Kraft Heinz’s Top Shareholder Berkshire Plots Exit

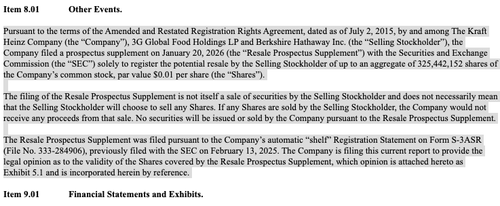

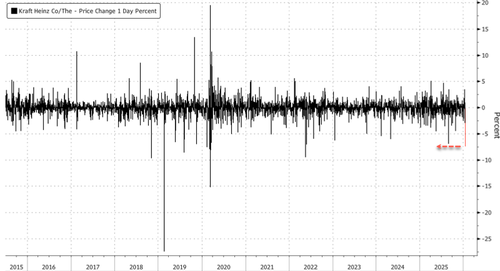

Kraft Heinz shares are down about 7.5% in New York premarket trading, the biggest drop in just under four years, after the company filed an 8K allowing Berkshire Hathaway to sell up to 325.4 million shares of stock if it chooses to do so.

Kraft Heinz’s permission to sell is not an actual sale. No shares have been sold as a result of this filing, and Berkshire is not obligated to sell anything.

The proposed sale of the 325.4 million shares by Berkshire represents about 28% of the packaged-food company. This comes as the company recently announced plans to split into two.

Berkshire’s Warren Buffett expressed disappointment last year about the potential split of the two companies. Berkshire played a critical role in the 2015 merger, partnering with 3G Capital as a financial backer.

As a result of the 8K filing, Kraft Heinz shares were down 7.5% in premarket trading on Wednesday. If losses extend and hold through the cash session, this would mark the largest daily decline since May 18, 2022, of -9.5%.

Kraft Heinz shares have tumbled 76% since peaking at around $100 per share in early 2017.

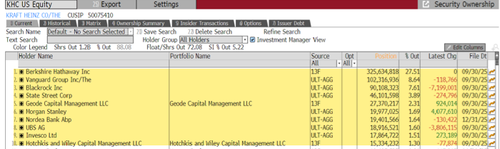

Berkshire, Vanguard, BlackRock, State Street, Geode Capital, Morgan Stanley, Nordea Bank, and UBS are the top shareholders of Kraft Heinz.

Bloomberg noted, “After years of underperformance, Kraft Heinz announced in September that it would separate into two public companies, essentially undoing its $46 billion mega-merger from a decade ago. Its chairman has blamed the company’s poor performance on an overly complex corporate structure and the inability to focus on capital allocation and the right projects to prioritize. Kraft Heinz also replaced its chief executive officer at the start of this month.”

Tyler Durden

Wed, 01/21/2026 – 10:35ZeroHedge NewsRead More

R1

R1

T1

T1