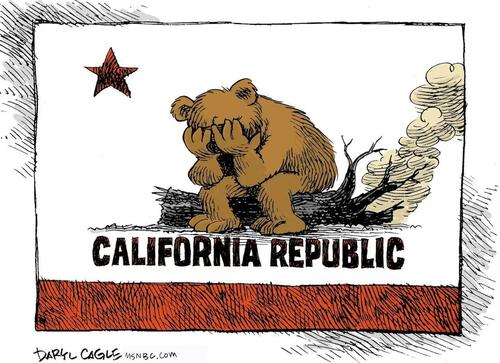

“The Giant Sucking Sound”: Exodus From California Continues For Taxpayers & Businesses

During the 1992 Presidential Debate, independent candidate Ross Perot famously warned that “there will be a giant sucking sound going south” due to the cheaper Mexican labor and lower regulatory demands on businesses. That sound is being heard again, but this time it is coming from California, which is virtually chasing taxpayers and companies out of the state with a massive state deficit, rising taxes, crippling regulations, and wasteful programs.

Recently, Gavin Newsom boasted, “California isn’t just keeping pace with the world — we’re setting the pace.”

Recent data shows he is right.

There is a record number of U-Hauls fleeing the state — more than any other state. Indeed, the only thing harder to find than a wealthy taxpayer in California appears to be a U-Haul.

According to U-Haul’s data, the state is again leading blue states in the exodus. The Washington Post noted this week that “California came in last. Massachusetts, New York, Illinois and New Jersey rounded out the bottom five. Of the bottom 10, seven voted blue in the last election.” Conversely, “nine of the top 10 growth states voted red in the last presidential election,” with Texas again leading the growth states.

The Post wrote that the conclusions are inescapable: “People want to live in pro-growth, low-tax states, while the biggest losers tend to be places with big governments and high taxes.”

What is most striking is how Democratic politicians and many voters are simply defying the data and logic. Democratic Rep. Ro Khanna, who represents part of Silicon Valley, recently mocked billionaires moving to escape a planned wealth tax. Some of us have criticized the tax as perfectly moronic for a state with the highest tax burden, soaring deficit, and shrinking tax base.

The “2026 Billionaires Tax Act” would impose a one-time 5% tax on individual wealth exceeding $1 billion. While technically using 2026 wealth figures, it would apply to billionaires who resided in California in 2025. So you cannot hope to flee… at least with your wealth intact. It is a penalty for those who stay too long hoping that rational minds would prevail in California.

Yet, Rep. Khanna mocked his own constituents planning to flee the state, quoting FDR in saying ‘I will miss them very much.”

Indeed, you will.

Democrats continue to act as if wealthy citizens are a type of captive audience. They are expected to be voluntary prey in a canned hunt for wealthy taxpayers. Many have chosen to take their money and businesses elsewhere.

As I discuss in my forthcoming book, Rage and the Republic: The Unfinished Story of the American Revolution, there is a common myth that the top five percent of this country do not “pay their fair share.” However, putting that debate aside, the question is whether it will produce more revenue than it costs the state in the long run. As these politicians campaign on clipping the “fat cats” who are not paying their fair share, many are likely to follow the exodus to lower tax states with greater fiscal discipline.

From New York to California, Democrats are pitching new programs from free buses to state-run stores to reparations as their tax bases contract. San Francisco recently approved the reparations plan that could give up to $5 million to qualified residents. The city faces a billion-dollar deficit, yet it continues to assume greater debt obligations.

Once again, denying basic economics will only lead to a rude awakening when these leaders, to quote Margaret Thatcher, “run out of other people’s money.”

Tyler Durden

Fri, 01/09/2026 – 18:05ZeroHedge NewsRead More

R1

R1

T1

T1