The Stock Market Isn’t A Market Anymore – It’s A Political Control Mechanism

Authored by Nick Giambruno via InternationalMan.com,

It has become increasingly clear to me that the stock market is no longer a stock market in the traditional sense.

Its primary purpose was once straightforward: a venue where companies could raise capital by selling shares to the public, and where investors could freely buy and sell those shares among themselves.

Today, the market still performs that function — but it has been far overshadowed by three larger, unofficial roles that have become existential to social and political stability:

-

Liquidity Sponge: All the trillions in newly created currency units have to go somewhere. Better to have them chasing stocks than bidding up the price of groceries.

-

De Facto Savings Account: Most people treat their brokerage account as if it were a savings account. Their financial futures depend on the stock market continuing to rise. But putting money into the stock market is not saving — it’s investing, and that’s a very different thing. The rapid debasement of fiat currency has destroyed savings for the average person, forcing them into riskier assets like stocks in a desperate attempt to outpace inflation.

-

Crucial Tax Revenue: Taxes on capital gains, dividends, corporate profits, and other market-related activity have become an essential pillar of government funding.

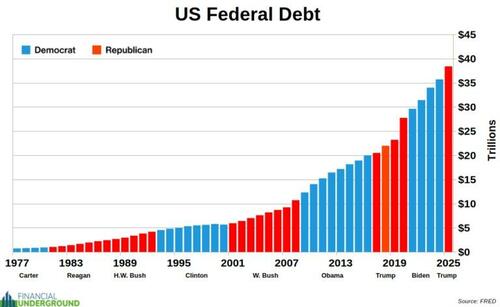

As the failure of DOGE — the most serious attempt to cut federal spending in most people’s lifetimes — demonstrated, it’s politically impossible to even slow the growth rate of federal spending, let alone cut it. It doesn’t matter which party is in office; they’re all headed in the same direction. It’s like riding a runaway train with no brakes.

Issuing debt and then printing money to buy that debt remains one of the primary ways this out-of-control spending is financed.

All those new currency units need an outlet.

If people lose interest in the stock market because it has declined, those freshly created dollars will start flowing elsewhere, bidding up the prices of housing, food, and other basic necessities, which could trigger real social upheaval.

Another reason the government cannot allow the stock market to fall is that it would devastate retirement savings and infuriate the most politically active demographic.

It’s a near-guaranteed way to lose the next election.

A third reason is fiscal. A declining market would slash hundreds of billions in federal revenue from taxes on capital gains, dividends, corporate profits, and other market-linked activity. That shortfall would further explode the deficit, which would then need to be financed by even more borrowing and even more money printing, compounding the problem.

This is why, in short, the political establishment cannot tolerate a sustained downturn in the stock market. It would unleash intense social and political instability that could bring down the entire system.

And this is also why the stock market is no longer primarily a stock market in the traditional sense. It has become a mechanism that the political establishment relies on to maintain control.

This is the backdrop behind today’s absurd valuation metrics.

The S&P 500’s Price-to-Earnings (P/E) and CAPE (Cyclically Adjusted P/E) ratios are near historical highs, while Free Cash Flow Yield and Dividend Yield are near historical lows.

Meanwhile, Market Cap to GDP (the Buffett Indicator) sits at a record high. It measures the total value of the US stock market relative to US GDP. Today, that ratio stands at roughly 221% — far exceeding prior peaks of 139% at the height of the dot-com bubble in 2000 and 106% at the peak of the housing bubble in 2007.

These are just a few examples. Nearly every fundamental measure of valuation is at or near all-time highs — and still climbing.

This highlights the biggest challenge with investing today: rampant money printing by central banks has distorted financial markets like never before, rendering traditional fundamental analysis far less effective. It’s like using a measuring stick where the length of a centimeter keeps changing.

As a result, finding high-quality businesses at reasonable valuations through Graham-and-Dodd-style securities analysis is becoming increasingly difficult, if not impossible.

You would be mistaken to believe today’s insane valuations reflect a voluntary free market of rational buyers and sellers operating with honest money. What we are witnessing instead is the financial equivalent of a carnival fun house — a distorted, warped mirror shaped by an ever-increasing supply of fake money.

Many are understandably confused because today’s stock market valuations don’t make financial sense. But what they overlook is that these valuations do make political sense — and political concerns will continue to trump fundamentals as long as politicians control the money printer.

The financial fun house illusions will persist, and they will become even more absurd.

To distill it down to its most concise form: the US government can either let the stock market decline and watch the whole house of cards come tumbling down, or continue to goose it with easy money. It’s not difficult to predict which option they’ll choose.

That is why, if we do see a stock market decline, I do not expect it to be prolonged. In the past 26 years, the only extended downturns were the dot-com bust and the 2008 financial crisis. Every other pullback — including the 2020 Covid collapse — was so brief that if you’d taken a long vacation, you might have missed it entirely. That’s because at the first sign of trouble, the Federal Reserve stands ready to create as many currency units as necessary to prop up the system.

I expect this dynamic to persist. If another downturn is coming, I wouldn’t expect it to last very long.

The far more likely outcome is that we’ll continue to experience a melt-up (in nominal terms) until they destroy the currency.

Ludwig von Mises, the godfather of free-market Austrian economics, summed up the US government’s dilemma:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion.

The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

The US government will not voluntarily “abandon credit expansion,” as Mises puts it, because Washington is dependent on issuing increasing amounts of debt — which the Fed buys with dollars it creates out of thin air — to pay for the ever-growing costs of Social Security, national defense, welfare, and interest on the federal debt.

That means their only choice is to debase the US dollar by ever-increasing amounts until, as Mises puts it, the “final and total catastrophe of the currency system involved.”

It’s like a drug addict who needs to keep raising his dose to get the same effect… until he dies of an overdose.

Could that happen in 2026?

I think it’s a growing possibility, but not the most likely outcome. I believe it’s more likely the melt-up continues.

My primary mission at Financial Underground: SPECULATOR is to put together the pieces to reveal the true Big Picture and get positioned in unstoppable investment trends ahead of the crowd with smart speculations.

I’m more interested in getting the Big Picture right than gambling on short-term trades in rigged markets.

In my latest free PDF report, The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now, I break it all down, explore what’s in store, and determine the best ways to get positioned for profits amid what promises to be a tumultuous year.

Tyler Durden

Wed, 01/21/2026 – 13:15ZeroHedge NewsRead More

R1

R1

T1

T1