2025 Greatest Hits: The Most Popular Articles Of The Past Year And A Look Ahead

One year ago, when looking at the 20 most popular stories of 2024, we said that “while 2024 had a seemingly endless variety of social, economic, political, geopolitical and of course, financial and market, drama, the unprecedented onslaught of 2022 and 2023 – which saw both the deadliest and most consequential global war since WWII and a historic inflationary onslaught – simply proved too great to beat…. although we are confident that’s only because the newsflow was merely resting ahead of 2025 when, thanks to the most consequential presidential election in modern US history, the coming avalanche of news and propaganda will be sheer insanity, especially since the Fed has made its long awaited dovish pivot without successfully stamping out inflation first. So in retrospect, 2024 being somewhat tame by recent standards may have been a good thing: it allowed everyone to rest ahead of the main event.“

Boy, were we right, and in retrospect we certainly hope everyone did rest ahead of the countless 2025 main events because while 2025 not only saw what was the closest event to a market crash in years, it was almost a sideshow to the most exciting and eventful rollercoaster of non-stop newsflow we have yet encountered (in large part thanks to the daily torrent of stream of consciousness unleashed by the occupant of the White House) one which not only saw the legacy political system finally crumble across “Western democracies” as country after country said “no more” to the four-headed globalist hydra of runaway inflation, corrupt establishment politicians, uncontrolled illegal immigration, and targeted assassination attempts, but one where the political economy and capital markets proved beyond a reasonable doubt that they are more inextricably welded together than ever before. Oh, and of course, it was also the year when the Fed’s apolitical facade crumbled, exposing the most important central bank in the world as nothing more than a puppet of shadowy establishment forces whose only task is to preserve the status quo.

But first, let’s first take a quick look at what happened in the past year through the lens of the masses, and as a quick 4-minute refresher, here is a highlight reel from Googles “year in search” of all the big, if mostly irrelevant, topics that people around the world obsessed over in 2025.

Of course, all of the stuff in the clip above is just fluff and distractions for and by the masses, meant to keep attention focused on trivial things and away from what really matters. What we tried to do with our reporting throughout the year was to minimize the noise and to bring you, our readers, the signal, and while there was a nonstop barrage of the former, the underlying newsflow largely boiled down to four main categories:

- Political/Tariffs

- Technological/AI

- Financial/Central Bank Credibility

- Geopolitical

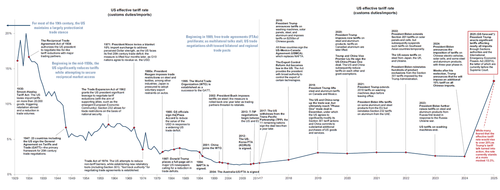

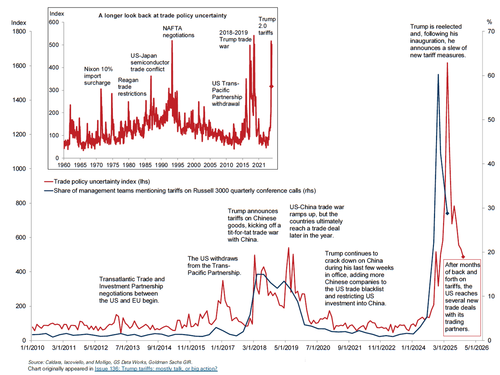

Starting with the first, the shock from the result of the November 2024 election – which together with the Trump assassination attempt were the biggest political events of 2024 – quickly turned to awe from Trump’s decision to immediately implement his transformational trade policies in the form of massive tariffs on most US trade partners, which upended decades of conventional trade policy through significant action and led to a surge in the effective tariff rate and countless predictions of doom, gloom and recessions from such cartoon economists as Paul Krugman who said that “it’s not the size of the trade policy shift, but the uncertainty around it that could cause a recession…. and at this point, policy reversals may actually worsen the situation because they would enhance uncertainty.”

But what Krugman, and so many other “experts” failed to understand is that, in keeping with the pattern set by the first Trump admin the president was setting new precedent and aggressively negotiating, leading not to a recession, but many new trade deals – all at far more advantageous terms to the us – with little of the “imminent” inflation passing through to US consumers as it was exporters (such as Japanese car makers) who ended up footing the bill for Trump’s tariffs.

The result was that the initial surge in trade uncertainty, which was loudly cheered on by liberal economists as it confirmed their anti-Trump bias, promptly faded…

… and recession fears disappeared almost as fast as they had emerged.

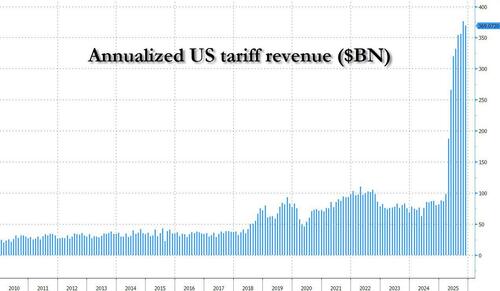

And while the inflation from Trump’s tariffs has yet to emerge, the benefits in the form of almost $400BN in annualized tariff revenues are already here, and could have been used to lower the US budget deficit…

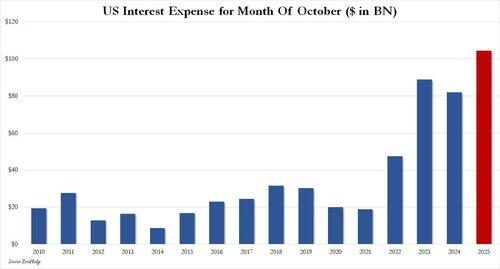

… if there was any hope that the US could ever spend less, which unfortunately is no longer feasible with the US starting fiscal 2026 with the biggest budget deficit on record….

… largely due to the now recurring $100+ billion in monthly interest expense on US debt.

And while politics – and the constant daily declarations from Trump’s Truth Social account – certainly meant much less sleep for anyone in 2025, one can certainly argue that innovation, in a broad sense, and especially AI technology, was as important as politics this year and certainly helped lift the US economy from a far worse place.

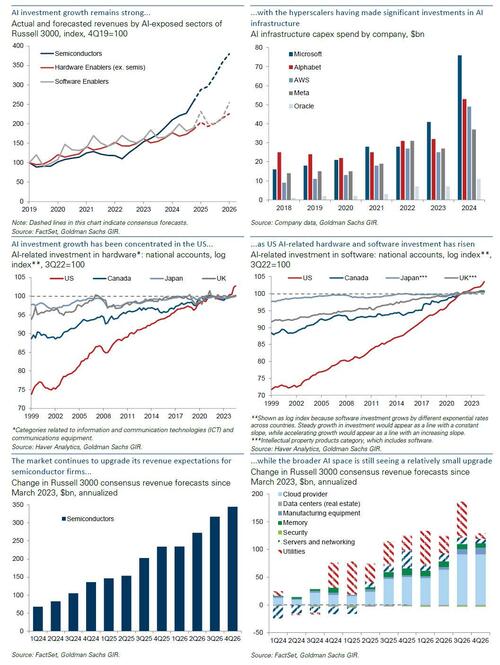

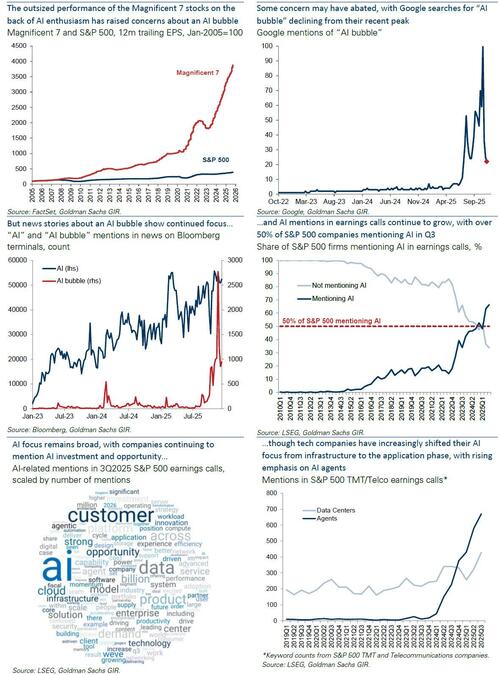

To be sure, the year started off on the right foot, with names that have become synonymous with the AI boom like Nvidia soaring, as Wall Street was content that investment in AI would continue to grow exponentially, as the following charts show.

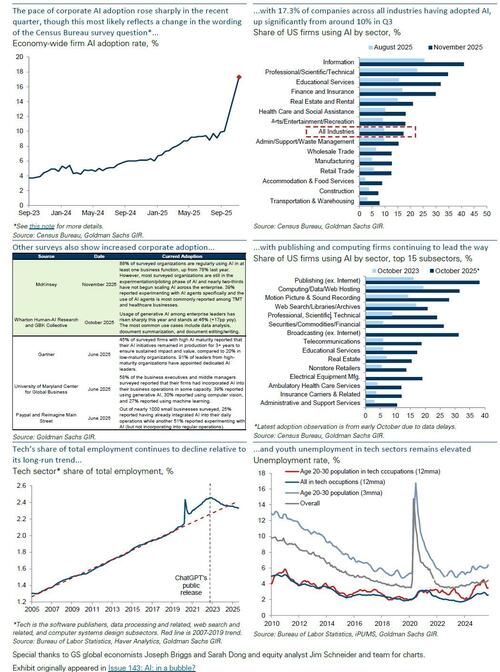

Optimism was also lifted amid reports that AI adoption was rising (even if as Goldman noted, it was due to a purposefully phrased question designed to give the impression that adoption was rising). The trade off to increased AI adoption – far more concerning in the short-run for politicians desperate for votes – is that both overall tech and especially youth unemployment, are rising dangerously fast, potentially leading to a sharp deterioration in the US labor market, assuming the AI cycle goes as planned… and the US wins the US-China AI war.

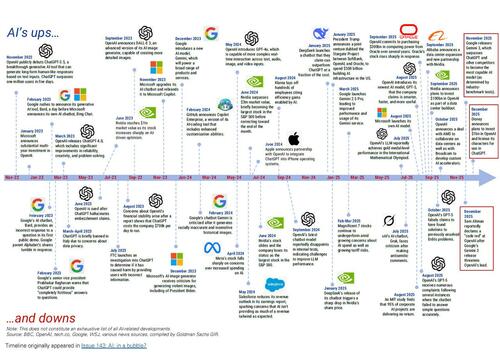

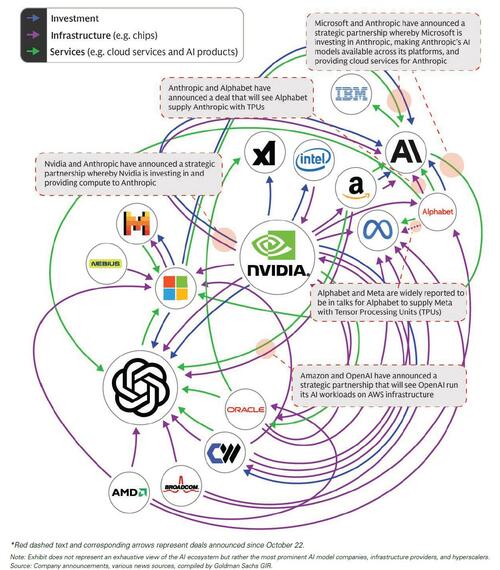

That outcome is far from certain, however, and it finally dawned on the market that the flurry of recent developments in the AI sector…

… was – as we first described it – one giant circle jerk, where little money actually changes hands yet the impression of top-line growth keeps pushing stock prices to record highs…

… resulting in a painful swoon for much of the AI sector in the second half amid renewed concerns about AI returns on investment, and the risk of a full-blown bubble which may burst any second

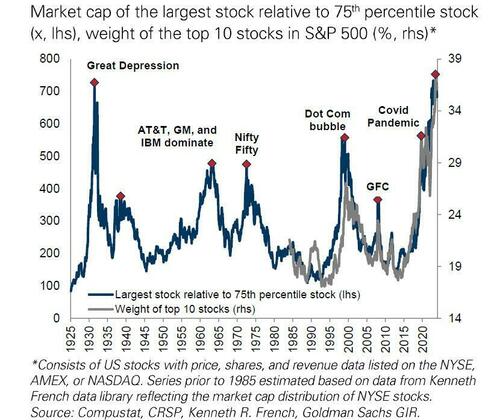

In any case, the reality is that we have seen chatbots come and go, and the world always moved on to a new, bigger and shinier fad. This time, however, prices may have pulled just a little bit too much from the future, as this breakdown of the Mag7 vs the S&P shows.

In any event, we don’t have that much new to add here: exactly two years ago we said that “we would be remiss not to mention the single biggest market narrative – and tech story – of 2023, namely the unprecedented AI mania, which manifested itself in an explosion in the “Magnificent 7” mega tech stocks which now make up a record 30% of the S&P’s market cap.” Two years later, AI is still the the biggest driver of financial assets, and that will continue… until it stops.

Maybe the biggest difference from two years ago is that “more of the same” means that never before has so much market influence and impact been concentrated in so few stocks, and at last check, the 10 largest stocks in the S&P now account for 38% of total market cap. Actually, one correction: it’s not “never before” – the last time so few stocks had such a big impact on the market was… just before the Great Depression.

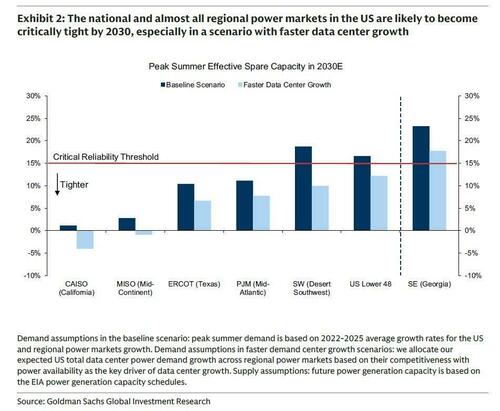

Actually, we do want to highlight one pretty notable change, and this one could be critical for the 2026 midterms: after two years of coasting on available grid capacity, the rampant data center buildout means that energy has officially become the bottleneck, and as the following chart from Goldman shows, eight out of the 13 US regional power markets are already at or below critical spare capacity levels.

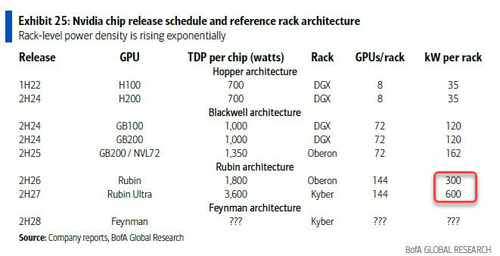

Add to this the stark reality that Nvidia’s upcoming Rubin/Rubin Ultra GPUs will be power hogs, raising the electricity demand for every rack from roughly 150kW to 300/600kW…

… and we stand by our claim made this summer that this chart of US electricity inflation – already surging in states like DC, Indiana, Illinois and NJ – will soon be the biggest political and economic talking point.

In one year, this will be the most popular chart on this site pic.twitter.com/h93gWXMoNL

— zerohedge (@zerohedge) August 11, 2025

Artificial Intelligence aside, another major technological innovation that also came to the fore in 2025, but received far less attention – even though it is possible its contributions to society will be just as important as AI – were stablecoins, a tokenized digital alternative to fiat currency which use blockchain technology and unlike cryptocurrencies, are designed to maintain a stable value, traditionally pegged one-to-one with the dollar (and collateralized by T-Bills, i.e., the more demand for stablecoins, the more demand for Bills) . In 2025 the value of the stablecoin market rose above $300 billion (with Tether accounting for more than half), and which many project will rise to $2-3 trillion over the next several years…

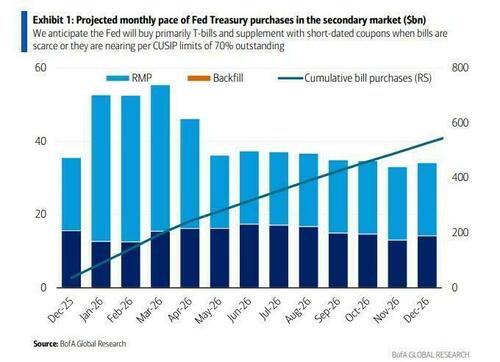

… providing a natural buyer of short-term debt and serving as a Plan B to the Fed’s upcoming mega QE, because you didn’t think all that debt that will be needed to fund the AI cycle – over $5 trillion according to JPMorgan – would buy itself.

And speaking of the Fed, our nemesis since day one of this website when gold was $700 and bitcoin didn’t exist, it is gratifying to see that the US central bank is circling the drain ever faster, and is likely at most a few years away from losing its “independence” – which never actually existed – and merging with the Treasury. Until then, however, the question is when will it all fall apart, with both the debt and deficit hitting daily record highs, while the interest on public debt at unprecedented levels, and well over $1 trillion now, despite 10Y yields just over 4%.

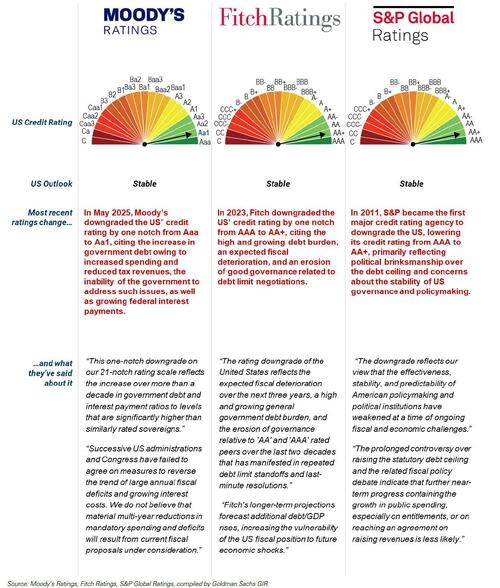

The rapidly deteriorating US fiscal situation was not lost on the rating agencies, and in May, Moody’s became the 3rd and last of the big three (after S&P and Fitch) to downgrade the US from the pristine Aaa to Aa1 citing the increase in government debt owing to increased spending and reduced tax revenues, as well as the growing federal interest payments.

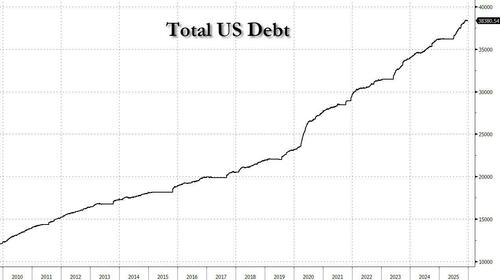

Downgraded or not, the dismal US fiscal picture got even worse in 2025 and despite some modest hopes that Elon Musk and DOGE would at least seek to slow down the relentless increase in US debt, that did not happen and on the contrary, total US debt rose by over $2 trillion this year to a new high of $38.4 trillion, more than tripling the debt load since 2010.

To be sure, this wasn’t just a US phenomenon, with debt ratios across the entire world already at nosebleed levels and expected to rise even higher to pay for unsustainable deficits across all economies but especially among emerging markets.

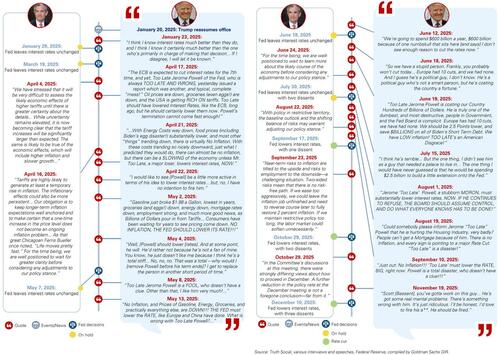

Yet the US was unique in that the status of the Fed is increasingly being challenged by Trump, who has made his displeasure with Fed Chair Powell quite public.

Ironically in the end Trump’s appeals for lower rates which saw much pushback by the Fed in early 2025 come to fruition when the Fed not only resumed its rate cuts in late 2025 (despite growing political opposition inside the Fed) but culminated in the Fed restarting QE Lite earlier this month, when Powell revealed that as part of the funding plans for 2026, the Fed would proceed to monetize $40 billion in T-Bills (to start), a number which will only grow.

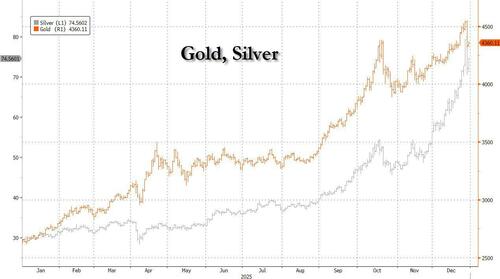

None of this was lost on the market, and while stocks staged a dramatic rebound from their Liberation Day lows and closed out the year at all time highs (more on the below), that move was nothing compared to the historic eruption in precious metals – which are far more sensitive to the monetary and fiscal challenges facing the US – and which had their best year since 1979, with gold up 70% and silver almost tripling at one point!

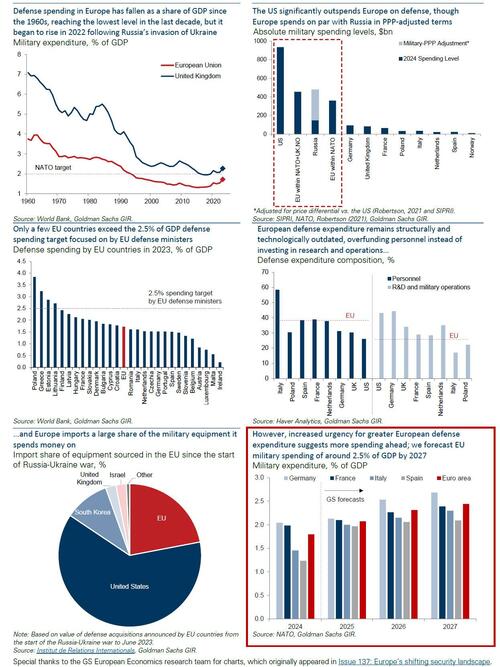

The last major theme of 2025 was a familiar one: geopolitics remained on the front page of most daily updates, only this time in addition to the hot war in Ukraine which entered its 4th year with little progress in sight, despite repeated attempts by Trump to mediate…

… prompting Europe to rapidly rearms itself for the first time since WW2 (and spend hundreds of billions in newly issued debt in the process)…

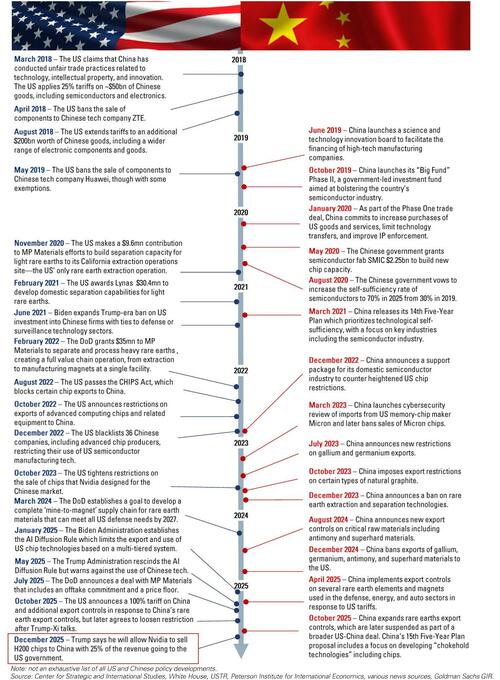

… we got to witness a new cold war erupt between the US and China as the tech race to win the AGI trophy quickly became the 21st century version of the nuclear arms race…

… amid a push for semiconductor…

… and rare-earth self sufficiency.

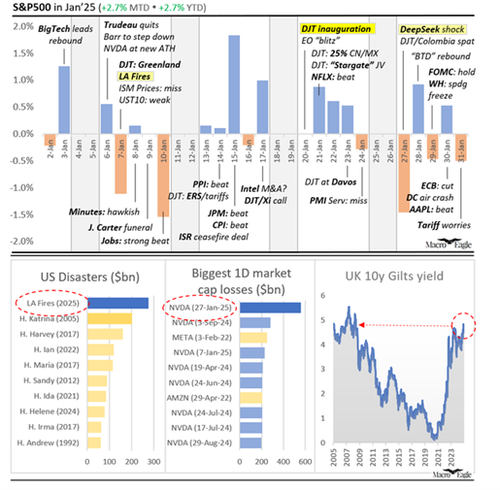

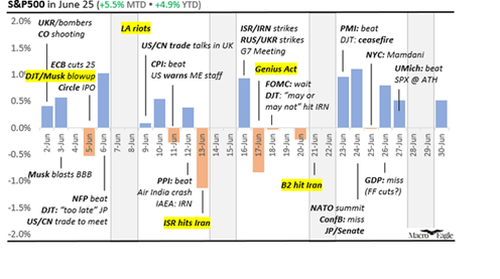

But while the four macro themes list above defined the narrative, the economy and the stock market across 2025, the day-to-day gyrations were defined by what at time seemed like unabashedly chaotic newsflow; and as we take a stroll through memory lane, here is a detailed look at the micro events that shaped trading across the past 11 months, courtesy of Bobby Vedral’s Macro Eagle monthly email:

January:

- Nvidia suffered the biggest single-day USD market cap drop ever when China launched a computational missile (“DeepSeek”) on US Inauguration Day, wiping out $1trn in market cap from Nvidia.

- Fires raged; it was the costliest natural catastrophe in US history.

- UK fiscal panic: 10 year government yields reached a high since the 2008 financial crisis, while 30 year government yields reached their highest since 1998.

- Trump easily broke the record for Executive Orders issued per day in office.

- A test aircraft by US start-up Boom broke the sound barrier, the first supersonic commercial travel since Concorde was grounded in 2003.

February:

- Due of Trump’s Russia-Ukraine policy, the Russian Ruble rallied 20%+ YTD.

- Bitcoin dropped 25% since it’s January highs, entering Bear Market – middle graph.

- DOGE induced a fall in consumer sentiment.

- The DAX hit new all-time-highs despite worrying German election results with significant gains for the hard-left and -right.

- Gold reached a new all-time-high.

- The US Conference Board consumer confidence recorded its biggest monthly drop in 4 years.

- The US reported a record trade deficit in January, thanks to tariff expectations.

- The biggest ever crypto hack of $1.5bn from Bybit.

- Births in Japan fell to their lowest since records began 125 years ago.

March:

- Daily stock market volatility picked up significantly.

- US consumer long-term inflation expectations hit a 32 year high.

- US consumer confidence fell to “the lowest level in 12 years, outside Covid – right graph.

- US Small Business uncertainty index near highest since survey started in 1970.

- Gold rose above $3,100 for the first time.

- Private Equity AUM fell 2% to $4.7tn in 2024, the first decline since 2005 as investors faced a $3trn backlog of unsold deals.

- Trump’s 100 minutes speech was the longest presidential address to Congress ever.

- BYD shares reached a record high after it said it could now charge its EVs as quickly as it took to fill a car with petrol.

- Germany’s Bundestag approved the biggest fiscal expansion in the country’s post-war history.

April:

- Highest effective US tariff rate since 1934/1909 – left graph.

- US equities recorded their worst weekly performance outside the 2008 Financial Crisi and Covid.

- This was followed by the best winning nine-day streak since 2004.

- University of Michigan consumer confidence fell to its second-lowest score since 1952.

- Gold hit another record high crossing $3400.

- Worst “first 100 days” for the Dow and S&P500 since Nixon.

- The dollar recorded its worst performance year-to-date since at least 1995.

- Pope Francis died: the new pope became the first pope from the Americas and Southern Hemisphere and first non-European since Syria-born Gregory III in 741 AD.

- Deadliest terrorist attack on tourists in Kashmir since the start of the insurgency in 1989.

May:

- Highest effective US tariff rate since 1934/1909 – left graph.

- US equities recorded their worst weekly performance outside the 2008 Financial Crisi and Covid.

- This was followed by the best winning nine-day streak since 2004.

- University of Michigan consumer confidence fell to its second-lowest score since 1952.

- Gold hit another record high crossing $3400.

- Worst “first 100 days” for the Dow and S&P500 since Nixon.

- The dollar recorded its worst performance year-to-date since at least 1995.

- Pope Francis died: the new pope became the first pope from the Americas and Southern Hemisphere and first non-European since Syria-born Gregory III in 741 AD.

- Deadliest terrorist attack on tourists in Kashmir since the start of the insurgency in 1989.

June:

- Israel launched a surprise attack on Iran, the biggest military assault on the Islamic Republic since the Iraq War of the 1980s – sending oil prices skyrocketing. The cost of a barrel of Brent Crude leapt by as much as 13.2% to hit $78.50.

- The US joined the fight, dropping various GBU-57, the world’s largest conventional bomb.

- Elon Musk, who was crucial in the re-election of Donald Trump had a high profile falling out with him.

- Earlier, Ukraine released killer drones from trucks to hit strategic bombers deep inside Russia.

- Despite the geopolitical turmoil, the S&P500 hit a new all-time-high.

- The ECB reported that global central banks now hold as much gold as they did in 1965.

- After riots in LA, Donald Trump deployed the National Guard despite the objections the governor – making it the first time since 1965 a US president deployed the National Guard without a governor’s consent.

- In the Democratic mayoral primary race for New York City, Andrew Cuomo lost to the 33 year old ‘Democratic Socialist’ Zohran Mamdani, despite raising a record $25m for his PAC.

- It was reported that UK vehicle production collapsed in May to the lowest level since 1949.

- Dubbed “the world’s most expensive acquisition”, Meta bought 49% of Scale AI for $14.3bn, valuing it at more than 30x revenues.

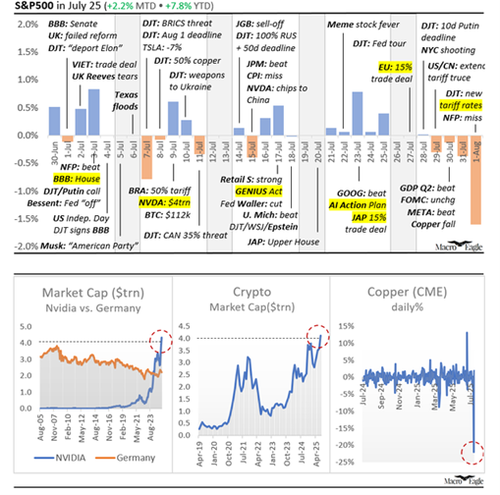

July:

- NVIDIA became the first $4 trillion company, followed by Microsoft.

- The Cryptocurrency market broke $4trn in market cap following the passage of the Genius Act.

- The Big Beautiful Bill was signed by President Trump.

- CME copper prices recorded their biggest ever 1-day fall, after President Trump excluded refined metals from tariffs.

- In the month of July, the US collected a monthly record of $29bn in tariffs.

- In Japan the ruling LDP party lost its majority in the upper house. Fiscal worries sent 20 year JGB yields to their highest since 2000.

- Global credit spreads hit a 2007 low.

- London stock market had their slowest first half of a year for IPO’s since 1997.

- Two governors dissented with the Federal Open Market Committee rate setting decision – a first such split in 30 years.

August:

- Japanese equities hit new all-time-highs on trade optimism and fiscal stimulus expectations.

- Chinese equities rallied, with the Shanghai Composite hitting a fresh 10 year high.

- UK 30 year debt yields rose to a 28-year high amid inflation and fiscal sustainability concerns – higher than the levels they reached following Lizz Truss’s ‘Mini-Budget’.

- Corporate credit spreads hit new record lows.

- Trump federalized Washington DC’s police operations under the 1973 DC Home Rule Act.

- First time a US president has tried to sack a governor of the Federal Reserve.

- It was reported that global central bank holdings of gold overtook those of US Treasuries as % of foreign reserves.

- Indian rupee tumbled to a new record low against the dollar, dragged by tariff concerns.

September:

- China’s Shanghai Composite rose above 3,800 for the first time in ten years.

- The $55bn leveraged buy-out of Electronic Arts is the largest leveraged buy-out ever.

- NATO saw the most serious incursion into its territory since the start of the alliance.

- Japan’s ruling LDP chose the country’s first female PM and, trying to beat the French, their fifth PM in five years.

- Jair Bolsonaro became the first former president in Brazil’s to be sentenced to prison – 27 years.

- Nicolas Sarkozy became the first ever French president to be sentenced to prison – 5 years.

- Israel launched an airstrike against a Hamas leader meeting in Doha, it’s first ever attack on Qatar. This was followed by Trump’s 20-point peace plan for Gaza – bringing two years of hostilities to an end.

- Ahmed al-Sharaa, became the first Syrian head of state to address the UN General Assembly since 1967.

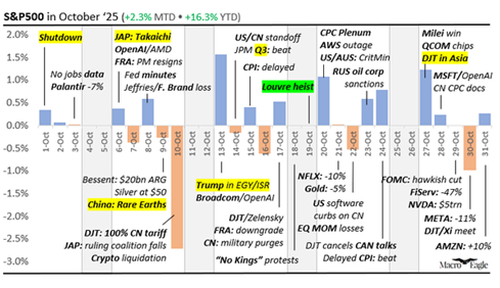

October:

- Nvidia became the first company ever to cross $5trn in market cap.

- The US stock market valuation vs US GDP ratio hit a record 225% vs an average of 85% since 1970.

- Silver crossed $50 for the first time since the Hunt Brothers cornered the market in 1980 – middle graph.

- China deployed rare earth restrictions.

- OpenAI became the world’s most valuable startup raising $6.6bn at a price tag of $500bn.

- The Nikkei rose 16% in October, its best monthly performance since 1990.

- Takaichi Sanae became Japan’s 104th and first female PM.

- Nicolas Sarkozy became the first former French head of state to be jailed since Marshal Petain after WWII, and before that Louis XVI in 1792.

- Hurricane Melissa became the first ever category-five hurricane to hit Jamaica.

- The Dutch government took over Chinese-owned Nexperia by invoking a 73-year old Cold War national security law for the first time ever

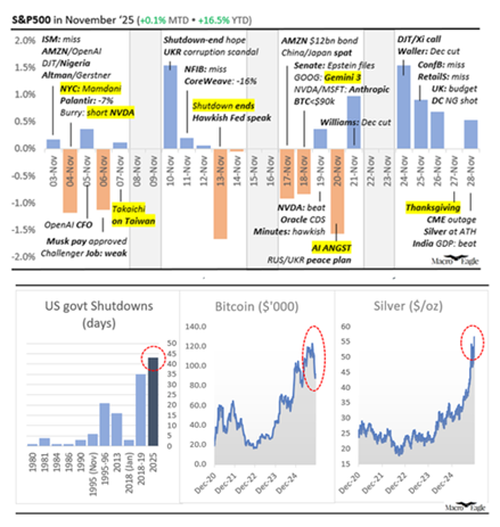

November:

- AI angst, crypto-crash and hawkish Fed speak made November look very shaky, only to be saved in the last week by (1) dovish talk from Fed Williams & Waller and (2) economic data misses, which brought a December Fed cut back on the table.

- The longest ever US government which began on October 1, 2025, and lasted for 43 days ended on November 13th.

- The Bureau of Labor Statistics cancelled the October Job data report, the first forgone monthly report ever.

- Bitcoin lost 1/3 of its value between Oct 6th and November 22nd – it’s biggest market value loss ever.

- US Consumer Sentiment fell to near lowest on record.

- The Challenger layoff announcements surged to a 22 year high.

- Silver hit a new all-time high

- Zohran Mamdani was elected mayor of New York, the first to win over a million votes since John Lindsay in 1969

- Answering a question on Taiwan, Japan’s new PM made the country’s first overt threat of force in 80 years.

- Hong Kong witnessed the world’s deadliest residential building fire since 1980, with 159 people killed

- The G20 summit was held in South Africa, the first ever in an African country.

Next, let’s do a quick a recap of the main market events of 2025, where as Goldman’s top trader John Flood reminds us, positive momentum from 2024 carried into January as investors remained optimistic on everything AI and a pro-business administration squarely focused on deregulation. The first real test of the year came on January 27th, aka “DeepSeek Monday.” The Chinese AI company released its chatbot which led to a sharp drawdown in global technology stocks. Investors worried that the AI hardware and large-model business architype might be disrupted with significantly cheaper (yet still efficient) models like DeepSeek potentially having the ability to knock off some of the biggest players. However, these fears tuned out to be relatively short lived as the AI complex quickly regained its footing and soared higher over the course of the year (it still remains the case that China will be able to confront US technology with much cheaper and just as efficient tech of its own).

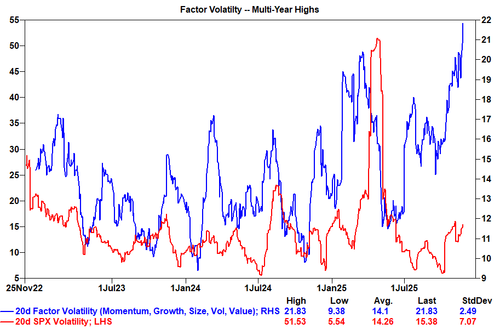

Due to a bout of extreme factor volatility, March 7 and March 10 will go down as one of the worst two-day stretches of hedge fund performance in years (multistrat-mageddon). The momentum factor experienced a 4+ standard deviation drawdown which led to forced derisking across various types of HF strategies. On the flip side, this episode also led to cleaner positioning as traders braced to enter the second quarter.

Donald Trump’s “Liberation Day” will be remembered as the most impactful event on the US stock market in 2025. After the market close on April 2, the president announced sweeping new tariffs on imports and famously held up his big boards with startling rates for the world to digest. The S&P 500 promptly lost 13% in the next weeks, from April 3 through 8, and closed under 5k on April 8, which was also the low close of the year. However, on April 9, Trump announced a 90 day pause on tariffs causing the S&P 500 to experience it sharpest intraday reversal since 2008 (the index closed +952bps on the day). This set the stage for the S&P 500 to make 36 additional record closes in 2025 (there have been 39 total this year).

After Liberation Day, a majority of professional institutional investors remained skeptical of the market’s rally and stayed on the sidelines. The most common reasons cited for this skepticism were geopolitical/macro/policy uncertainty, rich valuations, and poor market breadth. As a result, fundamental long/short HF net exposure spent most of the year well below the 50th percentile rank. Mutual Funds also sat on a significant amount of cash until the 4th quarter (when it was too late). As a result, only 28% of large cap mutual funds are outperforming their benchmarks, the lowest share since 2019…

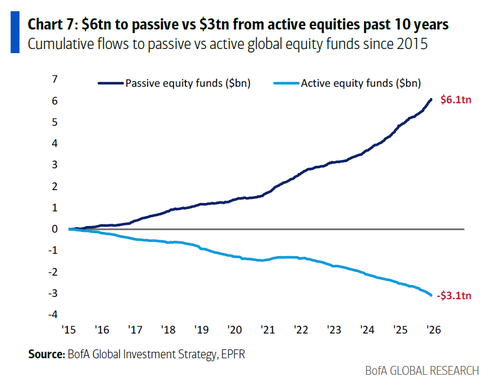

… while the average fundamental long/short hedge fund underperformed the S&P 500 by 200bps, which is yet another reason for the relentless rotation out of actively managed funds and into much cheaper, passive ones which deliver the same if not better results.

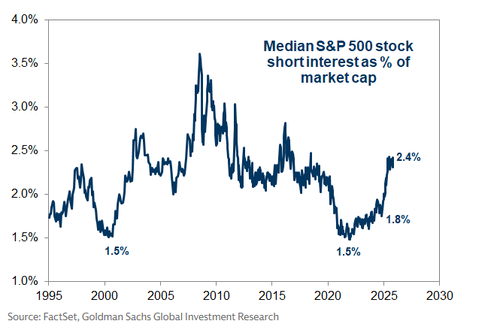

Goldman’s sentiment indicator spent most of the year in negative territory reflecting light institutional investor positioning, as the wall of worry has been extremely high this year and remains omnipresent. Furthermore, the stubbornly high short interest across the S&P suggests markets will likely continue to see bouts of short squeezes, pushing them above fair value.

As we have detailed extensively throughout 2025, three investor groups that have shown up as noteworthy buyers of US stocks this year are the retail community, corporates, and foreigners. Goldman data shows that the well informed retail community now only consistently sells stocks when there is significant job loss (as in March of 2020). The retail cohort’s most significant buy imbalances were in early April post liberation day, when retail got it right and professional investors were dead wrong.

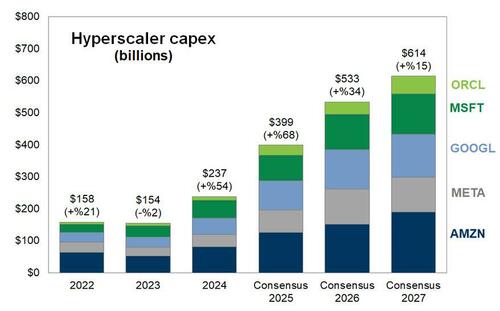

Meanwhile, companies again repurchased over $1 trillion of their shares in 2025 making it a top 3 buyback year in the history of the stock market, and as authorizations continue to ramp, $1 trillion annual corporate bids will be the new norm on the go forward, unless the Mag 7 are forced to plow all their free cash flow into capex… capex which accounted for a material portion of US growth in 2025.

The combination of aggressive retail buying and corporate buybacks provided a higher floor for the market at the index level, continuing to frustrate the HF and MF communities which just can’t get a dip that’s big enough for them to feel safe to buy. Meanwhile, despite ongoing debates around US exceptionalism (which contrary to leftist narratives, did not end when Trump entered the White House), foreign investors were the single largest source of US equity demand in 2025. Foreign investors bought nearly $280 billion in May and June this year, continuing the usual pattern of elevated foreign investor demand after the US dollar weakened and US equities underperformed.

Turning to the Fed, after putting rate cuts on hold in December 2024 – just after Trump won the election – Jerome Powell, facing a daily barrage of insults from Trump virtually non stop in 2025, pivoted back to dovish and cut rates by 25bps in September, October, and in December; not only that, but as noted above, the Fed resumed QE Lite announcing it would purchase a minimum of $40BN in Treasury Bills every month.

Lower rates, a weaker dollar, a resilient consumer, solid earnings, 2% GDP growth, and cautious sentiment make Goldman – and most other banks all of which have an average S&P price target well in the 7000 range – believe the US stock market will be the best place to be in 2026.

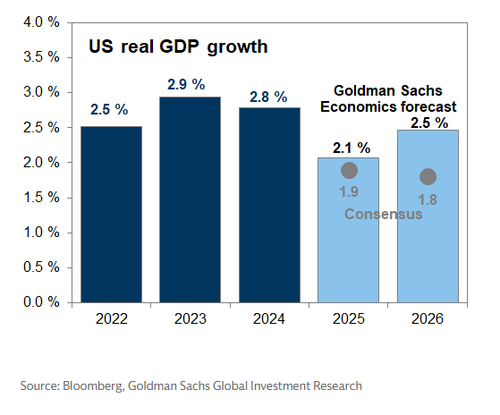

And speaking of Goldman, its baseline economic forecast is that growth reaccelerates to 2 – 2.5% in 2026 because of reduced tariff drag, tax cuts, and easier financial conditions. Standard models suggest that this should boost job creation and stabilize the unemployment rate at a level only modestly above September’s 4.44%. Under this forecast, the bank’s core assumption is that the FOMC slows the pace of easing in the first half, pausing in January but still delivering two more cuts in March and June which push the funds rate down to a terminal level of 3 – 3.25%.

Finally, from John Flood’s seat, an average of 17.5 billion shares traded across the US equity market each day this year. For context, this number was 10.8 billion shares in 2020. However, trading has never been more difficult as liquidity is hard to come by as this volume growth is happening off-exchange which traders cannot access. Over 75% of off-exchange volume now trades in OTC market centers, which includes retail flow mostly inaccessible to institutional investors. Fragmentation in the US markets poses further challenges with 16 exchanges, over 30 ATSs and hundreds of OTC liquidity destinations. The average trade size has dropped both on and off exchange, reaching a 15-year low this year of 150 shares per trade. Incidentally, the Retail bid should remain very strong in 2026 as tax refunds spike in early 2026 (2025 were never adjusted to reflect OBBBA and therefore many will be due a large refund). As Flood concludes, “knowing where the bodies lie” has never been more important.

Of course, 2025 was about much more than just markets, and one of the tragic developments of the increasingly polarized US society was the surge in political assassinations, which started in the summer of 2024 with the unsuccessful attempt on Donald Trump’s life, escalated when a troubled young man murdered the CEO of UnitedHealthcare in December 2024 to make a political statement, and culminated in September 2025 when a radicalized and brainwashed 22-year-old assassinated Charlie Kirk in broad daylight. Unfortunately, with mental illness largely normalized by the liberal establishment, and with mainstream media brainwashing an entire generation into believing that “killing fascists is ok“, we are confident that this is only the beginning and there will be many more political assassinations in 2026 and beyond.

But while tragic and inexcusable, the sad reality is that there is an entire generation of young Americans who feel an unprecedented degree of anxiety that the American Dream is now hopelessly lost. And, to an extent, one can’t blame them: we started off this website in 2009 with a clear warning that the Fed is the single biggest enemy of American prosperity, the future of the American experiment, and the American way of life, because artificial growth boosted by trillions in budget deficits promptly monetized by the central bank, and culminating in a record $38+ trillion in debt (rising by $1 trillion every few months), which has to be inflated away sooner or later (and judging by the price of gold, it will be “sooner”), will inevitably lead to devastating consequences.

17 years later we have been proven right, as America’s conversion into a banana republic is nearly complete with the vast majority of wealth now held by a handful of corporate shareholders, oligarchs and others within the top 1% of the wealth pyramid, while the middle class is disappearing at an exponential pace, drowned by the tide of rising prices. And with little hope to live for, it is understandable why so many young American men and women (and they/thems) are now willing to suicide themselves at the altar of generational disillusionment, but not before first making a deadly political statement.

In 2025, some tried to nudge the US off its doomed course with the iceberg of fiscal inevitably, most notably Elon Musk who launched the Department of Government Efficiency (DOGE), in hopes of streamlining and eliminating waste within the US government. We were skeptical, and in February we warned Musk that “what Musk is doing in trying to streamline the govt is admirable but ultimately it will be Congress that decides the endgame. And there things are as status quo as always.” A few months, and one very high profile feud with Donald Trump later, Musk agreed, saying that “the government is basically unfixable…. at the end of the day if you look at our national debt…if AI and robots don’t solve our national debt, we’re toast.”

🚨ELON MUSK: “I haven’t been to DC since May. The government is basically unfixable. I applaud David (Sacks’) noble efforts…but at the end of the day if you look at our national debt…if AI and robots don’t solve our national debt, we’re toast.” pic.twitter.com/XKSes4fBfq

— Autism Capital 🧩 (@AutismCapital) September 10, 2025

The DOGE experiment was quietly snuffed out and the uniparty, which thrives on corruption, opacity and waste, won again. That, too, was not lost on either gold or silver, which enjoyed their best year in nearly half a century, as the days of the US dollar as the world’s reserve currency draw to a close.

And speaking of Elon, he also deserves congratulations for continuing to convert X (f/k/a Twitter), from what was once the most corrupt and censored social media network in the world controlled by an army of woke, bluepilled Karens, into a bastion of free speech, one which many will agree was instrumental in Trump’s victory on in 2024. Many smirked two years ago this day when we said that “in less than a decade, Elon Musk’s $44 billion purchase of Twitter will seem like one of the century’s biggest bargains.” Fast forward to today when Elon Musk is not only the world’s richest man once more with a staggering net worth of over $600 billion, but he is that by a huge margin, worth some $350 billion more than Larry Page’s $270 billion, and he largely has X to thank for this, even as virtue-signaling corporations (who all work in conjunction with the deep state in hopes of getting some fast-track access to those very generous taxpayer-funded government contracts) continue to do everything in their power to isolate and blacklist both Musk and his various enterprises.

We say this as one of the very first media outlets that was dubbed “conspiracy theorists” by the authorities, leading to repeat attempts to demonetize and deplatform us, and ultimately put us out of business. Oh yes, we’ve been there: we were suspended for half a year on Twitter for telling the truth about Covid, and then we lost most of our advertisers after the Atlantic Council‘s weaponized “fact-checkers” such as Newsguard put us on every ad agency’s black list while anonymous CIA sources at the AP slandered us for being “Kremlin puppets” while – as we have since learned – the campaign to defund ZeroHedge, as well as The Federalist and Breitbart, could ultimately be traced to UK prime minister Kier Starmer. Which reminds us: for those with the means, desire and willingness to support us, please do so by becoming a premium member: we are now almost entirely reader-funded so your financial assistance will be instrumental to ensure our continued survival into 2025 and beyond.

That said, we did get a chuckle when, five years after he almost succeeded in shutting us down in collaboration with Google, Imran Ahmed, CEO of the Center for Countering Digital Hate (CCDH) was sanctioned by the Trump administration and barred from entering the US.

The bottom line, at least for us, is that the past five years have been a stark lesson in how quickly an ad-funded business can disintegrate in this world which makes the dystopian nightmare of 1984 seem more real each day, and we have since taken measures. Five years ago, we launched a paid version of our website, which is entirely ad and moderation free, and offers readers a variety of premium content. It wasn’t our intention to make this transformation but unfortunately we know which way the wind is blowing and it is only a matter of time before the gatekeepers of online ad spending return and block us – and those like us – as traditional media continues to melt away, losing more credibility and readers each and every day. As such, if we are to have any hope in continuing it will come directly from you, our readers. We will keep the free website running for as long as possible, but we are certain that it is only a matter of time before the hammer falls as the deep state retaliates to the shocking loss of 2025 and lashes out at all new media, as the deep state will stop at nothing to silence all independent voices in order to preserve mind control over the population.

As always, we thank all of our readers for making this website – which has never seen one dollar of outside funding (and despite amusing recurring allegations, has certainly never seen a ruble from either Putin or the KGB either, sorry CIA) and has never spent one dollar on marketing – a small (or not so small) part of your daily routine.

Which also brings us to another critical topic: that of fake news, and something we – and others who do not comply with the established narrative – have been accused of. While we find that narrative laughable, after all every single article in this website is backed by facts and links to outside sources, it is clearly a dangerous development, and a very slippery slope that the entire developed world is pushing for what is, when stripped of fancy jargon, internet censorship under the guise of protecting the average person from “dangerous information.” It’s also why we are preparing for the next onslaught against independent thought and why we had no choice but to roll out a premium version of this website.

In addition to the other themes noted above, we expect the crackdown on free speech by various deep state tentacles to accelerate in the coming years (although it will be mostly in the shadows, at least for the time being, until Trump gets bored or tired of fighting the infinitely more powerful octopus that is truly in control of the United States) especially as the following list of Top 20 articles for 2025 reveals, many of the most popular articles in the past year were precisely those which the conventional media would not touch with a ten foot pole, both out of fear of repercussions and because the MSM has now become a PR agency for either a political party or some unelected, deep state bureaucrat, which in turn allowed the alternative media to continue to flourish in an information vacuum and take significant market share from the established outlets by covering topics which established media outlets refuse to do, in the process earning itself the derogatory “fake news” condemnation.

We are also grateful that our readers have, for the 17th year in a row, realized that it is incumbent upon them to decide what is, and isn’t “fake news.”

* * *

And so, before we get into the details of what has now become an annual tradition for the last day of the year, those who wish to jog down memory lane, can refresh our most popular articles for every year during our no longer that brief, 16-year existence, starting with 2009 and continuing with 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, 2019, 2020 , 2021, 2022, 2023 and 2024.

So without further ado, here are the articles that you, our readers, found to be the most engaging, interesting and popular based on the number of hits, during the past year.

- In 20th spot we had a stark reminder that 6 years after the death of Jeffrey Epstein, not a single person has gone to prison for pedophilia or, well, anything else for that matter. And although the left was desperate to distract from their latest, record government shutdown (which achieved nothing) by making a spectacle of the Epstein files hoping that something would emerge damning the president (sorry to break it to you, but if 4 years of Democrat rule led to no Trump-crushing leaks, there is just nothing there), as the number of Epstein-related documents released to the public grew, we did get our first casualty, and it couldn’t have happened to a more worthy public persona as “Larry Summers Goes Into Hiding; Messages Sought Epstein’s Advice On Cheating With Daughter Of CCP Official.” And while the public destruction of what little was left of Larry Summers’ reputation was certainly a step in the right direction, if not the one his liberal friends were hoping for, we can only hope that many more corrupt oligarchs will follow in his footsteps.

- Number 19 was the story of one of the biggest home runs of Elon’s DOGE, which failed to slow down the rate at which the giant American budget deficit black hole swallowed trillions and pushed up govt debt by the same amount, but it did succeed in dismantling several openly evil government departments which for decades had been a front for even worse three-letter government agencies spreading deep state Pax American across the globe. That’s what happened in early 2025, when we learned that the notorious CIA spy cutout, “USAID Funded Massive ‘News’ Platform, Extending ‘Censorship Industrial Complex’ To Billions Worldwide.” Not surprisingly, just days later when Elon Musk’s DOGE was about to shut the door permanently on this particular deep state tentacle, we got the second, and more important part, of the story (which was also the 17th most popular article of 2025), namely that “USAID Staff Ordered To Destroy Evidence.“

- The 18th most read article of the year was on the lighter side, metaphorically speaking, and was a reminder that while Democrats in power may try to impose their perverted DEI ideals on the population in a desperate attempt to root out society’s most basic instincts, the desires of warm-blooded males can never be wiped out, especially when they go hand in hand with meme stock mania, as we learned in “Sydney Sweeney’s Breasts Spark American Eagle Meme Stock Frenzy.” And whether it was the glorious mammaries of the unwoke actress, or just a return of animal spirits, American Eagle stock not only outperformed bitcoin, and many AI names this year, but it closed 2025 at the highest level in four years. We wonder what female body parts comparable copycat stocks will use to achieve the same effect…

- Our 17th most read article of the year was written just days before the tragic assassination of Charlie Kirk, and it was the just as tragic cold-blooded murder of the unarmed and defenseless Iryna Zarutska, who was butchered by a deranged black person with a hatred for white people. The senseless attack and the even more gruesome aftermath of her lying in a pool of blood as she bled to death with barely anyone coming to her help is what we called “The Image That Killed The Democrats In 2026 And Beyond.” Although having since learned to what lengths democrats will go to rig and manipulate elections, we may have to revise that statement.

- 2025 was a year that mercifully saw the unwind of many fake narratives, and one of them, which also was the 16th most popular article of the year, was that Ukraine would somehow be able to oppose Russia in the ongoing war. Contrary to media reports that Ukraine was this close to ending the conflict any day now, and that Russia was suffering catastrophic losses, the reality was in fact just the opposite as we learned in March when “Thousands Of Ukraine Troops Were Suddenly Facing Encirclement In Russia’s Kursk.” Since then it has gone from bad to worse for Ukraine, which is suffering loss after loss in the Donbass region, while the noose around Zelensky is getting uncomfortably tight after his closest political aide was hounded out of Kiev for corruption that would make even career US politicians blush. The cherry on top, Trump’s now unyielding demands that Ukraine concede territory, hold presidential elections, and sign a peace treaty with Russia, indicate that the biggest military conflict of the 21st century may finally be drawing to a close.

- The 15th most read article of the year saw the end of yet another fake news narrative, the one that defined much of the past decade ever since the first Trump administration, namely that the president was somehow beholden to Russia, a carefully fabricated story that consumed America for years. In the end, however, it turned out that Russiagate was nothing more than another carefully orchestrated Democrat propaganda masterpiece, and this time justice might even be served as “Barack Obama Is Now Squarely In Russiagate Crosshairs.” Whether or not Obama, who facilitated what was in retrospect a treasonous coup, ends up in prison is to be determined, but as we said in July, his actions were the “Betrayal Of Every American.”

- Turning the page on sordid tales of political woe, we go to the 14th most popular post of 2025, in which we explained that “Something Extraordinary Is Taking Place In The Gold Vaults Below Manhattan” and showed how at the end of January amid fears of escalating trade tensions, the gold vaults that make up the CME system, those belonging to the likes of JPMorgan, Brinks and HSBC, had seen an blistering accumulation of physical gold to record levels, while vaulted gold elsewhere around the world quietly evaporated. This historic imbalance would lead to shocking reverberations for the physical metal for much of the rest of the year, and would culminate in the biggest increase in the price of gold since 1979.

- The 13th most read article of the year was one that covered the year’s most tragic event: the death of conservative speaker Charlie Kirk, one which the president called a “Dark Moment for America” as “Trump Addresses The Nation After Kirk Assassination.” Taking place just over a year after a failed assassination attempt on Donald Trump, the increasing frequency of political assassinations in the US is a testament to the liberals’ aggressive pursuit to normalize murder (and mental disease) in the name of “fighting fascism”, when the only fascists in the US are those who brainwash their pathological supporters into believing that the killing of an adversary solves something. Which, unfortunately, is why we expect many more such senseless killings in 2026 and beyond.

- In 12th spot was a vivid reminder that politics under Trump was anything but life as usual, when “Trump Stunned South Africa’s Ramaphosa, Played ‘Kill The Boer’ Clip In The Oval Office, Destroys NBC Reporter.” Whereas previous administrations would have bent over backwards due to faked white guilt to appease the South African regime, Trump played hard ball and encouraged by Elon Musk, who clearly laid out South Africa’s brutal, anti-white policies, the president made it clear that, at least when it came to racial matters, the new boss was anything but the old boss. There would be more, as the US further snubbed South Africa through boycotts and punitive actions related to the G20 summit, stemming from Trump’s claims about “white genocide” and land seizures, coupled with disagreements over climate/DEI priorities, leading the US to skip South Africa’s 2025 G20 and bar South Africa from the 2026 summit.

- The 11th most popular article of 2025 was also a tragic preview of what has emerged as one of the biggest stories of corruption and fraud in 2025, as a “Fake Cop Assassinates Minnesota Democrat Who Blocked Health Care for Illegals.” With much of the independent media now focusing on waste and abuse of taxpayer money by the Somali population in Minnesota, the June shooting by Vance Luther Boelter – a Democrat activist and 2019 appointee of Gov. Tim Walz – of MN lawmakers democrats Melissa Hortman and John Hoffman, just didn’t make sense; why would Democrats kill other Democrats. Unless, of course, someone was desperate to hide just how deep the rabbit hole went. Well, when it comes to taxpayer abuse in Minnesota, we have since learned that rabbit hole indeed goes to unprecedented depths, and we are confident that we will only learn more as the full extent of

- 2025 was a year rife with geopolitical conflict, and it wasn’t just Ukraine: in June, the Middle East was roiled by the most serious military escalation in decades, when Iran and Israel started a shooting war, threatening to drag in the entire region with some even speculating that nukes could be exchanged. And while at first, “Trump Rejects Netanyahu’s Request To Join War, As Israel Needs Large US Bunker Buster Bombs,” ultimately Trump did as Israel demanded, and not only supported Israel in a move that has resulted in a dramatic schism across the conservative movement (pro vs anti Israel) but also provided US bunker buster bombs to take out Iran’s nuclear centrifuge facilities. After Iran lobbed several theatrical cruise missile waves at Tel Aviv, and suffered heavy losses, the conflict quickly faded but it is likely only a matter of time before Tehran (potentially a nuclear-armed Tehran) seeks vengeance, leading to an even more serious conflict in 2026 and beyond.

- The 9th most read article of 2025 was a modest detour into levity, and one which caught many unaware when yet another company decided to go woke and quickly went broke, dragged into irrelevance – and bankruptcy – by years of imposed DEI standards: “Hooters Goes Tits-Up As Bankruptcy May Come Within Months.” Here’s to hoping that whoever acquires Hooters out of bankruptcy can recreate it as the cultural icon of middle Americana it deserves to be.

- The 8th most read article of the past year dealt with something far more serious, and unfortunately proved yet again that the conspiracy theorists were right: Dr Patric Soon-Shiong, founder of ImmunityBio and owner of the Los Angeles Times, made major headlines in March when “Billionaire Cancer Researcher Says Covid & Vaccine Likely Causing Surge In Aggressive Cancers.” To be sure, speculation that covid vaccines were potentially deadly had emerged long before his startling confession, but at the time anyone who voices skepticism was promptly canceled and erased. We can only hope that the scientific establishment has at least learned something from that catastrophic episode in American history.

- Earlier we said that Elon’s experiment in streamlining the US government was a failure after even he realized that it is hopeless to slowdown the pace of spending, but at least it was eye-opening: for the first time, thanks to DOGE, most Americans got a full view of how the sausage is made, and how pervasive corruption and waste are in the corridors of the Capitol. Needless to say, while everyone assumed as much, the confirmation was a shock, which is why so many were amazed to learn that “Musk Reveals Treasury Has Been Auto-Paying Everyone, ‘Even Known Terrorist Groups’“, the 7th most popular article of the year. Unfortunately, unless an impartial 3rd party continues policing US government spending, nothing will change and we will get more stories like this in the future.

- Once upon a time, Democrats were the party of tolerance and peace, or so the legend goes. That all changed in recent years when after relentless media brainwashing and normalizing that “killing fascists is fine” and that pretty much anyone to the right of communists is a fascist, not to mention that mental illness is something to be proud of, many Democrats emerged as a radicalized, violent group intent on inflicting harm if not outright murder their ideological opponents. In retrospect, it should not have been a surprise but the news that “Charlie Kirk’s Assassin Is A “Radical Left ANTIFA-Adjacent Creep”, Wrote “Hey Fascist” On Bullet Casing” was big enough to make the 6th most read article of the year. Here too, we are confident that much more bloodshed lies in store as the seed of leftist violence are only just starting to bear fruit.

- And speaking of catastrophic liberal policies, the very first major event of 2025 was a stark reminder of how bad things can get in the world of unbridled Democratic policies, when “Unprecedented Fires” Scorch 3,000 Acres In Los Angeles Area, Forcing 49,000 To Evacuate“ quickly became the 5th most read article of the year. The fires would never have been able to unleash that kind of destruction if local administrators had taken proactive measures and engaged in controlled burn ins, not to mention had given the local fire department access to water. Unfortunately, with California now a vibrant symbol of all that is broken in the US, the worst case scenario promptly emerged and it has only gotten worse since then, with many if not all of the burned down houses frozen in time, owners unable to rebuild and move on due to, you guessed it, suffocating liberal policies.

- We are not done with DOGE and government corruption: the 4th most read article of the year was news that “DOGE Is Investigating Feds Whose Net Worths Have Exploded After Samantha Power Bombshell.” The announcement, which came after President Donald Trump signed an executive order calling on federal agencies to work with DOGE, follows a bombshell report that Samantha Power, former head of USAID, saw her net worth explode to $30 million despite an annual salary under $250,000. Unfortunately, to this day the investigation has gone nowhere, meanwhile there are dozens if not hundreds of US politicians who have become multimillionaires with a salary that is barely enough for a family of four to live comfortably.

- Going back to finance, our 3rd most read article of the year was an in depth analysis of what happened during the April meltdown, one which we correctly warned about ten days in advance, and which was precipitated by yet another blow up of the basis trade, the same trade which nearly brought the world to a halt in March 2020; we described all this in ““Absolutely Spectacular Meltdown”: The Basis Trade Is Blowing Up, Sparking Multi-Trillion Liquidation Panic.” More importantly, it was the massive surge in bond yields in the days following Trump’s Liberation Day that prompted the president to announce a reversal in his tariff policies and also set the market’s low for the year, translating into a nearly 2000 point ascent for the S&P since April.

- The 2nd most popular post of the year is also the most topical as we close out the year: thanks to intrepid citizen journalism from Nick Shirley, America got a stark reminder that corruption across the US is vast not just at the federal level but also state as news emerged that hundreds of millions (if not more) had been embezzled by various immigrant groups in Minnesota and in other democrat states , as detailed in “Quality Learing Center” First Domino To Fall As Somali-Linked Minneapolis Daycare Scandal Shocks Nation.“ Just like many of the other top stories in this list, America got a glimpse into the corruption, but since politicians on both sides benefit, don’t expect anything to change.

- Finally, the most popular post of 2025 was a stark reminder that the US has not been a Democratic Republic in decades, and that those in control are unelected bureaucrats, unaccountable to anyone… or almost anyone because at the start of 2025, a brief shock rippled across the deep state as we described in the #1 most popular article of the year: “Eruption In “BleachBit,” “Wipe Hard Drive,” “Offshore Bank” Searches In DC Suggest Deep State Panic Mode.” Unfortunately, the panic was brief, and after a few months of pushback against Doge, and one high profile scandal between Trump and Musk later, things in DC quietly returned to normal, with the Deep State once again in control of everything and just biding its time until it can once again place a puppet of its own choosing in the White House.

And with all that behind us, and as we wave goodbye to another bizarre, exciting, surreal year, what lies in store for 2026, and the next half-decade?

We don’t know: as our frequent readers are aware, we do not pretend to be able to predict the future and we don’t try, despite repeat baseless allegations that we constantly forecast the collapse of civilization: we leave the predicting to the “smartest people in the room” who year after year have been consistently wrong about everything, and never more so than in 2025 when all the experts predicted soaring inflation as a result of Trump’s tariffs, alongside a sharp drop in the stock market… only to flip-flop and concede that not only is tariff inflation not coming but the market is set to close at fresh record highs…

Wall Street strategists’ year-end target on S&P 500 at different points throughout year…

What a complete joke.

Nobody. Knows. Anything.

via @geoffreymorgan pic.twitter.com/VEAn7p7DOd

— Nate Geraci (@NateGeraci) December 21, 2025

… in the process adding strategists and analysts to the clueless ranks of economists, mainstream media and the professional polling class, not to mention all those “scientists” who made a mockery of both the scientific method and the “expert class” with their catastrophically bungled response to the covid pandemic, and then the response to the response, and so on… We merely observe, find what is unexpected, entertaining, amusing, surprising or grotesque in an increasingly bizarre, sad, and increasingly crazy world, and then just write about it.

We do know, however, that with the Fed having flip-flopped yet again, and re-pivoting dovishly just months after the latest hawkish pivot when Trump was elected, only to back off following a now all-out war of words between the White House and the Marriner Eccles building (located just a few hundred feet away) which led to the launch of QE Lite (ahead of a full-blown QE soon) with home prices and rents still refusing to drop despite mortgage rates peaking around 7%, and overall prices stuck at all time highs, it is not Trump’s trade war but year of catastrophic monetary and fiscal policy that will inevitably lead to another surge in inflation right around the time of the midterms (Trump will, of course, do everything in his power to delay the inevitable until at least 2027) and Jerome Powell becoming not the second coming of saint Paul Volcker but of satan Arthur Burns.

But even ignoring the impact on prices, one can’t just undo almost 20 years of central bank mistakes by willing them away (especially after Elon Musk and DOGE confirmed what we said at the start of the year, namely that the level of corruption and out of control spending is so embedded in every corridor of the US government that it will never be eradicated); after all it is the trillions and trillions in monetary stimulus, the helicopter money, the MMT idiocy, and the endless deficit funding by central banks that sent gold and silver into the clearest red alert warning yet that hyperinflation and a fiat collapse is looming, and that the current attempt to stuff 15 years of toothpaste back into the tube, will be a catastrophic disaster.

We are confident, however, that in the end it will be the very final backstoppers of the status quo regime, the central banking emperors of the New Normal, who will again be revealed as completely naked. When that happens and what happens after is anyone’s guess. But, as we have promised – and delivered – every year for the past 17, we will be there to document every aspect of it.

Finally, and as always, we wish all our readers the best of luck in 2026, with much success in trading and every other avenue of life. We bid farewell to 2025 with our traditional and unwavering year-end promise: ZeroHedge will be there each and every day – usually with a cynical smile (and with the CIA clearly on our ass now) – helping readers expose, unravel and comprehend the fallacy, fiction, fraud and farce that defines every aspect of our increasingly broken economic, political and financial system.

Tyler Durden

Wed, 12/31/2025 – 13:40ZeroHedge NewsRead More

R1

R1

T1

T1