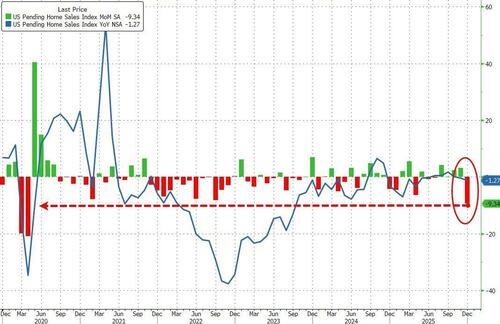

US Pending Home Sales Crash Most Since COVID, Back Near Record Lows

After four straight months of increases, US pending home sales crashed in December (-9.3% MoM vs -0.3% MoM exp), dragging sales down 1.27% YoY in 2025…

Source: Bloomberg

This is the biggest monthly decline since COVID.

“The housing sector is not out of the woods yet,” NAR Chief Economist Lawrence Yun said in a statement.

“After several months of encouraging signs in pending contracts and closed sales, the December new contract figures have dampened the short-term outlook.”

December’s collapse crashed the US Pending Home Sales Index back near record lows (from 33 month highs)…

Source: Bloomberg

Housing activity typically slows in winter months and picks up more in the spring selling season. While NAR adjusts the data for these patterns, the drop was still the largest for any December in data back to 2001.

Yun said it’s unclear whether the figure was a one-off or the start of a worsening trend.

Activity may pick up soon as mortgage rates have kicked off the new year at some of the lowest levels since 2022, and home prices are growing at a much slower pace than last year. However, much of the outlook also depends on available inventory, which has struggled to recover to pre-pandemic levels.

Pending-homes sales tend to be a leading indicator for previously owned homes, as houses typically go under contract a month or two before they’re sold.

Meanwhile, addressing affordability concerns, President Trump just laid out a slate of proposals aimed at the housing market including an executive order targeting institutional investors.

Tyler Durden

Wed, 01/21/2026 – 10:08ZeroHedge NewsRead More

R1

R1

T1

T1