Booz Allen Shares Hammered After Treasury Cancels Consulting Contracts

Shares of Booz Allen Hamilton tumbled the most in months during late Monday morning trading after U.S. Treasury Secretary Scott Bessent canceled dozens of contracts tied to the consulting firm.

Secretary Bessent said 31 contracts with Booz Allen were terminated, representing $4.8 million in annual spending and $21 million in total obligations.

“President Trump has entrusted his cabinet to root out waste, fraud, and abuse, and canceling these contracts is an essential step to increasing Americans’ trust in government,” he said, adding, “Booz Allen failed to implement adequate safeguards to protect sensitive data, including the confidential taxpayer information it had access to through its contracts with the Internal Revenue Service.”

Treasury pointed to an incident with Booz Allen in recent years:

Most notably, between 2018 and 2020, Charles Edward Littlejohn — an employee of Booz Allen Hamilton — stole and leaked the confidential tax returns and return information of hundreds of thousands of taxpayers.

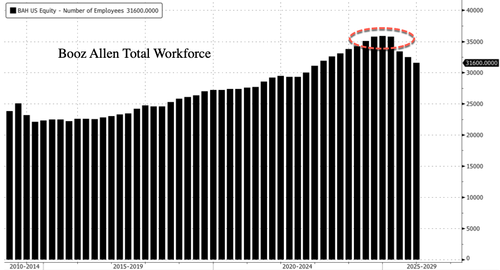

Last spring, Booz Allen said it was undergoing a major restructuring and planned to cut roughly 2,500 jobs, about 7% of its workforce, as President Trump’s DOGE efforts reduced government spending by discontinuing federal contracts.

Later in the year, CEO Horacio Rozanski told investors the company was “making the difficult decision to reduce layers and numbers in our senior ranks” due to federal contract reductions and a broader slowdown in government funding.

Shares of Booz Allen are down 7.5% in the cash session this morning, marking the worst single-day decline since October 24, when the stock fell about 9%. Shares have been cut roughly in half since President Trump’s November 2024 election victory, as Elon Musk’s DOGE initiative began aggressively targeting waste, fraud, and abuse across the federal bureaucracy in early 2025.

In May 2025, Goldman analyst Noah Poponak downgraded Booz Allen from “Neutral” to “Sell,” noting medium-term revenue growth is expected to be flat as federal civilian spending comes under pressure and priorities shift within many federal agencies.

Tyler Durden

Mon, 01/26/2026 – 11:40ZeroHedge NewsRead More

R1

R1

T1

T1