Europe’s Ideological Paralysis Threatens AI Boom

Submitted by Thomas Kolbe

Economic prosperity is created in free markets by innovative companies. Over 50 percent of globally operating AI unicorns are located in the U.S., while Europe plays virtually no role. The race for the next future technology is already decided.

It seems that economic history is repeating itself in these months. On the stock markets, companies in the artificial intelligence and data center sectors are being traded feverishly. Massive capital flows into this technology. Much of it resembles the dot-com boom 25 years ago.

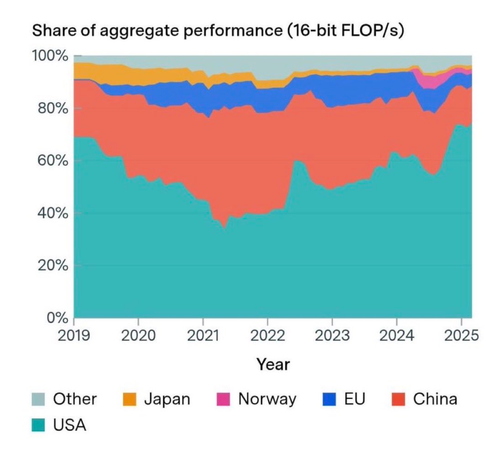

Structurally and regionally, little has changed since then: The U.S. and China are fighting for pole position, while the European Union’s economy remains largely on the sidelines, pushed into a spectator role by EU regulators.

Unicorns as a Measure of Innovation

An interesting measure of the EU’s lag in artificial intelligence is the number of so-called unicorns—private startups valued at at least one billion U.S. dollars before going public. This metric is considered a valid indicator of a region’s innovative capacity—and for the EU, the comparison with the U.S. is catastrophic.

About 1,700 such innovative companies currently operate in the U.S., while the EU has only around 280. The U.S. dominates this market with over 50 percent share, whereas the European economy lags far behind with less than ten percent of the global market.

This economic gap is also reflected in investment volume. Hyperscalers such as Amazon, Microsoft, Alphabet, and Meta invested over $320 billion in AI and corresponding data center infrastructure this year alone. More than 550 new projects—with a focus in Virginia, Texas, and Arizona—are forming the backbone of a new economy.

Data center capacity in the U.S. grew by around 160 percent this year, while Europe’s capacity increased by only about 75 percent, equaling an investment volume of just under €100 billion.

With investments of around $125 billion, China’s economy also lags far behind the American one. An interesting context—especially from the perspective of European, and particularly German, policymakers—is that nuclear power is gaining noticeable momentum in these regions.

Even if green-minded Germany refuses to acknowledge it due to its ideological stance against nuclear energy, the enormous energy demand of new technologies will in the future be covered to a significant extent by the expansion of nuclear power.

Among the few major projects in the European Union are the Brookfield project in Sweden, with an investment volume of around $10 billion, and the Start Campus in Portugal, which could also activate nearly $10 billion in investments.

Crash of Ideologies

Especially in AI, the ideological clash between the U.S. and the EU can be observed in practice and in all its consequences. While the U.S. relies on deregulation and private solutions, removing barriers for intense competition, EU Europe still adheres to the mantra of political global control. Nothing may happen unless Brussels officials have schemed it at their green table in all their wisdom.

The Draghi motto still applies here: Only massive public investments—credit-financed and centrally planned—will, in the view of EU statist planners, help overcome the enormous gap between Europe and the U.S.

In the simulations of the EU Commission’s master plan, now stretched over seven years under Ursula von der Leyen, everything seems surprisingly simple, almost simplified. The EU’s Invest-AI plan intends to borrow around €50 billion in loans and invest them in selected projects in the coming years. This is supposed to trigger private investments of €150 billion, ultimately creating four AI gigafactories.

Welcome to the socialist textbook world of “Habeckonomics”: a system in which state projects like Northvolt repeatedly fail. Yet as long as public guarantees, subsidies, and state-guaranteed purchase prices are in prospect, the small flame of political hope continues flickering in Europe’s lukewarm wind.

As usual, we also observe the typical European jungle of funding programs, subsidies, and steering projects. These include “Horizon Europe,” which is meant to strengthen computing power in science, the RAISE pilot, and the Gen-AI-4-EU initiative, together investing another billion euros in the EU’s digital infrastructure.

The Power of Competition

The ideological clash between the two major economic blocks, the U.S. and the EU, is producing strange effects. While the open capital market in the U.S. lets startups sprout like mushrooms from fertile soil, EU regulation—especially under the Digital Markets Act—has fostered a predatory mentality. That this was likely the Eurocrats’ goal from the start comes as no surprise.

Brussels imposed more than €3.2 billion in competition fines this year, mainly targeting U.S. corporations. Brussels has degenerated into a bureaucratic leviathan—a parasitic glutton absorbing economic energy and generating ossified structures and economic vacuum.

In EU Europe, the motto is: the regulatory framework matters most—and the state takes its cut. That private industry prefers other locations and withdraws capital matters little to Brussels’ extraction experts.

Against the backdrop of Europe’s massive descent into a climate-socialist dystopia, it is surprising that the roots of libertarian economic thinking originate precisely on this continent. Consider the great economist Ludwig von Mises, who repeatedly pointed out that it is the entrepreneur who drives the engine of the market economy through profit-seeking, and that without exception, decentralized processes create prosperity—while state interventions regularly derail it.

Civilization-superior models like the free market sink in the waves of ideological EU infantilism. Its repressive climate socialism promotes the growth of corporatist structures in which politics and subsidized parts of the economy carry out the extraction, eliminating competition.

The rigid adherence to centrally planned control of the new tech industry tragically mirrors the timeline of the dot-com era. What Europe fails to understand is that groundbreaking innovation inevitably triggers an investment boom, often resulting in overinvestment and a stock market crash—but ultimately leaving economically profitable structures permanently woven into the existing economy.

As with companies like Amazon, Google, or Microsoft, Europeans will look back in a few years at these months and examine this intercontinental economic bifurcation through the examples of OpenAI, Gemini, or Perplexity. The energy needed will come from French nuclear reactors and soon also from Polish nuclear power.

Tyler Durden

Tue, 12/30/2025 – 05:00ZeroHedge NewsRead More

R1

R1

T1

T1