Germany’s Fiscal Illusion: Bond Markets Rebuke Merz’s Debt Spiral

Submitted by Thomas Kolbe

Germany was long seen as a bastion of fiscal stability in the Eurozone. But the erratic fiscal policy of the Merz government is now creating tensions in the bond market. Risk premiums on traditional periphery sovereigns like Italy, Portugal and Spain relative to German Bunds are shrinking.

For months, something remarkable has been happening in European debt markets. Risk spreads on the key ten year sovereign bonds of countries such as Italy, Portugal and Spain versus the economic anchor Germany have been steadily falling. Spanish yields now sit only about 0.4 percentage points above German Bunds; Italian paper — from a country with around 125% debt to GDP — trades just about 0.7 points wider.

Capital is clearly shifting out of Germany into other European bond segments. Is the market pricing in catastrophic German fiscal policy?

Repricing German Policy

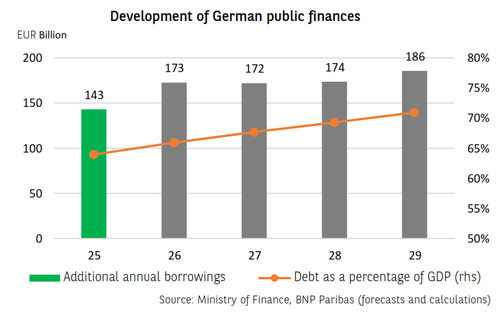

Germany’s debt strategy is unmistakably being reassessed by markets. With the so called special fund, Berlin has effectively thrust the country into a debt spiral virtually overnight. Over the next decade, more than €850 billion in new debt is to be issued — on top of a core budget already running a 2.5 – 3% deficit.

By decade’s end, Germany’s debt burden will likely hover near 85 – 90% of GDP — and nothing suggests an economic miracle will pull the nation out of this spiral. Miracles happen in fairy tales and children’s books — but even children’s book co author Robert Habeck didn’t achieve such an economic feat as Economics Minister.

Implicit obligations from pension and social systems aren’t even factored in — in Germany or elsewhere. What matters in the move in bond yields isn’t the absolute level, but the relative jump in German indebtedness, and markets are pricing exactly that. All this meets an economic reality with no meaningful extra value creation. German policy is pumping state credit — which will later surface as higher taxes and inflation — into an economic vacuum, just like centrally planned systems do.

Looking Ahead

Investors are watching German policy with hawkish scrutiny: the nuclear exit, sky high energy prices crushing industry, a migration policy that drains the welfare state like a vampire — all feed into German bund pricing. Bond markets are always a bet on the future — a judgment on national stability.

The consequence is clear: yields are rising. And they’ll keep rising. A mounting debt pile becomes ever more expensive — that’s how markets must respond.

These hard facts cannot be spun away by Kanzleramt spin doctors or orchestrated party media. German productivity has flatlined since 2018 — and is now declining. Industrial output has collapsed by about a fifth. Hundreds of thousands of manufacturing jobs have vanished while only the public sector expands, with the state’s share of the economy above 50%.

Germany is gearing toward a wartime economy that yields near zero benefits for real economic output. Alongside an already failed “eco economy,” this parasitic sector consumes resources, fosters make work, and feeds a nexus of extraction firms. It’s funded by ever rising levies that increasingly burden productive workers. Prosperity and economic substance are being systematically — purposefully — undermined by central planners in Berlin and Brussels.

This downward spiral is knowingly and ideologically accelerated by Chancellor Friedrich Merz’s government. The crisis is engineered as the solution — to bend the populace toward the climate socialist agenda and secure political power even as social stress rises. An ideological crash course — without doubt.

What seems lost on climate socialist planners like Merz is this: economic action and potential prosperity fundamentally depend on cheap, reliable energy. Germany’s current crisis — productivity collapse and industrial decay — speaks for itself. It happened without necessity and stands in economic history as a unique act of self inflicted vandalism.

That Merz and fellow climate socialists, using media plays, escalating censorship, and constant business bashing at events like employer forums, are trying to steer their political core through crisis shows only one thing: they fail to see this is a one way street. Climate socialism is the problem, not the solution — and markets along with German output are proving it.

Yet this mindset is typical for career politicians trapped in ideological echo chambers. We saw this with Economics Minister Robert Habeck — a party functionary mythologized by state affirming green media, utterly unversed in economics, and intellectually overwhelmed. He failed to understand how the crisis of subsidized sectors he inflated with bailouts came about.

Socialism is a recurring phenomenon in new guises. Climate socialism, like its predecessors, will fail through mass impoverishment. Harsh years lie ahead for Germany, and nothing seems able to prevent green vulgar socialism from metastasizing here. EU capitals have become adjunct outposts of Brussels’ cancerous core.

Some shifts are already visible. Italy, for example, has begun transferring gold reserves from its central bank to state vaults and is pursuing independent energy security via North African gas. At the bond market, this is rewarded: yields and risk premiums there are falling. Investors apparently see Italy as a “First Survivor” in a severe Euro crisis. Germany has no similar narrative.

Compounding this is Berlin’s almost unfathomable commitment to the Ukraine conflict without democratic mandate, accelerating fiscal decay. Merz plans to funnel around €11.5 billion from the 2026 federal budget directly into the Kiev black hole — a stance shared by Paris, London and Brussels — utterly detached from reality and dismissing even the possibility of a full U.S. pullback from the European theater.

This geopolitical folly echoes in bond markets. Germany’s leaders are playing Vabanque — without historical sense, responsibility, or foresight.

Those who hope that rising French and Belgian debt ratios (soon above 120% of GDP) can defuse hyper state growth via bond markets may be disappointed. Japan shows that even heavily domestically financed debt — at historically extreme ratios around 235% of GDP — can float for a while, though future obligations aren’t counted. Markets price in that the ECB will protect Eurozone debt by buying excess bonds — delaying collapse. But how exactly it intervenes now — since the “bazooka” of 2020 — is opaque and hidden. Risk premiums tell the tale.

That U.S. Treasuries trade at around a 1.3% premium over German bonds — and 60bp above Greek and Italian paper — is grotesque given Europe’s structural weaknesses. This stark mismatch between economic reality and bond pricing screams manipulation by Frankfurt central bankers.

Predicting when markets will finally downgrade a Eurozone pillar — likely France first — and bring the whole debt house of cards down is impossible. As Hemingway wrote in The Sun Also Rises:

“How did you go bankrupt?” “Two ways,” Mike said. “Gradually, then suddenly.”

* * *

About the author: Thomas Kolbe is a graduate economist. For over 25 years, he has worked as a journalist and media producer for clients from various industries and business associations. As a publicist, he focuses on economic processes and observes geopolitical events from the perspective of the capital markets. His publications follow a philosophy that focuses on the individual and their right to self-determination.

Tyler Durden

Mon, 01/05/2026 – 03:30ZeroHedge NewsRead More

R1

R1

T1

T1