Resilience Of US Economy Showing “Signs Of Cracking” As US Services PMI Disappoints

Following yesterday’s US Manufacturing ISM survey disappointment, this morning we get yet more soft survey data – this time a look at the Services sector via S&P Global.

The final (December) US Services PMI data was a disappointment, printing 52.5 vs 52.9 expected…

Source: Bloomberg

While the print was a disappointment, it remains above 50 – expansion – but new business inflows rising to the weakest degree in over a year-and-a-half, growth of activity faltered and was the lowest since last April.

Confidence in the outlook also weakened, whilst employment volumes stagnated, failing to rise for the first time since last February.

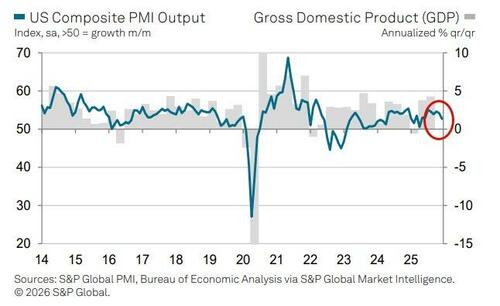

The S&P Global US Composite PMI recorded 52.7 in December, down from 54.2 in the previous month.

Business activity continued to expand in December, rounding off another quarter of robust growth, but as Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, points out, “the resilience of the US economy is showing signs of cracking.”

“New business placed at services providers showed the smallest rise in some 20 months which, accompanied by the first fall in orders placed at manufacturers for a year, points to a broad-based weakening of demand growth.

“Not only has service sector business activity slowed in response to concerns over order books, with the December surveys signaling the weakest economic expansion since last April, but the number of companies cutting headcounts has exceeded those reporting higher employment for the first time since February.

Optimism is fading…

“We also enter 2026 with future output expectations running much lower than seen at the start of 2025, fueling concerns that December’s slowdown and job market malaise could spill over into the new year.

“Confidence has been dampened principally by uncertainty over government policy and the broader economic outlook, with tariffs and affordability featuring as common threads throughout companies’ more cautious views on their prospects.

Affordability worries are underscored by companies reporting an “increased impact of tariffs on both input costs and selling prices in December,” suggesting we could see the unwelcome combination of slower economic growth and stubbornly high inflation at the start of the new year.

However, Williamson notes that “there is an expectation among many companies that lower interest rates and government policy will start to boost demand again as the new year proceeds.”

Tyler Durden

Tue, 01/06/2026 – 09:55ZeroHedge NewsRead More

R1

R1

T1

T1