Stocks, Dollar Drop, Gold Jumps As Fed Probe, Iran Unrest Darken Mood

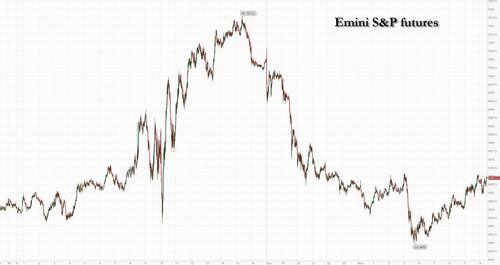

“Sell America” is back: US equity futures and other US assets – including the dollar – are lower (even as Europe and Asia rise) while precious metals surge to new record highs after the DOJ subpoenaed the Fed and launched a criminal probe into Jerome Powell; ongoing protests in Iran are also denting sentiment. As of 8:15am, S&P 500 contracts are lower by 0.5%, Nasdaq down 0.7%. In premarket trading, credit card stocks are down following President Trump’s late Friday remarks on rate caps. The attack on the Fed has been felt on the US yield curve, with 10- and 30-year yields higher by 3bps and 4bps, respectively. The dollar is down versus most major currencies – Bloomberg Dollar Index lower by 0.3%. Swiss franc outperforms on haven appeal, yen unable to benefit amid the prospect for Japanese elections. Precious metals hit further record highs; gold up 1.7%, silver higher by over 5%; the former stalled ahead of $4,600/oz. Brent crude faded upside triggered by supply concerns from Iran, lower by 0.8%. Bitcoin down 0.2%.

In premarket trading, Mag 7 stocks are mostly lower (Apple +0.5%, Tesla -0.7%, Alphabet -0.7%, Microsoft -0.6%, Amazon -0.8%, Meta -0.8%, Nvidia -1%)

- Credit card companies and banks slide as President Donald Trump said credit-card lenders would be “in violation of the law” if the firms don’t cap interest rates at 10% for one year. Movers include American Express (AXP -4%), Capital One (COF -8%) and JPMorgan (JPM -2.5%).

- Precious metals and mining shares rally after the US threatened the Federal Reserve with a criminal indictment, undermining the dollar and sending gold and silver prices to record highs. Deadly protests in Iran and the possibility of a government overthrow also boosted demand for haven metals.

- Akamai Technologies Inc. (AKAM) rises 4.5% after Morgan Stanley upgraded the infrastructure software company by two notches, to overweight.

- Albemarle Corp. (ALB) gains 3.9% after analysts raised their price targets on the lithium producer as metal prices rally.

- Day One Biopharmaceuticals (DAWN) rises 20% after the drugmaker reported preliminary sales for its Ojemda cancer drug in the fourth quarter that topped expectations. The company also gave revenue guidance for 2026 that came ahead of the average analyst estimate.

- Shake Shack Inc. (SHAK) falls 5% after the burger chain reported preliminary revenue for the fourth quarter that missed the average analyst estimate.

- Soleno Therapeutics (SLNO) rises 4% after announcing some preliminary fourth quarter results.

- Sun Country Airlines Holdings Inc. (SNCY) jumps 15% after Allegiant Travel agreed to buy the company in a $1.5 billion cash-and-stock transaction, further driving consolidation in the US airline industry amid intensifying competition.

- UnitedHealth (UNH) slips 1% after the Wall Street Journal reported that a Senate committee investigating the company’s practices found that the health insurer deployed “aggressive tactics” to collect payment-boosting diagnoses for its Medicare Advantage members.

In other corporate news, shares in French biotech Abivax are surging amid speculation over a possible takeover. UBS said planned Swiss banking reforms are a threat to the national economy as pressure builds on the government to water down its proposals. Meta Platforms has shut down almost 550,000 accounts in Australia to comply with the country’s landmark social media ban for children.

Stock futures and the dollar fell as investors trimmed exposure to US assets after the Trump administration significantly escalated its attacks on the Federal Reserve. Longer-dated yields surged while gold hit a new high. In a video message, Powell said the threat of a US criminal indictment — related to his congressional testimony on renovations at the Fed’s HQ — was because of disagreement over monetary policy. While Trump faced immediate bipartisan pushback from key Republican Thom Tillis, the development is fueling concerns over Fed autonomy. Bloomberg Economics’ 2025 modeling of a hit to Fed independence is a helpful read.

“Concerns about the Fed’s independence have really been reinforced with the latest criminal investigation,” Jan Hatzius, chief economist at Goldman Sachs Group Inc., said at a strategy conference in London. “Our expectation, though, is that this is a committee decision. I have no doubt that in his remaining term as chair, Powell is going to make decisions based on the economic data.”

Geopolitics is also adding to the cautious mood, with haven assets like gold and silver rising to records amid deadly protests in Iran over the weekend (the attack on the Fed doesn’t help). Elsewhere, a group of European countries led by the UK and Germany is discussing plans for a military presence in Greenland.

Shares in banks stocks and credit card firms like American Express are sliding in premarket trading after Trump said lenders would be “in violation of the law” if the firms don’t cap interest rates at 10% for one year. Barclays Plc dropped as much as 4.8% in London, while Citigroup Inc., American Express Co. and Capital One Financial Corp. retreated in early US trading. And the rally in US bank stocks will be tested this week when big Wall Street names report results. Top of mind will be consumer lending, with the data potentially clouded by the government shutdown.

While JPMorgan, Citigroup and Bank of America are expected to post slower revenue growth as trading gains ease from the elevated levels experienced in recent quarters, investment-banking fees are likely to remain robust following a wave of deals, with upbeat projections for 2026.

“US banks have performed pretty well during the past quarter, so I’ll be looking into whether this earnings season provides confirmation,” said Andrea Tueni, head of sales trading at Saxo Banque France. “If that’s the case, the sector may actually become one of the drivers of this year.”

Goldman Sachs strategists expect S&P 500 companies to report fourth quarter year-over-year sales growth above the 6% consensus estimate. They also forecast 2026 EPS growth of 12% to $305, driven by sales growth of 7% alongside margin expansion of 70 bps. Economy-linked cyclical sectors are likely to outperform in 2026, driven by a supportive trade off between growth and inflation, according to JPMorgan strategists.

Citi strategists led by Beata Manthey expect diversification away from US stocks to continue this year, with European fiscal spending, reflation in Japan and widespread AI adoption supporting flows elsewhere. Today’s Taking Stock looks at positioning: Cash levels at asset managers are sending a sell signal while the general mood is pretty bullish. That may make the market prone to setbacks, but something would really need to break to trigger a proper drawdown.

Elsewhere, US consumers probably experienced a modest pickup in inflation in December, consistent with price pressures that are gradually abating. Core CPI is seen rising 2.7% in December from a year earlier, with economists expecting 0.3% increases in both overall and core prices on a monthly basis.

Stocks in Europe have a mild negative tilt, Stoxx 600 down 0.1%. IBEX 35 lags, down 0.2%, DAX continues to outperform regional peers, higher by 0.4%. Miners outperform on elevated demand for havens, while travel and leisure stocks lag. Here are some of the biggest movers on Monday:

- Abivax shares surge as much as 31% to a record high as speculation mounts over a possible takeover of the French biotech.

- BE Semi shares rally as much as 9% after the chip equipment company reported preliminary orders of about €250m, beating analyst estimates amid a rapid rollout in AI data centers.

- Fresnillo shares climb as much as 7.1%, leading a rally in precious metals miners after gold and silver hit record highs as concerns over independence of the US Federal Reserve and protests in Iran drive demand for havens.

- Oxford Nanopore shares rise as much as 10%, the most in more than two months, after the British DNA-sequencing company said it expects to report 2025 revenue growth slightly ahead of guidance.

- BAE Systems shares rise as much as 3.1% to a record high as defense stocks rally on continuing Greenland tensions.

- Barclays shares fall as much as 4.8%, the most since October, as the bank is seen as exposed to President Donald Trump’s demand to cap credit card interest rates at 10% for one year.

- Heineken shares drop as much as 3.9%, the most since July, after the brewer said CEO and Chairman of the Executive Board Dolf Van den Brink would step down at the end of May.

- Impax Asset Management shares fall as much as 3.6% after the investment firm reported £1.6 billion net outflows for the quarter ended December 31, 2025.

- British Land shares fall as much as 3.3% as the commercial property group announces CEO Simon Carter is to step down to become CEO of P3 Logistics Parks, according to a statement.

Asian stocks rose as a rally in the region’s tech shares and a weaker US dollar boosted sentiment, helping offset broader concerns over rising geopolitical tensions. The MSCI Asia Pacific excluding Japan Index rose as much as 0.8%, poised to snap a three-day losing streak. Alibaba, Tencent and TSMC provided the biggest boosts to the gauge. Most markets were in the green, with Hong Kong-listed Chinese stocks and indexes in Taiwan and South Korea among key gainers. Japan was shut for a holiday. South Korea’s tech-heavy market extended its new-year rally, with the Kospi rising for a seventh session to a fresh record. It has been up in every session so far in 2026 and is less than 10% away from a much-touted 5,000 level.

In FX, the dollar is down versus most major currencies – Bloomberg Dollar Index lower by 0.3%. Swiss franc outperforms on haven appeal, yen unable to benefit amid the prospect for Japanese elections.

In rates, treasuries hold losses in early US trading led by long-end tenors ahead of an accelerated and compressed auction calendar that includes 3- and 10-year note sales Monday and a 30-year bond reopening Tuesday. Risk to Fed independence is a factor after Chair Powell’s response to Sunday’s revelation of a federal criminal investigation.US yields are 1bp-4bp cheaper on the day with 2s10s and 5s30s spreads both wider by more than 2bp. European debt is steadier, German 10 year yield down 1bps, UK up 1bps. US 10-year near 4.2% trails bunds and gilts in the sector by 4bp and 2bp. Monday’s Treasury auctions are $58 billion 3-year new issue at 11:30am and $39 billion 10-year reopening at 1pm; WI 3-year yield near 3.61% is less than 1bp richer than last month’s, which stopped through by 0.8bp; WI 10-year near 4.2% is 2.5bp cheaper than December’s result.IG credit new-issue calendar has begun to build; around $60 billion of supply is expected this week, following last week’s $90.2 billion haul, the fourth largest on record.

In commodities, precious metals hit further record highs; gold up 1.7% above 4600, silver higher by over 5% as repeated attacks on the Fed were a major factor aiding gold and silver in 2025, and that driver looks set to persist. Brent crude faded upside triggered by supply concerns from Iran, lower by 0.8%. Bitcoin down 0.2%.

“All the reasons that pushed it higher last year are still relevant this year, even more so given what we’re seeing on the geopolitical side,” said Peter Kinsella, head of foreign-currency strategy at Union Bancaire Privee SA. “A question I’m often asked is, ‘is it too late to buy gold?’ My answer is a resolute ‘no.’”

The US economic calendar is empty Monday, while ahead this week we gett CPI, PPI and retail sales data. Scheduled Fed speakers include Bostic (12:30pm), Barkin (12:45pm) and Williams (6pm). Five Below is expected to issue December sales before the market opens. JPMorgan Healthcare conference begins in San Francisco with Johnson & Johnson, Medtronic, Biogen and Pfizer among many companies presenting. Investors will also watch the Supreme Court’s next opinion day on Wednesday for a possible ruling on Trump’s tariffs. New York Fed President John Williams and Atlanta Fed President Raphael Bostic are set to speak on Monday.

Market Snapshot

- S&P 500 mini -0.6%

- Nasdaq 100 mini -0.9%

- Russell 2000 mini -0.5%

- Stoxx Europe 600 -0.2%

- DAX +0.1%

- CAC 40 -0.3%

- 10-year Treasury yield +3 basis points at 4.2%

- VIX +1.9 points at 16.4

- Bloomberg Dollar Index -0.2% at 1208.95

- euro +0.4% at $1.1678

- WTI crude -0.6% at $58.76/barrel

Top Overnight News

- Jerome Powell said the Fed was served grand jury subpoenas threatening criminal charges over his testimony on renovations at the central bank’s headquarters. He said the move was part of the administration’s “ongoing pressure” on interest rates. Republican Senator Thom Tillis vowed to oppose any Fed nominees until the matter is resolved. Donald Trump told NBC he had no knowledge of the DOJ’s investigation. BBG

- U.S. Treasury Secretary Scott Bessent on Friday said the goal of the Trump administration’s launch of mortgage-backed securities purchases is to roughly match the rate at which those bonds are rolling off the Federal Reserve’s balance sheet. RTRS

- Credit card and bank shares fell premarket after Trump doubled down on a demand that issuers lower rates to 10% by Jan. 20 and keep them there for a year. Capital One was down nearly 9%. BBG

- China overtook the US in investing abroad in the first half of 2025, signaling a historic shift in global capital flows. BBG

- A group of countries led by the UK and Germany is discussing plans for a military presence on Greenland to appease Trump and show that Europe is committed to Arctic security, people familiar said. BBG

- President Trump is scheduled to be briefed Tuesday on options to respond to the protests in Iran, according to U.S. officials, a sign the president is considering reprimanding the regime for its crackdown on demonstrators as he has repeatedly threatened. WSJ

- Iran warns it will hit American bases in the Middle East if the Pentagon launches strikes, along with Israel and regional shipping lanes. WSJ

- Israel and Hamas are preparing for renewed fighting as the Palestinian militant group is refusing to disarm, a requirement that is holding up progress on President Trump’s peace plan for Gaza. Israel’s military has drawn up plans for a new ground operation inside Hamas-controlled territory in Gaza. WSJ

- Exxon CEO Darren Woods offered the starkest assessment, telling Trump in the live-streamed meeting in the East Room that Venezuela is “uninvestable” under current conditions. He said major changes were needed before his company would return to the country, and that big questions remain about what return Exxon could expect from any investments. Politico

- Trump said he might block Exxon from drilling in Venezuela following comments by the Co.’s CEO: WSJ.

- Judge grants US FTC request to block Edwards Lifesciences Corp’s (EW) acquisition of JenaValve Technology Inc, via court records.

Trade/Tariffs

- India announces plans to conclude FTA with the EU during visit to the EU next week.

- EU Commission issues Guidance Document on submission of price undertaking offers for battery electric vehicles from China. “It covers various aspects to be addressed in a possible undertaking offer, including the minimum import price, sales channels, cross-compensation, and future investments in the EU.”.

- China’s Commerce Minister said the EU will release guidance document on submitting price commitment application, in regard to talks with EU on EV. EU will assess every price commitment application based on WTO rules.

- India’s Trade Minister said they are in the ‘final’ stages, in regards to trade deal with Europe.

- China is resuming its soybean auctions after a three-week pause to free storage while continuing US purchases under the trade truce.

- The US is to host a meeting on rare earths this week, according to Bloomberg.

Central Banks

- Federal prosecutors have opened up a criminal investigation into Fed Chair Powell over the central bank’s renovation of its Washington headquarters and whether Powell lied to Congress about the scope of the project, NYT reported citing officials.

- Fed Chair Powell said DoJ served the Fed with subpoenas, threatening indictment; Powell said he will continue to do the job. Fed Chairman Powell said the Department of Justice is threatening a criminal indictment against him. The Fed Chairman said it is about his testimony in front of the Senate Banking Committee last June, but called this a pretext. The Fed Chairman thinks this is really about interest rates saying, “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”.

- US President Trump denies involvement in the DoJ’s issuance of federal subpoena to the Fed; issued subpoenas unrelated to interest rates.

- US Senator Tillis criticises the move against Fed Chair Powell, and said he will “oppose the confirmation of any nominee for the Fed—including the upcoming Fed Chair vacancy—until this legal matter is resolved.

- Goldman Sachs expects the Fed to deliver 25bps cuts in June and September (vs. prior forecast of cuts in March and June).

- ECB’s Muller said there’s no reason to ease further in the near term and that rates have been in the right place for some time. Rates, however, could edge higher in a few years.

- ECB’s de Guindos said the USD is not behaving as a haven, at this point.

- ECB Bulletin: “Inside the food basket: what is behind recent food inflation?”; “Looking ahead, food inflation is expected to ease further, supported in the near term by easing selling price expectations”.

- Former PBoC Director of Statistics and Analysis Department Songcheng expects the central bank to take “small steps” toward monetary easing in the near future, Shanghai Securities News reported citing a speech.

- SARB is reportedly working on a review of its Prime Lending Rate, via Bloomberg. This has historically been fixed at the policy rate +350bps.

A more detailed look a global markets courtesy of Newsquawk

APAC stocks were mostly in the green, following on from the positivity seen stateside during Friday’s session. Japanese traders were away today amid a domestic holiday. ASX 200 saw gains of as much as 0.7% as the APAC session got underway but pared back slightly as XAU pulled back from new record highs. Despite spot XAU pulling back, gold miners outperformed, followed by consumer discretionary and energy. KOSPI was the Asian outperformer, with gains as much as 1.5% but the index completely reversed the move alongside further losses in tech-laden NQ. Hang Seng and Shanghai Comp conformed to the regional gains, although upside was capped amid a lack of major drivers for the bourses.

Top Asian News

- China Vanke (2202 HK) dollar bondholders have been advised to consider calling a default on the Cos noted, Bloomberg reported citing sources.

- China’s MOFCOM says its key priorities are to strengthen legal frameworks, improve export controls, and enhance risk prevention to safeguard supply chain resilience and national security.

European equities (STOXX 600 -0.2%) are trading mostly on the backfoot, in contrast to a mostly stronger APAC session. Sentiment appears to be subdued by Fed independence woes, after Federal prosecutors opened a criminal investigation into Chair Powell. European sectors are mixed. Leading sectors are Basic Resources (+0.6%), Food Beverage and Tobacco (+0.3%) and Retail (+0.3%). Basic Resources has been underpinned by stronger metal prices. On the downside, Autos (-0.9%), Banks (-0.9%) and Travel (-1.4%) lag, with the banking sector pressured by Trump’s credit card fee cap plan.

Top European News

- EU Sentix Index (Jan) -1.8 vs. Exp. -4.9 (Prev. -6.2)

- Swiss Consumer Confidence (Dec) -31 vs. Exp. -33 (Prev. -34).

FX

- DXY is under pressure this morning as Fed independence takes the limelight once again. Currently trading at the lower end of a 98.70-99.24 range, and just shy of its 200 DMA at 98.82. Further pressure for the index could see a test of its 100 DMA at 98.62.

- Downside for the USD this morning can be attributed to Fed independence woes. In brief, Federal prosecutors have opened up a criminal investigation into Fed Chair Powell over the central bank’s renovation of its Washington headquarters. As it stands, markets appear to be running with the “sell America” theme, with the USD & US equity futures lower and the curve steeper. The USD may also be pressured thanks to the affordability implications of Trump’s demand for credit card rates to be capped at 10%.

- JPY remains the only currency flat vs the USD, with USD/JPY currently trading within a 157.90 to 158.20 range. The JPY was pressured overnight amidst further reporting of PM Takaichi planning to dissolve the Lower House – as a reminder, this was first reported last Friday which spurred hefty upside in USD/JPY. Since, price action has stabilised with USD/JPY gradually moving back towards overnight troughs as the risk tone remains subdued.

- Other G10s are stronger against the USD to varying degrees. The Antipodeans are amongst the top performers, benefiting from the strength seen across the metals complex. The CHF appears to be the favoured haven this morning, and currently sits second in the G10 leaderboard.

Fixed Income

- Fixed benchmarks in proximity to the unchanged mark.

- Overnight, while modest, the bias was downward as the US yield curve steepens over Fed independence concerns and the narrative that a more dovish Fed now could lead to higher inflation and, by extension, higher rates further down the line.

- USTs at the low-end of a 112-02 to 112-11 band, posting losses of five ticks at most. Support resides at 111-31 from Friday, below that we look to 111-26 from late-August. By extension, the 10yr yield is at a 4.2% peak, just shy of last Friday’s 4.21% high. Thereafter, we return to levels from early-September/late-August when 4.35% printed (18th Aug.).

- In Europe, action is much the same. Bunds were unchanged for much of the session, but now incrementally firmer in 127.82 to 128.10 parameters. Elsewhere, Gilts opened near-enough unchanged before coming under modest pressure, echoing the above. At the low-end of a 92.30-53 band with downside of 18 ticks at most.

- OATs await Wednesday’s no-confidence motions against the French government re. Mercosur. On Wednesday, January 14th, two no-confidence motions will be placed against the government, one from the far-left (LFI) and another from the far-right (RN). Neither motion is expected to succeed, as LFI will not support RN and the Socialists (PS) will not support LFI. However, Politico has a line from a centrist official noting that “there could be an accident”. Amidst this, the OAT-Bund 10yr yield spread remains just above the 71bps mark and at the top-end of the 69-72bps 2026 range. OATs themselves trade in line with fixed income peers, as the updates around Fed Chair Powell dominate, and as such are near enough flat.

Commodities

- A softer start to the week for crude benchmarks, under modest pressure of c. 0.50/bbl at most to lows of USD 58.64/bbl and USD 62.89/bbl for WTI and Brent, respectively. Benchmarks spent APAC trade chopping in relatively wide bands in excess of USD 1.00/bbl. The complex began APAC firmer, peaking at USD 59.80/bbl and USD 64.00/bbl. Upside driven by increased geopolitical tensions, particularly relating to Iran. However, despite the escalatory remarks from POTUS that Iran is beginning to cross the line, the benchmarks failed to sustain early gains. Thereafter, they came under modest but notable pressure and slipped into the red.

- Spot gold opened on a slightly firmer footing, made a trough at USD 4,511.41/oz before gradually sauntering higher as the APAC session got underway. Thereafter, the yellow-metal surged beyond the USD 4.6k/oz mark, to make a fresh ATH at USD 4,601.19/oz. Since, spot gold has scaled back below USD 4.6k/oz, albeit it remains within a handful of dollars of that mark. Price action during European trade has been sideways.

- Upside for the yellow metal can be attributed to two points, which have attracted haven inflows. 1) Fed independence woes, and 2) heightened geopolitical tensions. Starting with the Fed, US Federal prosecutors have opened a criminal investigation into Fed Chair Powell over the central bank’s renovation of its Washington headquarters, and whether Powell lied to Congress about the scope of the project, NYT reported, citing officials. This has raised concerns among traders regarding the Fed’s independence, given Trump’s continued attempts to threaten Chair Powell’s job.

- Base metals have followed the metals sentiment, with 3M LME Copper currently higher by around +1.7% and towards the upper end of a USD 13,086-13,233/t range. In Shanghai, tin hit its daily limit, rising 8% to CNY 376,920/ton to set a new ATH.

- Kazakhstan oil shipments from the Black Sea CPC terminal halted on Saturday, Bloomberg reported citing sources, this caused crude intake into the pipeline system to stop.

- Hunan Silver has restarted production on 12th January, following the completion of its maintenance plans.

- Australian Resources Minister King said Australia is to have an operational critical minerals reserve by year-end.

- Trafigura CEO expects to load first vessel for Venezuelan oil exports to the US next week.

- China buys at least 10 cargoes of US soybeans for April-May shipment, according to traders.

Geopolitics: Ukraine

- Ukraine President Zelensky said US President Trump should enter a free trade deal with Ukraine.

- Over the weekend, Ukraine targeted three drilling platforms in the Caspian Sea owned by Lukoil. Elsewhere, Russian troops struck a Ukrainian military-industrial and energy facilities, according to TASS.

Geopolitics: Middle East

- US President Trump said Iran has proposed negotiations after US leader threatened action on Tehran for crackdown on protesters, AP News reported.

- US President Trump said the military is considering very strong options on Iran.

- An increase in the number of US planes near Iranian airspace, according to Israel’s Channel 14.

- US President Trump said Iran called to negotiate yesterday on nuclear, we may meet them.

- US President Trump said Iran has proposed negotiations after US leader threatened action on Tehran for crackdown on protesters, AP News reported.

- US President Trump said Iran called to negotiate yesterday on nuclear, we may meet them.

- An increase in the number of US planes near Iranian airspace, according to Israel’s Channel 14.

- US President Trump said “Iran is starting to cross it [Trump’s red line]”.

- US President Trump said the military is considering very strong options on Iran.

- Iran, in letter to UN, said US is to blame for the transformation of peaceful process into violent subversive acts and widespread vandalism.

- Iranian Foreign Ministry spokesperson Baghaei said communication with the US Special Envoy is open. Adds, they are ready to negotiate on the basis of mutual respect.

- US President Trump said in contact with Iranian opposition leaders.

Geopolitics: Other

- German Finance Minister Klingbeil said the transatlantic relationship “is disintegrating”, Die Zeit reported. Adds, We must further strengthen Europe, and we must do so much faster. The current pace is inadequate. European sovereignty now has top priority”.

- State Department Spokesperson said US Secretary of State Rubio spoke with Mexican Foreign Secretary de la Fuente today about the need for stronger cooperation against narcoterrorists and trafficking of fentanyl and weapons.

- US President Trump posted a picture in which he is labelled “Acting President of Venezuela”, via Truth Social.

- US President Trump said we are going to have Greenland, one way or another. We are talking about acquiring, not having short-term.

- US President Trump said working well with Venezuela’s leadership. Meeting with Machado is on Tuesday or Wednesday.

- Trump administration officials are set to meet with Danish officials about Greenland on Wednesday, diplomatic sources tell CBS News. Multiple European diplomats said that they increasingly understand that America’s commitment to the defence of Europe and NATO is no longer as ironclad as it has been over the past decades.

- Trump administration officials are set to meet with Danish officials about Greenland on Wednesday, diplomatic sources tell CBS News. Multiple European diplomats said that they increasingly understand that America’s commitment to the defence of Europe and NATO is no longer as ironclad as it has been over the past decades.

- North Korea accused South Korea of provocation via a drone, via local press.

US Event Calendar

DB’s Jim Reid concludes the overnight wrap

It’s hard to believe that we’ve only had one full week so far this year. A lot seems to have happened in a short space of time. For this week, the highlight will be the US CPI report for December and the start of US earnings season, both tomorrow. We may also get a ruling on the IEEPA tariffs from the Supreme Court (possibly Wednesday as that’s when the next “opinion day” from the Court arrives), and a meeting between US Secretary of State Marco Rubio with Danish and Greenland officials at some point this week. Also keep an eye on events in Iran where the nationwide anti-government protests that started on December 28th have become more violent with the US and Israel keeping a very close watch. We might also hear news of a snap Japanese election in the lower house, although with the next Parliamentary session starting on January 23rd we may have to wait for then on any official announcement. If that’s not enough, last night Fed Chair Powell disclosed that the Department of Justice issued a subpoena to the central bank on Friday, signaling the potential for a criminal indictment. In a video statement he stated that the threatened indictment pertains to his June testimony before the Senate regarding the renovation of Federal Reserve office buildings. He made it clear that he views the move as one aimed at influencing Fed independence. So remarkable stuff and all in all plenty of opportunities for big headlines over the coming days.

Turning to the week’s main data now, Tuesday’s December CPI report will capture most of the limelight. Our expectations are for this data to come in on the stronger side, unwinding some of the distortions induced by the government shutdown. Specifically, DB are looking for a 0.36% gain in headline CPI which would keep the year-over-year rate roughly unchanged (2.75% vs. 2.74%). As to core, DB expect a 0.35% gain (just barely rounding down to 0.3%), which would have the year-over-year rate increase by a rounded up two-tenths (2.77% vs. 2.63%).

Wednesday brings producer prices, covering October and November, forecast at +0.1% month-on-month for both months, and retail sales, expected to rebound by +0.4% after being flat in the prior month. For PPI, the read through for the categories that feed directly into core PCE will as ever be the most important part of the release.

The week closes with industrial production on Friday, pencilled in at +0.1%, signalling only incremental improvement in manufacturing output. The Fed’s Beige Book, also due Wednesday, will offer qualitative insights into demand, labour conditions, and pricing trends across districts, complementing the hard data. For the rest of the US data see the global day-by-day week ahead at the end as usual.

Beyond the US numbers, policy signals will be abundant. A roster of Fed officials—including Bostic, Barkin, Williams, Musalem, Kashkari, and Jefferson—are scheduled to speak throughout the week, providing markets with nuanced views on the balance of risks and the timing of potential rate adjustments. These remarks will be parsed against the backdrop of last week’s employment report, which showed the unemployment rate unexpectedly falling to 4.375%, with November’s reading revised down a tenth to 4.5%. This occurred alongside other decent employment data last week with a firmer quits rate, decent claims, and low Challenger layoff data. While these developments ease fears of a sharp labour market deterioration, payroll growth remains narrow and subdued. Headline payrolls were in line with DB expectation of 50k (consensus 70k) and private payrolls were only slightly below our expectations at 37k (consensus 75k), but after -76k of downward revisions to the prior two months, average monthly private payroll gains over the past three and six months are only 29k and 43k, respectively.

In terms of US earnings season, the major banks will lead the charge. JPMorgan Chase, Bank of New York Mellon, and Delta Air Lines report first tomorrow, followed by Citigroup, Bank of America, and Wells Fargo on Wednesday, and Goldman Sachs, Morgan Stanley, and BlackRock on Thursday, alongside TSMC for a global tech angle. Our equity strategists anticipate S&P 500 earnings growth rising to 15% year-on-year in Q4, up from 14% in Q3, implying average beats of 5.5% versus consensus, slightly above the historical norm of 4.9%. See their preview here.

Away from the US, Europe faces a lighter calendar, though Thursday’s UK November GDP will be closely watched for signs of stabilisation amid a soft recent growth narrative. Denmark’s December CPI today adds to the recent regional inflation picture, while the euro area releases industrial production and trade balance on Thursday. ECB speakers, including Guindos and Villeroy, will punctuate the discussion with policy nuance, complemented by Thursday’s Economic Bulletin.

In Asia, attention turns to China’s December trade balance on Wednesday, where exports are expected to slow to +4% year-on-year from +6%, reflecting softer global goods demand and ongoing electronics cycle normalisation. Japan’s data flow includes producer prices and machine too orders (Wednesday), seen unchanged at +2.7%, alongside the Economy Watchers survey (tomorrow). These releases will help shape expectations for BoJ policy calibration as the debate over normalisation continues. On Friday we saw widespread speculation that PM Takaichi may soon call snap lower house elections to capitalise on 70% approval ratings and try to boost its slim majority. This could put an election in early to mid February if called by the time parliament starts sitting on January 23rd. Given her expansive fiscal program it probably wasn’t a surprise to see the Yen hit a one-year intra-day low on Friday. It’s a holiday in Japan today so markets are closed but Nikkei equity futures are up +3.1% so it’s clear how markets view this but watch out for JGB yields in the days ahead. Bond futures are testing multi year lows again this morning.

Asian equity markets are opening the week higher even with S&P (-0.66%) and Nasdaq (-0.99%) futures lower on the Fed indictment story. The Hang Seng (+0.86%) is being driven by gains in the technology sector, alongside the Shanghai Composite (+0.83%) and the KOSPI (+0.30%).

Recapping last week now and markets started their first full week of 2026 in buoyant mood despite geopolitical developments, including Maduro’s removal and new US pressure around Greenland. The S&P 500 climbed +1.57% (+0.65% Friday) to a new all-time high, while the NASDAQ moved +1.88% higher (+0.81% Friday). There were a few notable sectoral stories. Oil services majors SLB (+12.44%) and Halliburton (+10.24%) led the gains for the S&P 500 energy sector (+2.13%) on the week following the Venezuela news and ensuing uptick in oil prices. Meanwhile, the S&P Aerospace & Defense index surged +10.56% amid the geopolitical volatility and President Trump’s proposal to increase the military budget to $1.5 trillion in 2027. More broadly, non-tech cyclical stocks outperformed, with the small cap Russell 2000 up +4.62% (+0.78% Friday), also supported by solid US data.

While the ISM manufacturing index, which came in at a 14-month low of 47.9 (vs. 48.4 expected), pointed to a weak manufacturing sector, more domestic-oriented data was more positive, as the services ISM hit a 14-month high of 54.4 (vs. 52.2 expected). The US labour market data was mixed but apart from a slightly disappointing payrolls print generally showed no alarms. That led pricing of a January Fed rate cut to decline to just 5%, with the amount of cuts priced by December falling to 52bps (-5.7bps on the week and -4.4bps Friday). This drove a significant flattening in Treasuries, with the 2yr yield rising +5.9bps to 3.53% (+4.4bps Friday), while the 10yr yield fell -2.6bps to 4.17% (-0.2bps Friday).

In Europe, softer-than-expected December CPI prints and PMI releases led investors to consider that the ECB might yet cut rates again this year. Sovereign bonds rallied, with 10yr bund yields down -3.7bps to 2.86%, with OATs (-8.8bps) and BTPs (-11.8bps) outperforming amid the risk-on mood. Gilts saw an even better performance, with the 2yr yield down -9.0bps and the 10yr yield -16.2bps to 4.37%. Equity markets put in a strong performance, helped by defence companies such as Rheinmetall (+18.60%) and BAE (+17.05%), with the STOXX 600 +2.27% (+0.97% Friday), the DAX +2.94% (+0.53% Friday), the FTSE 100 +1.74% (+0.80% Friday) all hitting new record highs. Credit also rallied, with EUR IG (-2bps) and HY (-13bps) credit spreads slightly outperforming their US counterparts (-1bps and -11bps respectively).

In commodities, precious metals continued to rally on the back of heightened geopolitical stress, with gold up +4.09% to above $4,500/oz, and silver +9.67% higher at $79.86/oz. Oil experienced high volatility, with Brent crude initially falling below $60/bbl due to more optimistic output expectations after Maduro’s removal. However, by Friday it had rebounded to $63.34/bbl (+4.26% on the week), including a +2.18% rise on Friday as Trump’s meeting with oil executives delivered no new investment promises for future Venezuelan production.

Tyler Durden

Mon, 01/12/2026 – 08:39ZeroHedge NewsRead More

R1

R1

T1

T1