Trump Launches His Own QE: Directs GSEs To Purchase $200 Billion In Mortgage Bonds

First, Trump short-circuited the Fed’s rate-cut process. Now he is going after QE by launching his own version of it.

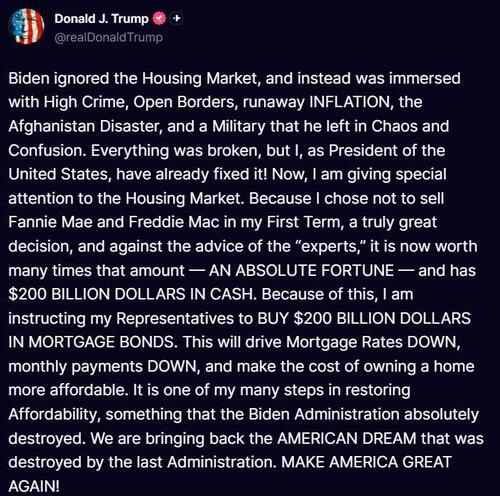

In a post on late Thursday post on Truth Social, President Trump said he was directing the purchase of $200 billion in mortgage bonds, which he framed as his latest effort to bring down housing costs ahead of the November midterm election.

“This will drive Mortgage Rates DOWN, monthly payments DOWN, and make the cost of owning a home more affordable,” Trump wrote in his post.

He added that his decision not to sell Fannie Mae and Freddie Mac during his first term allowed them to amass “$200 BILLION DOLLARS IN CASH” and that he was making his announcement “because of that.”

Federal Housing Finance Agency director Bill Pulte, said soon after that the president aims for Fannie Mae and Freddie Mae to execute the purchases. Pulte said Thursday the bond purchases “can be executed very quickly. We have the capability, we have the cash to do it, and we are going to go about executing it very smartly and in a very big way.”

“It is one of my many steps in restoring Affordability, something that the Biden Administration absolutely destroyed,” the president said. Mortgage backed securities rallied relative to Treasuries on the news.

Fannie Mae and Freddie Mac have added billions of dollars of mortgage-backed securities and home loans to their balance sheets in recent months, fueling speculation that they’re trying to push down lending rates and boost their profitability ahead of a potential public offering; now those speculations have been validated.

The government-backed housing-finance giants increased their retained portfolios, the portion of bonds and loans they hold onto rather than sell to investors, by more than 25% in the five months through October, according to recent figures.

The announcement comes one day after Trump said on Wednesday that he would seek to ban institutional investors from buying single-family homes. The president’s advisers have repeatedly raised alarms that affordability has become a political albatross for the GOP and could cost the party control of Congress in the elections this fall.

In keeping with Trump’s housing obsession, overnight Politico reported that the White House is drafting an executive order broadly targeted at addressing Americans’ frustration with the cost of living, including a push to allow people to dip into their retirement and college savings accounts to afford down payments on homes.

Of course, by simply adding even more fuel to the demand side – which is what this kind of conversion from savings into home equity will do – it will achieve the opposite of what Trump is pursuing, which means even more mortgage bond purchases, which means even more rate cuts, which means even more direct intervention in the market by various third parties, which means even more endogenous liquidity generated, and so on. Of course, it also means we have barely scratched the surface of where gold and bitcoin will eventually trade.

Tyler Durden

Thu, 01/08/2026 – 18:05ZeroHedge NewsRead More

R1

R1

T1

T1