Defense Stocks Blast Off As Trump Seeks Budget Boost To Defend Western Hemisphere

European and US defense stocks rose early Thursday after President Trump pushed for a 50% increase in defense spending by 2027.

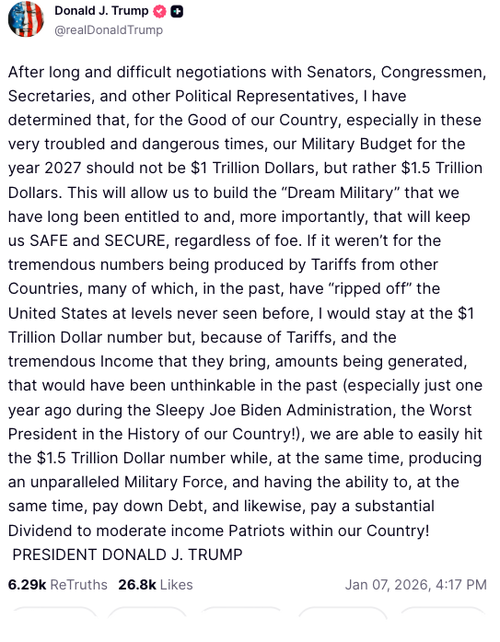

“After long and difficult negotiations with Senators, Congressmen, Secretaries, and other political representatives, I have determined that, for the good of our country, especially in these very troubled and dangerous times, our military budget for the year 2027 should not be $1 trillion, but rather $1.5 trillion,” Trump wrote on Truth Social late Wednesday.

Trump demanded a $500 billion increase in annual defense spending by 2027.

A Goldman Sachs basket of European defense stocks jumped as much as 3.8% and is up 18% year to date.

“Italy’s Leonardo tops the Stoxx Europe 600, up 4.2%, followed by Germany’s Rheinmetall. The UK’s BAE Systems was up about 6%, with Chemring 2.6% higher. About 35% of BAE’s sales are to the US Department of Defense, and around 20% of Leonardo’s are as well,” UBS analyst Tricia Wright said.

In the US, Northrop Grumman rose more than 8.5%, Lockheed Martin gained about 8%, and L3Harris Technologies climbed roughly 8%.

Goldman Sachs basket of US defense stocks…

Wright noted, “The share price gains come amid broader concerns about security stability, as the US discusses aims to acquire Greenland, potentially including the use of the military.”

Comments from Bloomberg Intelligence:

-

Additional spending will likely be focused on shipbuilding, long-range strike capabilities and the Golden Dome missile- defense project, analysts Will Lee and George Ferguson write

-

“This likely offsets pressure from Trump’s earlier message rebuking defense companies for prioritizing shareholder returns amid delays delivering military equipment to the Pentagon and in maintaining it”

Separately, Trump signed an executive order directing major defense companies to halt stock buybacks and dividends until they significantly increase investment in production capacity, infrastructure, and weapons development. The order also seeks to cap CEO pay at $5 million annually until new factories are built.

“A limit on capital return is an incremental negative, but the size is manageable,” Morgan Stanley analyst Kristine Liwag told clients, in response to the EO. She said that if dividends and buybacks were limited, this could free up billions of dollars in capital to be deployed to investments such as capacity increases or M&A.

JPMorgan analyst Seth Seifman noted, “We wouldn’t be surprised to see some upward pressure on capex estimates and perhaps some near-term limitations on share repo expectations when contractors offer their 2026 guidance shortly.”

The “potential budget increase would support sustained growth, taking some sting out of the EO,” Seifman said, adding, “Smaller and midcap US defense tech stocks in our group (such as KTOS) tend not to return cash and so the executive order is less of a focus for them. They are already expected to grow quickly, but to the extent the administration can deliver some incremental defense budget, even if it is well below $500b, we assume that would be helpful for the stocks.”

Jefferies analyst Sheila Kahyaoglu wasn’t thrilled about this new development, telling clients that Trump’s comments about buybacks, dividends and compensation seem “again to be an overreach.”

“The industry has been clear that it is ready to invest on clearer demand signals along with procurement reform offering a clear avenue to accelerating development and production ramps,” Kahyaoglu said.

Now we have some sort of an idea of how much control of the Western Hemisphere – or what some call the Donroe Doctrine – will cost.

Tyler Durden

Thu, 01/08/2026 – 08:45ZeroHedge NewsRead More

R1

R1

T1

T1