28 EPS estimate

For the full note, ZeroHedge Pro subs can view it here.

Sole’s view comes as the stock is locked in Nike’s worst declines since the late 1970s.

At some point, Nike will figure out how to sell more Air Force 1s in China and, if management is smart enough, stop selling “woke” propaganda.

Tyler Durden

Fri, 12/26/2025 – 13:00ZeroHedge NewsRead More

R1

R1

T1

T1