The Bearish Counterpoint: What Could Go Wrong For Markets In 2026?

Authored by Lance Roberts via RealInvestmentAdvice.com,

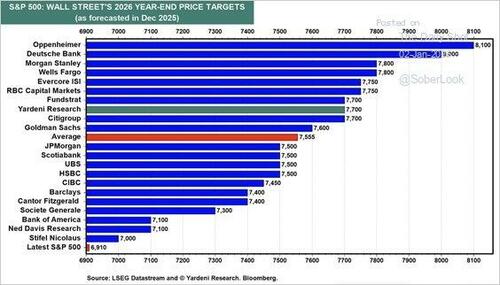

Wall Street’s market outlook enters 2026 in a bullish mood, albeit with nuance. After three consecutive years of substantial gains in major indexes, many strategists expect the U.S. stock market to extend its rally into another year, with the central Wall Street banks highlighting several drivers supporting continued upside, from increases in productivity due to AI to the tax cuts and deregulation from the OBBBA.

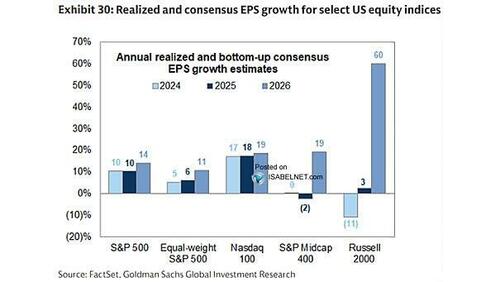

Goldman Sachs, for example, forecasts that S&P 500 earnings per share will accelerate in 2026, rising approximately 12 percent from 2025 levels. This earnings momentum underpins the constructive view on equities, and they see opportunities not just in prominent technology names, but also across cyclical sectors such as small caps, non-residential construction, and consumer stocks exposed to the middle-income consumer.

Furthermore, global growth is expected to stay sturdy in 2026. Goldman Sachs projects 2.8 percent global GDP growth, up from consensus expectations, with the U.S. economy outpacing most major peers. China’s growth is also forecast to improve, broadening the backdrop for global stock demand.

Morgan Stanley echoes a positive but tempered outlook, suggesting that U.S. equities will outperform global peers, a reversal from last year, with the S&P 500 projected to rise to about 7,800.

Regardless of the firm, several key structural factors universally support their bullish outlook:

-

Monetary policy is expected to remain supportive. The Federal Reserve has already enacted rate cuts in 2025, and further moderation in borrowing costs could preserve liquidity and investment demand. Historical data indicate that positive equity returns occur when rate cuts coincide with established bull markets.

-

Earnings growth is forecast to remain robust. Beyond headline numbers, broad sectors could benefit from technological adoption and operational leverage as companies expand margins.

-

Sector breadth may improve. After several years of narrow leadership dominated by mega‑cap tech, strategists see room for cyclicals, financials, and industrials to play a larger role in 2026 performance.

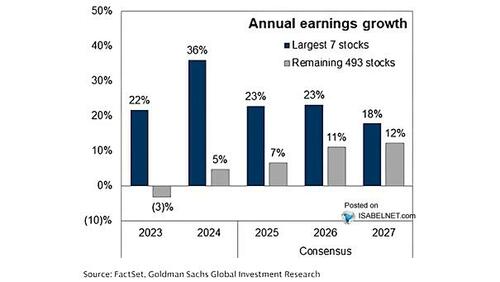

This combination drives the bullish premise: 2026 will not just be about extending the past year’s returns, but consolidating gains across more parts of the market. That view is supported by the earnings expectations for this year, with the Magnificent 7 growth rates slowing but the bottom 493 surging.

So, with such a bullish market outlook, what is there to worry about?

The Bearish Counterpoint: What Could Go Wrong?

Despite the bullish narrative, a thoughtful case against unbridled optimism exists. Unlike the simple bull versus bear dichotomy, credible risks could significantly dampen or reverse the more bullish market outlooks.

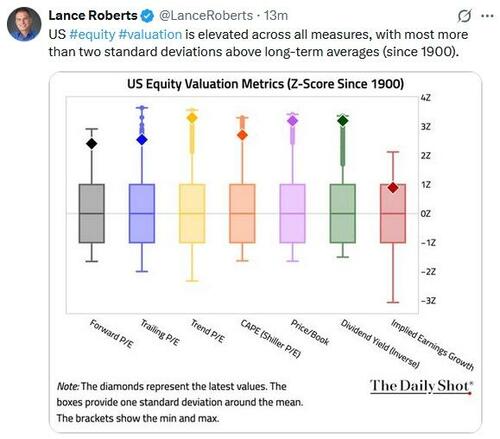

First, we would be remiss not to mention valuations. Forward valuations are elevated, and while they are terrible market timing devices, they do represent investor sentiment, which is universally bullish. This means the market’s upside is more sensitive to disappointments in earnings or macro trends. If earnings growth does not materialize as expected, stocks may struggle, even in a benign macro setting. We discussed this recently, in “Risks To Market Outlooks.“

“Notably, these forecasts rest on an assumption that the economy will not only avoid recession but reaccelerate in the face of waning inflation. As noted, equity markets have responded by pushing valuations higher across major indexes, with price-to-earnings ratios well above historical medians. Simultaneously, investors have rewarded narratives built on the idea of a soft landing and a return to pre-pandemic trends.”

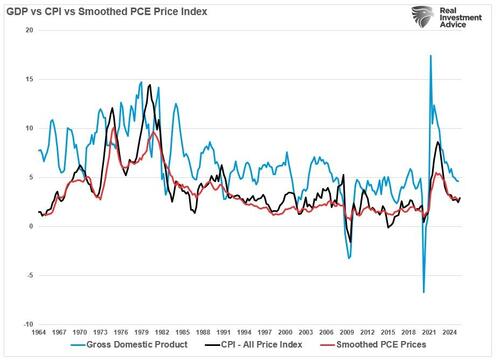

“However, this narrative appears to overlook the trends in recent economic data. Inflation expectations have moderated, not because of increased demand, but due to weaker consumption and cooling labor dynamics. As recent economic data indicate, disinflation has accompanied slower GDP growth and a decline in personal consumption momentum. If the economy were indeed set to reaccelerate, these trends should be increasing rather than returning to historical averages.”

Secondly, the market is pricing a “soft landing” where inflation cools, growth persists, and rate cuts continue. Yet, that outcome would be historically rare. When inflation falls this quickly, it typically reflects a slowdown in demand rather than policy success. Additionally, the strong relationship between economic growth and earnings should not be dismissed. That disconnect exposes investors to market risk if growth does not materialize as expected and valuations are reconsidered.

Furthermore, if inflation stubbornly remains above targets or the labor market shows uneven data, the Federal Reserve might delay or reduce the magnitude of rate cuts. A less accommodative stance could tighten financial conditions and pressure asset prices as market outlooks reverse.

Third, earnings growth estimates are very optimistic. As we head into 2026, strategists are hopeful that the bottom 493 stocks will begin to grow earnings aggressively. As noted previously:

“Wall Street currently expects the bottom 493 stocks to contribute more to earnings in 2026 than they have in the past 3 years. This is notable in that, over the past three years, the average growth rate for the bottom 493 stocks was less than 3%. Yet over the next 2 years, that earnings growth is expected to average above 11%.

“Furthermore, the outlook is even more exuberant for the most economically sensitive stocks. Small and mid-cap companies struggled to produce earnings growth during the previous three years of robust economic growth, driven by monetary and fiscal stimulus. However, next year, even if the Fed’s soft landing narrative is valid, they are expected to see a surge in earnings growth rates of nearly 60%.”

There is nothing wrong with having an optimistic market outlook when it comes to investing; however, “outlooks can change rapidly,” which is a significant market risk, particularly when expectations and valuations are elevated.

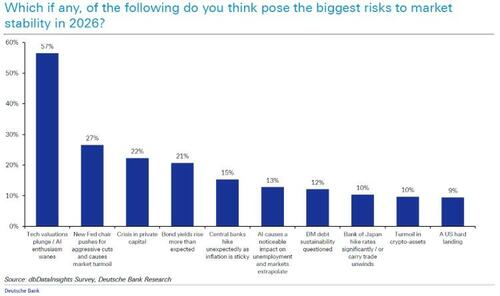

Third, geopolitical and global trade pressures persist as a threat to more bullish market outlooks. Trade friction, geopolitical tension, or currency instability all contribute to sudden shifts in risk tolerance. Recent fund manager surveys identify AI valuation bubbles, bond market turbulence, inflation resurgence, credit stresses, and trade escalations as top concerns.

Which one will it be that “derails the apple cart?”

The most likely answer is that it will be none of them. This is because when investors are monitoring some risk, they make portfolio changes to hedge against that risk. Therefore, that “risk” becomes priced into the market. Most likely, the risk that eventually manifests itself will be something that no one is expecting. That “surprise” is what causes markets to buckle. Consider Trump’s tariff announcement last March; investors had to materially reprice the markets for a rapid change in forward expectations of earnings.

Finally, investors have become extremely complacent about above-average returns. Take a look at the total annual returns of the market since 2019.

-

2019 +31.2%

-

2020 +18.0%

-

2021 +28.5%

-

2022 -18.0%

-

2023 +26.1%

-

2024 +24.9%

-

2025 +17.8%

While those returns have been very healthy, they are detached from the underlying drivers of economic growth, which is why valuations have risen so much in recent years.

With analysts’ market outlooks based on strong revenue growth and margin expansion, several factors could derail the markets. As is always the case, a market priced for perfection leaves little room for earnings misses or growth shocks. If reality falls short of those optimistic assumptions, market risk could rise abruptly.

Tyler Durden

Sun, 01/04/2026 – 11:40ZeroHedge NewsRead More

R1

R1

T1

T1