Stocks, Gold, Bitcoin All Jump As Venezuela Concerns Outweighted By AI Optimism

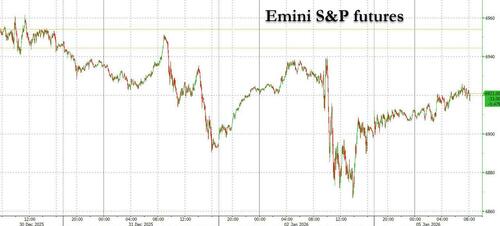

Global stocks, US futures, gold, the dollar and bitcoin all rose after the purge of Venezuela’s President Nicolas Maduro fanned geopolitical risk, while renewed momentum in the AI trade powered tech heavyweights in Asian hours. As of 8:15am ET, S&P futures were up 0.3% while Nasdaq futures gained 0.6%, with chip stocks such as AMD, Micron Technology and Intel gaining more than 3% in premarket trading. . In Europe, the Stoxx 600 rose 0.4% and was on course for a record close with most of the upside coming from a handful of sectors. Tech stocks are leading, as they did in Asia overnight. Spot gold advanced nearly 2% to climb above $4,410 an ounce, while silver jumped more than 3%. A gauge of the dollar headed for its biggest gain in two weeks. The US economic calendar includes December ISM manufacturing at 10am; ahead this week are S&P Global US services PMI, ADP employment change, ISM services index, JOLTS job openings, factory orders and December employment. No Fed speakers are scheduled for Monday; Richmond Fed’s Barkin is set to speak on the economic outlook on Tuesday.

In premarket trading, Mag 7 stocks are mostly green (Tesla +1.5%, Nvidia +1.5%, Amazon +0.4%, Alphabet +0.2%, Microsoft +0.1%, Apple -0.2%, Meta -0.1%).

- Energy names including Chevron (CVX +6%) and Baker Hughes (BKR +6%) are rallying after President Donald Trump said a team of US officials will “run” Venezuela and that Washington requires “total access” to the country, including its oil reserves.

- Gold stocks, including Newmont (NEM +1.7%) and Barrick Mining (B +1.8%) are higher as precious metals advance while investors weigh elevated geopolitical risks.

- Memory and semiconductor equipment stocks rise amid continued optimism over the rollout of AI. Micron (MU) +3%, and Sandisk (SNDK) +4%

- Centene (CNC) rises 1.8% and Oscar Health (OSCR) gains 3% after Barclays upgraded both health insurance names. Barclays writes that Centene has “attractive” margin upside from the Affordable Care Act exchange, while Oscar is “priced attractively and the market is currently over-discounting the negative outcomes from expiring subsidies.”

- Estee Lauder (EL) gains 4% after Raymond James analyst Olivia Tong raised her recommendation on the beauty company to strong buy. Her price target of $130 is the highest of all analysts tracked by Bloomberg.

- Fortive Corp. (FTV) falls 1.5% premarket after Mizuho Securities analyst Brett Linzey cut the recommendation on the industrial technology company to underperform, expecting “a slow start to ‘26 across more than half of its portfolio (government, medical, retail/consumer) as funding delays and uncertainty persists.”

- GH Research (GHRS) soars 36% after saying that the FDA has lifted the clinical hold on its investigational new drug application for GH001, allowing US subject enrollment and advancing the company toward initiating its global Phase 3 program in 2026.

- Mobileye (MBLY) rises 7% after saying an unnamed US-based automaker has chosen its EyeQ6H chip powered solution as standard across mass-market to premium vehicles.

- QXO (QXO) climbs 4% after the company confirmed that funds managed by Apollo Global and other investors agreed to invest $1.2 billion through a new series of convertible perpetual preferred stock to strengthen the company’s financial flexibility for acquisitions.

- Zenas Biopharma (ZBIO) slumps 49% after detailing results from a Phase 3 trial of obexelimab in immunoglobulin G4-related disease.

In corporate news, Musk’s Grok is facing mounting criticism and threats of government action around the world. The AI chatbot created sexualized images, including of minors, on the social media platform X in response to user prompts. Saks is said to be in talks for a $1 billion bankruptcy loan to keep the business running.

Trump’s assertion that the US will run Venezuela, at least temporarily, means the country has a shot at restoring democracy and prosperity, according to Latin America Geo-economics analyst Jimena Zuniga. Hedge Fund Tribeca eyes a “massive gold rush” of investment opportunities in the country. On the geopoltical front, Secretary of State Rubio said the US will use leverage over oil to force further change in Venezuela and demanded it sever ties with Iran, Hezbollah and Cuba. Social media users in China are pointing to the US attack as providing a template for a possible move against Taiwan.

Brent crude swung between gains and losses as oil traders weighed the fallout from the developments in Caracas. Chevron Corp. rose more than 6% in early trading, alongside sharp gains across US oil majors, after President Donald Trump floated plans for a US-led revival of Venezuela’s industry.

“The economic impact of what happened in Venezuela is too small to weigh on equity markets,” said Christopher Dembik, senior investment adviser at Pictet Asset Management. “That’s also true when it comes to oil: people have had the time to take a look at the data and in the most optimistic scenario, it will take two or three years to have a significant impact.”

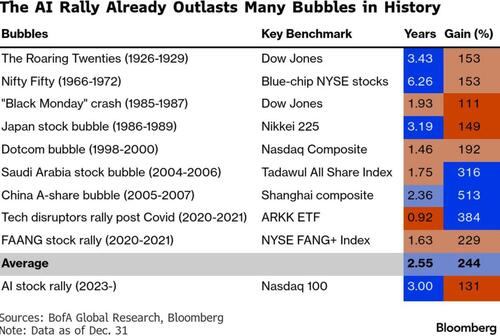

Meanwhile, AI remains the hot topic for equity traders this Monday. Nvidia partner Hon Hai’s quarterly sales beat estimates after global tech firms accelerated their build-out of data centers, TSMC jumped after Goldman analysts lifted their price target by 35% and a Chinese national investment fund raised its stake in SMIC. And while some investors are asking if the AI boom is a bubble waiting to pop, history suggests the answer isn’t easy to gauge as the following table from Bloomberg shows.

The buoyant mood in big tech stocks was most prevalent in Asia, where a regional gauge hit an all-time high. Technology and mining equities led gains in Europe.

AI “absolutely stays the most dominant factor in the markets right now,” Charu Chanana, chief investment strategist at Saxo Markets, told Bloomberg TV. “Tech optimism continues to overpower any of the other narratives.”

Elsewhere, the Fed’s Paulson said modest additional rate cuts could be appropriate later this year, but conditioned that outcome on a benign outlook for the economy. Former Treasury Secretary and Fed Chair Yellen warned of a growing “fiscal dominance” threat to the US economy when she spoke at the AEA’s weekend meeting.

- In Europe, the Stoxx 600 is up 0.4% and on course for a record close with most of the upside coming from a handful of sectors. Tech stocks are leading, as they did in Asia overnight. And defense stocks have benefited from the US capture of Venezuela’s President Nicolás Maduro. Oil prices erased an earlier fall to trade slightly higher. Sentiment around artificial intelligence got another boost after a broker upgrade for ASML. Miners also outperform, tracking gains across the metals complex. Here are some of the biggest movers on Monday:

- Ashmore shares surge as much as 14%, the steepest gain in more than three years, as analysts expect the emerging-market fund manager’s Venezuelan assets to benefit following the capture by US forces of President Nicolas Maduro.

- Saab shares climb as much as 7.1% to a record high as US military strikes on Venezuela lift European defense stocks.

- Syensqo shares climb as much as 4.7% after the chemical manufacturer announced a new CEO, and Morgan Stanley seperately said the stock was a top chemicals pick.

- Johnson Matthey shares rise as much as 8.1%, hitting their highest level since early 2023, after the chemicals company was upgraded at Berenberg on potential for earnings consensus to rise this year.

- ASML shares rally as much as 4.5% to a record high after Bernstein upgraded its rating to outperform from market perform, saying the AI-driven memory-chip super cycle will benefit the chip-equipment firm.

- Eurofins shares rise as much as 6.8%, the most since April, after the laboratory-testing company was double upgraded to outperform at BNP Paribas on receding governance concerns.

- Next shares drop as much 2.4%, the most since November, as Barclays analysts warn updated guidance due to be issued in Tuesday’s Christmas trading update may be cautious, weighing on sentiment for the stock.

Earlier in the session, Asian equities rose to a record high, supported by gains in tech-heavy markets such as Taiwan and Japan, as investors look past geopolitical risks surrounding Venezuela. The MSCI Asia Pacific Index advanced for a third session, rising as much as 1.7%. TSMC was the major contributor to the index’s gains, after Goldman Sachs raised its price target by 35% on AI opportunities. Samsung Electronics and Alibaba also led gains. Japan’s Nikkei 225 stock gauge jumped nearly 3%, while benchmarks in South Korea and Taiwan notched new record highs. China’s onshore benchmark CSI 300 Index rose 1.9% on its first trading day of 2026, marking its strongest start to a year in over a decade, as technology shares gain. Asian traders brushed off geopolitical risks sparked by US’ capture of Venezuelan President Nicolas Maduro due to the perception of their limited impact to global supply chains. Attention is shifting back to fundamentals, including earnings, while interest in the artificial intelligence theme remains strong.

Emerging-market stocks are on track to hit a record, buoyed by persistent strength in Asian technology shares and a broad rally globally. The MSCI Emerging Markets Index rose as much as 1.5% Monday, poised to surpass a peak notched five years ago.

In FX, the Bloomberg Dollar Spot Index is up 0.1%, having pared gains, with the yen now top of the G-10 FX leaderboard. The pound has also turned positive against the greenback.

In rates, treasury futures hold small gains accumulated during London morning as gilts advanced, with yields near session lows as US day begins. US yields are 2bp-3bp richer across tenors with belly-led gains steepening 5s30s spread by about 1bp. 10-year near 4.165% is 2.6bp richer on the day with UK counterpart outperforming marginally. Coupon auctions resume next week. IG dollar bond issuance slate contains several offerings to begin a week anticipated to be among the year’s busiest; Treasury coupon supply resumes next week with 3-, 10- and 30-year auctions.

“There are too many uncertainties to contend with,” wrote Mohit Kumar, chief economist and strategist for Europe at Jefferies. “Near-term drivers are likely to shift back to macro – the AI debate, unemployment and inflation picture and the large supply in government and corporate bonds in January.”

In commodities, spot silver climbs 3%, having briefly topped $76/oz. Gold and most base metals are also in the green. Oil prices are up slightly after paring losses, showing muted impact from weekend US capture of Venezuela’s president. US session includes December ISM manufacturing gauge. Bitcoin climbs 1.8% to about % $93,000.

Today’s US economic calendar includes December ISM manufacturing at 10am; ahead this week are S&P Global US services PMI, ADP employment change, ISM services index, JOLTS job openings, factory orders and December employment. No Fed speakers are scheduled for Monday; Richmond Fed’s Barkin is set to speak on the economic outlook on Tuesday

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.7%

- Russell 2000 mini little changed

- Stoxx Europe 600 +0.4%

- DAX +0.8%

- CAC 40 little changed

- 10-year Treasury yield -2 basis points at 4.17%

- VIX +0.6 points at 15.13

- Bloomberg Dollar Index +0.2% at 1206.8

- euro -0.3% at $1.1687

- WTI crude little changed at $57.33/barrel

Top Overnight News

- Venezuela’s deposed leader Nicolas Maduro was due in a New York court on Monday to face drug charges while the U.N. was to scrutinize the legality of U.S. President Donald Trump’s extraordinary operation to capture him. After first denouncing Maduro’s capture as a colonial oil-grab and “kidnapping”, Venezuela’s acting president Delcy Rodriguez changed her tune on Sunday, saying it was a priority to have respectful relations with Washington. RTRS

- Trump on Sunday predicted Cuba’s government could soon collapse and threatened Colombia’s president, a stark warning that underscored his administration’s increasingly aggressive posture toward leftist governments across Latin America. Trump reiterated his desire to annex Greenland, as well. Politico

- White House is considering giving Homeland Security Adviser Stephen Miller a greater role in overseeing operations in post-Maduro Venezuela, according to Washington Post.

- China asked its policy banks and other major lenders to report their lending exposure to Venezuela, people familiar said. BBG

- Moscow accused Kyiv on Monday of trying to strike a residence of Putin in Russia’s northern Novgorod region with 91 long-range attack drones, and said Russia would review its negotiating position in ongoing talks with the U.S. on ending the Ukraine war. Trump said he did not believe that an alleged Ukrainian strike on President Vladimir Putin’s residence took place as claimed by Russia. RTRS

- Volodymyr Zelenskiy said the US will join the EU for talks in Paris tomorrow on security guarantees for Ukraine. Meanwhile, Trump said he’s “not thrilled” with Russian leader Vladimir Putin because he’s “killing too many people.” BBG

Chinese social media users suggest Maduro’s capture as a potential template for Beijing to handle Taiwan. But Taiwanese officials expect the US action will act as a deterrent against China attacking the island, a person familiar said. BBG - Bank of Japan Governor Kazuo Ueda said on Monday the central bank will continue to raise interest rates if economic and price developments move in line with its forecasts. BBG

- The Fed’s Anna Paulson said modest rate cuts may be appropriate later in 2026. She expects inflation to continue easing, the labor market to stabilize and growth to run near 2%. BBG

- OPEC+ agreed to pause supply increases through the first quarter amid a looming surplus. Delegates said Venezuela was not discussed at the brief meeting yesterday. BBG

- Fed’s Paulson (2026 voter) said she sees inflation moderating, the labour market stabilising and growth coming around 2% this year, while she added that if all of that happens, then some further adjustments to the Fed Funds Rate would likely be appropriate later in the year. Paulson said she views the current level of rates as still restrictive and sees a decent chance that they will end the year with inflation that is close to 2% on a run-rate basis, as tariff-related price adjustments will likely be completed. Furthermore, she stated that while the labour market is bending, it is not breaking and that the baseline outlook for the economy is pretty benign.

- Nomura CEO sees the Fed cutting rates twice this year.

Trade/Tariffs

- US President Trump said could raise tariffs on India if they don’t help on Russian oil issue.

- US President Trump blocked HieFo Corp’s USD 3mln acquisition of assets in New Jersey-based aerospace and defence specialist Emcore on Friday and ordered HieFo to divest all interests and rights in Emcore assets due to national security and China-related concerns, according to Reuters.

- Irish PM Martin arrived in Beijing as part of a five-day visit aimed at boosting trade between the two countries, according to Chinese state media. There were later reports that Chinese President Xi said in a meeting with Ireland’s PM that China and the EU should take a long-term view and adhere to the positioning of partnership, while Xi also commented that unilateral bullying is undermining the international order.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher as the region shrugged off the US strike on Venezuela and resumed last year’s semiconductor-led rally which lifted the KOSPI to a record high, while TSMC shares also notched firm gains after Goldman Sachs raised its price target by 35% and its ADR’s jumped late last week to become the sixth-largest company in the world by market cap. ASX 200 was flat as gains in mining and material stocks were counterbalanced by losses in the tech and consumer sectors.

Nikkei 225 rallied on its first trading session of 2026 with notable strength in the heavy industries and semiconductor stocks. Hang Seng and Shanghai Comp traded mixed as the Hong Kong benchmark lagged and with the mainland buoyed on return from the New Year holiday closure, which saw the Shanghai Comp reclaim the 4,000 status, while participants digested the latest RatingDog Services PMI, which matched estimates at 52.0 (prev. 52.1) and the Composite figure slightly accelerated to 51.3 (prev. 51.2).

Top Asian News

- Japanese PM Takaichi said will pursue economic growth relentlessly.

- Japanese PM Takaichi said 2026 can be a major turning point for Japan, adds Rapidus holds key to Japan’s chip revival.

- Chinese President Xi said unilateral bullying is undermining international order, according to Bloomberg.

European bourses (STOXX 600 +0.4%) are broadly on a stronger footing this morning (ex-SMI), with sentiment seemingly boosted by the US strike on Venezuela. A move which has pressured energy prices, and perhaps boosts optimism surrounding cheaper oil for global firms. European sectors are mixed, with Tech, Industrials and Basic Resources forming the top three; Tech lifted by ASML, Industrials by defence names and Basic Resources benefits from stronger copper prices. Food Beverage & Tobacco lags, hampered by Nestle. ASML (+3%) has been boosted after Bernstein named the Co. as its top pick for 2026, citing a combination of accelerating memory investment and a more attractive valuation backdrop; its updated PT of EUR 1300/shr (prev. EUR 800/shr), implies a circa 30% gain from current levels.

Top European News

- UK PM Starmer said the UK should move to closer alignment with the European single market on an “issue-by-issue” basis if it is in the national interest, according to Reuters.

- Chinese President Xi said in a meeting with Ireland’s PM that China and the EU should take a long-term view and adhere to the positioning of partnership and view, according to Xinhua.

FX

- Dollar benefitted overnight from the mild losses in its major peers and with some haven appeal following the US intervention in Venezuela, with President Trump stating that the US will ‘run’ Venezuela and ‘fix oil infrastructure’, while he also signalled potentially widening their focus in the region to Cuba and Colombia.

- “Given the uncertainty about how the next few days will pan out, investors will probably prefer the liquidity of the dollar”, suggests the analysts at ING, whilst adding that “Away from Venezuela, the dollar could also be enjoying some delayed buying interest after the blow-out 4.3% quarter-on-quarter annualised US third quarter GDP figure released on 23 December.”

- Aside from that, little to mention on FX during the European session thus far. JPY sees shallower losses than other peers on haven appeal, although the CHF has plumbed the depths, although no obvious catalysts to explain the downside. GBP narrowly outperforms the as the cross fell under 0.8700 for the first time since Oct 2025. AUD and NZD are both subdued by the Buck, although the AUD/NZD cross remains above 1.1600 amid firmer copper prices.

Fixed Income

- A slightly firmer start for Bunds and USTs. All focus on the geopolitical situation re. Venezuela, with newsflow otherwise a little light.

- Bunds up to a 127.31 peak with gains of 20 ticks at best. However, the benchmark has since trimmed to unchanged but remains clear of the overnight 126.98 low. Within Europe, focus on Dutch pension reform as while the switch in the pension system has been long flagged, the full scale of the impact is not yet known.

- USTs similar, hit a 112-12 peak with strength of six ticks at best before fading to just above unchanged but above the 112-05 base.

- JGBs sold overnight as the 10yr yield hit another multi-year high amid outperformance in domestic stocks.

- Ahead, US ISM Manufacturing is the main scheduled event. However, any fresh updates on the geopolitical situation will undoubtedly take centre stage.

Commodities

- Crude benchmarks was choppy in APAC trade, but then moved lower in the early portion of this morning, as traders digest the US strike on Venezuela and the capturing of President Maduro. US President Trump commented that they are going to run Venezuela and “get oil flowing like it should be”. This hints of further addition of oil into an already-oversupplied market, causing Brent to fall below USD 60/bbl. Since, the complex has trimmed earlier losses to now trade around unchanged; Brent Mar in a USD 59.75-61.24/bbl parameter.

- Spot XAU gapped higher, opening at USD 4357/oz, and continued to trend higher to an APAC session high of USD 4420/oz. Currently, XAU is trading at session highs of USD 4432/oz, with demand for safe havens rising, following the Venezuela strike, but also potential further rate cuts by the Fed and continued concerns over US fiscal debt

- 3M LME Copper gapped above the range formed in the past 2 trading sessions, opening at USD 12.68k/t and driving to a high of USD 12.88k/t as the APAC session got underway. The red metal consolidated before briefly extending to a new session high of USD 12.91k/t. However, price pulled back but 3M LME Copper remains above USD 12.8k/t and just shy of ATHs at USD 12.97k/t.

- OPEC+ agreed to keep the group’s output unchanged as expected following a brief meeting on Sunday.

- Venezuela’s oil exports, which had dropped to a minimum amid the US blockade of sanctioned tankers, are said to now be paralysed as port captains have not received requests to authorise loaded ships to set sail, according to four sources close to operations cited by Reuters.

- Former top Chevron executive is raising USD 2bln for Venezuelan oil projects as investors race to heed Trump’s call to pour “billions of dollars” into the country, according to FT.

- Goldman Sachs said Venezuela’s oil production could increase in the long term and that scope for higher Venezuelan oil output could eventually pressure prices, according to Bloomberg.

Geopolitics

- US President Trump announced on Saturday that the US successfully carried out a large-scale strike against Venezuela, while he added that President Maduro and his wife were captured and flown out of Venezuela. Trump also commented that they are going to run Venezuela until such a time that they can do a safe, proper and judicious transition, while he added they are going to run Venezuela with a group and will get oil flowing like it should be, with Trump anticipating US oil producers spending billions in Venezuela.

- US President Trump said they are ready to stage a second strike if necessary and had assumed a second wave was needed, but now probably not. Furthermore, he said the US is not afraid of boots on the ground in Venezuela, and commented that they will be ‘reimbursed’ and will be selling large amounts of oil to other countries. It was separately reported that President Trump signalled the US could widen its focus in the region to Cuba, and he will be meeting with House Republicans in a closed-door meeting on Tuesday, following mixed reactions to the Venezuela attack including praise from top Republicans regarding the operation and questions by some lawmakers regarding the legal authority.

- US President Trump said it sounds good to him regarding whether there will be an operation in Colombia, while he added that Colombia is very sick as the country is being run by a sick man, but he won’t be doing it very long. Trump also commented that Cuba looks like it is ready to fall and looks like ‘its going down for the count’. Furthermore, Trump said if Venezuela doesn’t behave, the US will do a second strike on Venezuela and noted that troops on the ground in Venezuela depend on how they act, while it was separately reported that Trump warned of dire consequences if Venezuela fails to meet US demands.

- Venezuela’s VP Rodriguez was granted temporary presidential powers, while she called for the return of Maduro and said the capture of Maduro has a ‘Zionist tint’. Furthermore, she said that they will not be anyone’s colony and that what is being done to Venezuela is barbaric.

- US Secretary of State Rubio and Defense Secretary Hegseth are among the Trump administration officials to brief some lawmakers regarding Venezuela on Monday, according to Punchbowl and The Hill.

- US Transportation Secretary Duffy said original restrictions around the Caribbean airspace were expiring and flights could resume.

- World leaders responded to the situation in Venezuela and largely called for restraint and an orderly transition to a legitimate government. Furthermore, German Chancellor Merz said the legal assessment of US strikes in Venezuela was complex, while Spanish PM Sanchez said they will not recognise a US intervention in Venezuela that violates international law, and UK PM Starmer said the UK sheds no tears about the end of Maduro’s regime.

- China said the US should immediately release Venezuela’s Maduro and his wife and resolve the situation in Venezuela through dialogue and negotiation, according to Reuters. It was separately reported by Bloomberg that China was deeply shocked and strongly condemned the hegemonic acts by the US and that threaten peace and security in Latin America and the Caribbean region, while other allies of Venezuela’s allies including Brazil denounced the US attack, and Russia also criticised it as an ‘unacceptable violation of the sovereignty of an independent state’.

- UN Security Council is to convene an emergency meeting on Monday to discuss the US operation in Venezuela.

- US President Trump said he is not thrilled with Russian President Putin regarding the war in Ukraine and said that too many people are dying, according to Bloomberg. Trump separately commented that there is no deadline on a Russia-Ukraine deal, while he thinks they will have a deal on Russia and Ukraine in the not-too-distant future.

- Moscow claims Ukraine is escalating drone attacks on Russia and has targeted Moscow with drones every day of 2026 so far, according to The Guardian.

- US President Trump said could raise tariffs on India if they don’t help on Russian oil issue.

- US President Trump said it sounds good to him regarding whether there will be an operation on Colombia, adds Colombia is very sick as the country is being run by a sick man… but he won’t be doing it very long. said:. If they don’t behave, we will do a second strike on Venezuela, also noted that troops on the ground in Venezuela depend on how they act. No deadline on Russia-Ukraine deal. Think we’ll have a deal on Russia and Ukraine in the not-too-distant future. Cuba looks like it is ready to fall and looks like ‘its going down for the count’.

- Large-scale fire broke in the area of the “Energiya” plant in Russia’s Lipetsk region following a drone attack.

- Iran’s Supreme Leader Khamenei labelled protestors ‘enemy mercenaries’, while he approved a crackdown and said that rioters must be put in their place, according to Iran International. It was separately reported by Reuters that US President Trump warned Iran on Friday that the US would come to the aid of protesters in Iran if security forces fired on them and said that the US is ‘locked and loaded and ready to go’. In relevant news, Iran’s Revolutionary Guards began a military exercise including missile launches and testing of air defence systems, according to correspondent Amichai Stein on X.

US Event Calendar

- Dec Wards Total Vehicle Sales, est. 15.75m, prior 15.6m

- 10:00 am: Dec ISM Manufacturing, est. 48.44, prior 48.2

- 10:00 am: Dec ISM Prices Paid, est. 58.7, prior 58.5

DB’s Jim Reid concludes the overnight wrap

As we return for the first full week of 2026, the main story this morning remains the weekend developments in Venezuela, whose President Nicolás Maduro was captured by US forces and taken to New York. To bring you quickly up to speed, events moved rapidly from Saturday morning when reports came through of explosions in the Venezuelan capital Caracas. Then shortly after, President Trump posted that Maduro had been “captured and flown out of the country”. And later on, at a Saturday news conference, Trump said that the US would “run Venezuela” until there was a transition.

This morning there’s still a lot of uncertainty, and for markets, there’s a debate about the extent to which any short-term oil supply disruption from the upheaval will end up being outweighed by a longer-term supply boost from higher Venezuelan production. After all, the US Energy Information Administration have said that Venezuela has the world’s largest proven crude oil reserves, at 17% of the global total. But despite those reserves, production has declined significantly over recent years, with crude oil production in 2023 down 70% from its 2013 levels. So the prospect of a long-term supply recovery would serve to lower oil prices, and Trump himself said over the weekend that US oil companies would “go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country”. Indeed, those expectations have already brought down oil prices this morning, with Brent crude falling -0.43% to $60.49/bbl, whilst WTI is down -0.54% to $57.01/bbl. Meanwhile, US equity futures have risen slightly, with those on the S&P 500 up +0.12%.

In terms of Venezuela itself, it’s also not entirely clear what’s happening next in terms of potential US involvement in the country’s administration. Venezuela’s Supreme Court have granted the VP Delcy Rodríguez presidential powers on an acting basis, and Trump said that Secretary of State Marco Rubio had spoken with her. But although there hasn’t been direct US administration over Venezuela thus far, Rubio said on CBS that there was “an oil quarantine that allows us to exert tremendous leverage over what happens next”. And Trump said he was “not afraid” for there to be US boots on the ground in the future. Overnight, acting President Rodríguez said in a statement that they “extend an invitation to the US government to work together on a cooperation agenda, aimed at shared development, within the framework of international law, and to strengthen lasting community coexistence”.

From the perspective of global markets, it’s worth noting that geopolitical shocks historically don’t tend to have much of a lasting impact. That might seem surprising, but that’s because markets generally trade on macro variables like growth and inflation, rather than geopolitical shocks per se. We’ve seen this pattern again this morning, with US and European equity futures both higher, whilst US Treasuries have rallied slightly across the curve. Another recent example of this pattern have been events in the Middle East in the last few years, where markets outside the Middle East have seen a consistent pattern of quick recoveries from initial selloffs. For instance, at each point when tensions between Israel and Iran escalated, in April 2024, October 2024, and most recently in June 2025, the wider impact was limited outside of commodities and Middle Eastern equities.

This isn’t to say that geopolitics can’t have a lasting market impact, but when it’s done so, it’s been those events which affected key macro variables. Examples of that include the stagflation shocks after the 1970s oil crises, the Gulf War in 1990, and Russia’s invasion of Ukraine in 2022. In each case, they had a big impact because they caused a sufficiently big oil price shock that led to a sustained rise in inflation, whilst also having a meaningfully negative impact on growth outside the areas directly affected. By contrast today, we haven’t seen those kind of effects yet.

Otherwise this morning, Asian equity markets have risen sharply across the board. For instance, the KOSPI (+3.17%) is up to another record high, alongside gains for the Nikkei (+3.09%), the CSI 300 (+1.53%), the Shanghai Comp (+1.11%) and the Hang Seng (+0.09%). Tech stocks have done particularly well, with Samsung Electronics (+6.03%) as one of the top performers in the KOSPI this morning. But Japanese government bonds have continued to struggle, with the 10yr yield (+6.4bps) up to 2.12%, its highest level since 1999. Separately in China, the RatingDog Services PMI fell to a 6-month low in December at 52.0, although the composite PMI ticked up slightly to 51.3, a tenth higher than November.

In terms of the week ahead, clearly geopolitical developments will be top of mind. But otherwise, one of the main highlights will be the US jobs report for December on Friday. That’s an important one because there’s been more weakness in the labour market over recent months, with the unemployment rate rising to a 4-year high of 4.6% in November. So that’s seen the Fed deliver 3 consecutive rate cuts since their September meeting, and futures are still pricing in a 53% chance of another cut by the March meeting. So investors still think a Q1 rate cut is in the balance, and Friday’s report will go some way to determining if that happens. In terms of what to expect, our US economists think that nonfarm payrolls will rise by +50k in December, with the unemployment rate declining a tenth to 4.5%.

Over in Europe, the main highlight will be the flash CPI prints for December, with Germany and France reporting on Tuesday, ahead of the Euro Area-wide print on Wednesday. This isn’t a print expected to have too many implications for near-term ECB policy, with markets expecting them to keep rates on hold for the rest of the year. However, headline inflation is expected to fall below the 2% target early this year, largely driven by energy base effects. And our economists think that if the decline for headline inflation is large enough, that could spill over to weaken core and inflation expectations too, which would lower the bar for further policy easing. So that’ll be a key theme for H1. In terms of this print for December though, our economists expect Euro Area headline inflation to fall back to +2.0% thanks to those falling energy prices, down from +2.1% in November. And for core CPI, they expect that to remain at +2.4%.

Finally, before the weekend developments in Venezuela, markets had got the year off to a steady start last Friday, with a risk-on move on both sides of the Atlantic. Indeed, the S&P 500 (+0.19%) had its first positive start to a year since 2022, whilst Europe’s STOXX 600 (+0.67%) closed at an all-time high. Admittedly, there were some points of weakness, and the Mag 7 (-0.95%) posted a further decline after Tesla (-2.59%) reported Q4 deliveries that missed analyst estimates. But as we mentioned on Friday, we really shouldn’t extrapolate the day one moves, as the first trading day has often been a reverse indicator for the rest of the year. Indeed, 2023-25 all saw a negative start for the S&P before it then recorded a double-digit annual gain. By contrast, the last time we had a positive start in 2022, that year then saw a bear market and the index’s worst performance since 2008.

Meanwhile, the selloff among long-end bonds also continued last Friday, with yields hitting new milestones across several countries. That was particularly notable in Europe, where the 10yr bund yield (+4.5bps) closed at 2.90%, its highest level since October 2023, whilst the 30yr German yield (+6.4bps) moved up to its highest since 2011, at 3.54%. Similarly in the US, the 10yr Treasury yield (+2.4bps) moved up to 4.19%, and the 30yr yield (+2.7bps) rose to 4.87%, which in both cases was their highest since early September. And it also that meant the US 2s10s yield curve closed above 70bps on Friday for the first time since January 2022.

Those moves capped off a mixed week for financial markets, with lots of key assets struggling to gain much traction. For instance, the S&P 500 was still down -1.03% for the week, despite Friday’s recovery. In large part, that was driven by weakness among the Mag 7, which fell -2.46%, with other cyclical sectors also struggling. Sovereign bonds also struggled, with the 10yr Treasury yield up +6.3bps last week, whilst the 10yr bund yield was up +3.9bps. European equities were a key outperformer however, with the STOXX 600 up +1.26% over the week to a new high, whilst the FTSE 100 was up +0.82% and even crossed the 10,000 mark on an intraday basis for the first time. Finally in credit, US HY spreads (-3bps) and Euro HY spreads (-2bps) both tightened last week. But US IG spreads (+2bps) moved wider, whilst Euro IG spreads were unchanged.

Tyler Durden

Mon, 01/05/2026 – 08:38ZeroHedge NewsRead More

R1

R1

T1

T1