Yentervention? Goldman Delta-One Desk-Head Questions FX Market’s Reaction To BoJ’s ‘Hawkish Hold’

Technically, the Bank of Japan actions overnight should be seen as “a hawkish hold”, according to Goldman Sachs Delta-One desk-head Rich Privorotsky.

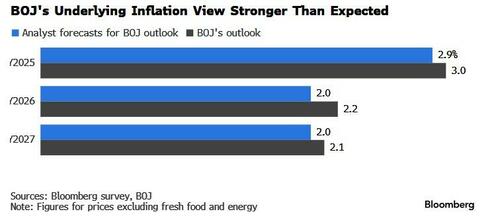

The Bank raised its growth estimate and maintained its hawkish inflation forecasts on Friday even as it kept interest rates steady, signaling its confidence a moderate recovery would justify raising still-low borrowing costs further.

While Ueda had suggested that overall inflation will weaken below 2% soon, he also left open the possibility of an early rate hike.

“April is a month where there’s relatively high numbers of price revisions,” Ueda said.

“We have a certain amount of interest in that, and while it’s not the most important factor in deciding the next rate hike, it’s one of the factors.”

The BOJ gave other signs of a more robust view, too.

It softened its assessment of economic risks as they are now generally balanced. With the negative impact of US tariffs receding, the bank cut the wording that it needs to watch if the economic outlook will materialize “without any preconceptions.”

However, Governor Ueda’s press conference leaned cautious on market functioning, flagging discomfort with the pace of long end moves and a willingness to act if volatility becomes disorderly.

Ueda said the central bank may conduct operations to smooth volatility in the bond market in a nimble fashion if needed, while indicating that exceptional circumstances would be needed.

“In a situation that’s different from usual, we could conduct nimble operations to encourage stable yield formation in the markets,” Ueda said.

“We’ll keep closely cooperating with the government and keep watching the situation while considering our respective roles.”

That’s not a return to formal YCC, but it does keep a soft backstop in place.

The immediate reaction made sense…

-

front-end rates higher,

-

some flattening further out,

-

and FX weaker (could be a lot weaker if people think YCC is back).

It remains very hard to thread the needle of strong growth, high inflation, stable rates, and a stable currency.

Repatriation flows help at the margin, but the currency still looks like the pressure valve.

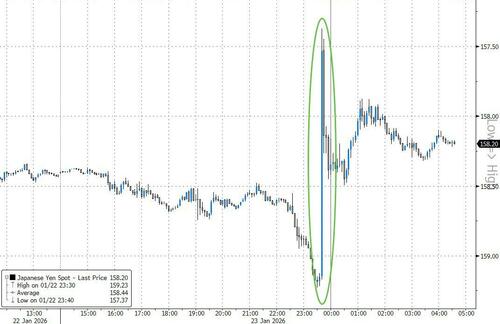

Privorotsky ended his note by pointing out that “sharp moves as this is going to press, curious if some intervention happening…”

“USD/JPY initially moved higher after Governor Ueda’s comments were interpreted as slightly more dovish on rate hikes,” said Fukuhiro Ezawa, head of markets Japan at Standard Chartered Bank in Tokyo.

“The pair then pulled back, prompting market chatter that the move may have reflected intervention or a rate check. USD/JPY subsequently drifted lower, though dip-buying emerged on the downside, allowing the pair to retrace part of the move.”

Around 2amET, as Bank of Japan Governor Kazuo Ueda ended his post-policy decision press conference, with JPY weakness accelerating above 159/USD (near the 160 Maginot Line), there was a sudden and very violent lurch higher in the yen (USDJPY puked 150pips in minutes)…

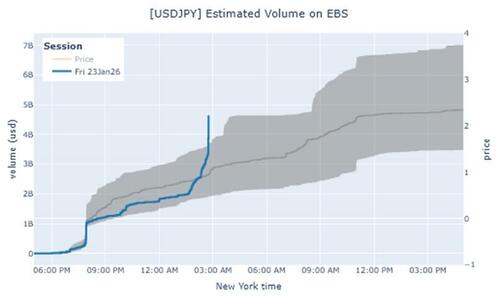

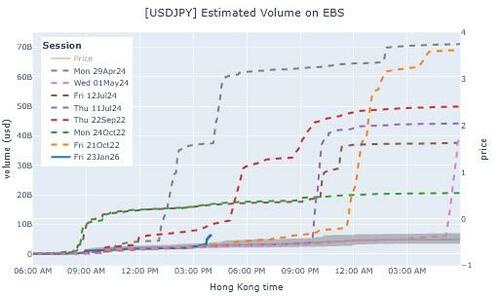

The volumes traded during that period were dramatically above normal..

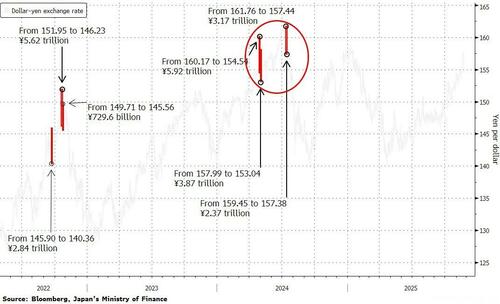

But, not particularly significant relative to recent (alleged) interventions…

Of course, that could simply reflect the ever shrinking level of liquidity (and this lower level of actual intervention required to move the Japanese currency).

“It is tempting to conclude that we may be in the early stages of an official intervention,” said Valentin Marinov, strategist at Credit Agricole.

“The reaction is also showing how nervous the markets are when the JPY is trading so close to the ‘line in the sand’ – levels where we had interventions in the past.”

Finance Minister Satsuki Katayama declined to answer when asked if Japan had intervened in the market, keeping investors in the dark regarding the moment of yen volatility.

“We’re always watching with a sense of urgency,” she said.

As a reminder, the government spent almost $100 billion on yen-buying to prop up the currency in 2024.

On each of the four occasions the exchange rate was around 160 yen per dollar, setting that level as a rough marker for where action might take place again… and very close to where we saw this move overnight.

The bottom line is simple: by refusing to admit they can control two opposing variables simultaneously, they will lose control of everything and as Privorotsky notes… the currency will likely be the release valve (hence the ‘alleged’ intervention)

Overnight Ueda effectively confirmed YCC coming, sparking yen selloff… then immediate U-turn spike driven by what appears to be one-time small intervention by MOF/BOJ.

BOJ hoping to control yields (yen negative) while intervening in FX to prop it up.

Another disaster coming https://t.co/HLlYjAGN10

— zerohedge (@zerohedge) January 23, 2026

“Another disaster coming” indeed!

Tyler Durden

Fri, 01/23/2026 – 08:05ZeroHedge NewsRead More

R1

R1

T1

T1