Rivian Shares Slide After Second Sell Downgrade In Week As UBS Flags “Limited Catalysts”

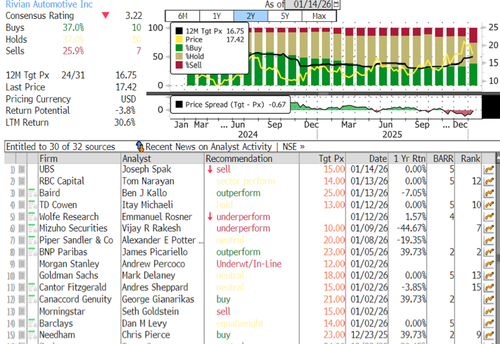

Shares of Rivian Automotive moved lower on Wednesday morning after UBS analyst Joseph Spak downgraded the struggling EV maker from “Neutral” to “Sell,” marking the second analyst this week to slash their rating on the stock.

Spak told clients that his downgrade of Rivian from Neutral to Sell, along with shifting his price target from $15 to $13, implies about 20% downside from current levels, and that it was driven by stretched expectations rather than deteriorating fundamentals.

Here’s the analyst’s reasoning:

We are downgrading RIVN to Sell from Neutral, $15 PT

We downgrade RIVN to Sell, $15 PT seeing a less favorable risk/reward. RIVN stock has been prone to sentiment swings (often driving stock more than fundamentals) and the stock is +15% since Autonomy and AI Day on Dec. 11 (vs. S&P500 +1%) as the market assigned more enthusiasm to their AI potential. However, in our view, most of the AI related news is “out”. The other point of enthusiasm is the launch of the R2 and while we like the vehicle, expectations may be too high; our 2026/27 sales forecast is 16/19% below consensus, and current stock prices in ’27 sales ~25% above UBSe. We see ~20% downside in our base case ($15 PT) and a ~1.6x downside to upside negative skew.

Limited AV catalysts

We see limited autonomous catalysts near-term as point-to-point (P2P) capabilities are not until 2H26 and “eyes-off” not until 2027. Further, while some investors expressed enthusiasm for the potential to sell/license their AV tech to other OEMs, we saw two developments at CES that could dampen hope: 1) the release of Nvidia’s open sourced Alpamayo model, 2) Ford developed their own L3 P2P system in-house.

Risk to R2 2026 delivery expectations

Our 26/27 R2 forecasts are ~22/7% below consensus. Recall, R2 is scheduled to start in 1H26. However, Gen 3 hardware available late ’26. We believe early customers are likely current RIVN owners or early adopters, and we see risk they wait for the latest and greatest R2 (that may be available ~2 qtrs later). Further, we see a tougher US BEV environment with the absence of the EV tax credit and a pull back in regulations, which means R2 will compete against broader ICE/hybrid offerings, not just BEVs. We do see an opportunity for R2 to capitalize off customers changing from Tesla. Our 2026 R2 forecast is 10.6k vs. consensus at 13.6k (S&P production forecast is only 6.1k). We forecast R1 units -7% y/y (pre-buy giveback, no EV credit, high lease rate) vs. consensus that has R1 +10% y/y. Further, we see cost pressure from DRAM and lithium pricing.

Where could we be wrong?

1) Sentiment/momentum could continue to trump fundamentals leading to multiple expansion; 2) R2 demand and production is stronger than we forecast; 3) RIVN is able to license more of their technology.

Valuation: $15 PT based on 2.5x 2027e EV/sales

We now apply a 2.5x EV/sales multiple to our 2027 sales estimate from 2.0x prior. 2.5x is below current NTM of ~3x, but at the +1 st. dev. level over past 3-years. We believe 2.5x balances near-term concerns with long-term potential.

Following the downgrade, shares in the U.S. cash session fell 7.5% by late morning. The stock has been locked in a four-year lateral move amid declining EV sales across the industry.

Spak’s downgrade to Sell from Hold comes shortly after Wolfe Research analyst Emmanuel Rosner also cut the stock to Sell. According to Bloomberg data, there are 10 Buy ratings, 10 Holds, and 7 Sells. The average 12-month price target among analysts tracked by Bloomberg is around $16.75.

Perhaps Rivian just needs to replicate Tesla by adding robots and AI. If not, Rivian appears to be treading water.

Tyler Durden

Wed, 01/14/2026 – 13:00ZeroHedge NewsRead More

R1

R1

T1

T1