USAR’s New CEO Executing On Strategy

Submitted by Tight Spreads

USA Rare Earth’s (USAR) strategy is characterized by its comprehensive “mine-to-magnet” vertical integration, a significant geographic footprint across North America and Europe. While competitors often focus on specific segments of the value chain, USAR is the only company outside of China positioned to offer a true end-to-end solution. In this note we’ll go over the business, key differentiators, and what the company has as remaining gaps in their operations to execute their strategy. A valuation note will follow soon.

Key notes include how on September 29, 2025, USAR announced the appointment of Barbara Humpton as the company’s Chief Executive Officer, effective October 1, 2025. Barbara Humpton had a distinguished 14-year tenure at Siemens before joining USAR.

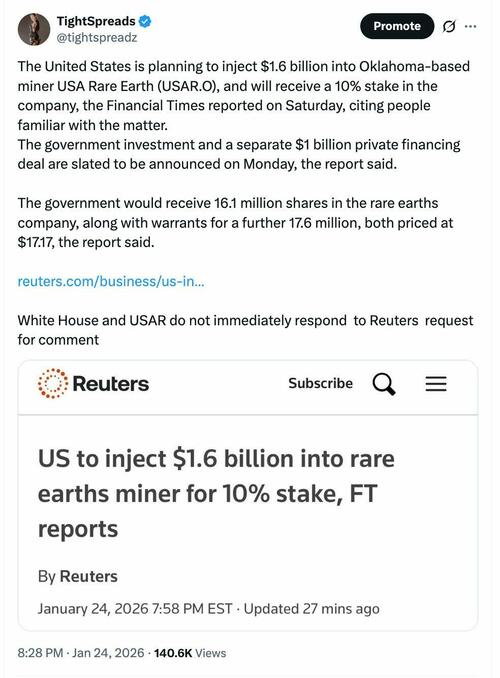

For those of you who saw the Bloomberg and Reuters headlines:

Today, January 26th, it was confirmed true.

Business Overview and Segments

The company operates as a single reportable operating segment focused on the vertically integrated production of rare earth element magnets. Its business model encompasses the entire value chain through the following core components:

-

Upstream (Mining): Development of the Round Top deposit in Sierra Blanca, Texas, which is the richest known domestic source of heavy rare earth elements, gallium, beryllium, and yttrium.

-

Gallium: Round Top is one of the largest known deposits of gallium, a mineral where China currently accounts for approximately 98% of primary production. It is essential for semiconductors, compound semiconductors, and defense technologies, and was recently subject to export bans by China.

-

Beryllium: This element is used in specialized applications including military radar, nuclear power, X-rays, and MRIs. Its presence at Round Top was identified as early as the 1970s associated with fluorite deposits.

-

Yttrium: Classified as a heavy rare earth, yttrium is critical for radiation therapy for certain cancers and is a foundational material for chemical vapor deposition in semiconductor manufacturing.

-

-

Midstream (Processing & Metal-Making): Ownership of Less Common Metals (LCM), a leading producer of rare earth metals and alloys based in the UK, and development of a processing lab in Wheat Ridge, Colorado.

-

LCM is the only proven scaled producer of rare earth metals, alloys, and strip casting outside of China.

-

Feedstock Security: The acquisition ensures a reliable supply of NdFeB strip cast alloy, which is a mandatory input for the Stillwater, Oklahoma magnet facility.

-

Specialized Materials: LCM provides leadership in Samarium and Samarium Cobalt metals, which are critical for defense and medical sectors and identified as high-risk for supply vulnerabilities.

-

Circular Manufacturing: LCM brings the ability to process recycled rare earth oxides from end-of-life magnets and production swarf, creating a more sustainable supply chain.

-

Hafnium Extraction: During piloting of its separation methods, the company successfully isolated hafnium, a material used in advanced semiconductors and nuclear reactors.

-

-

Downstream (Magnet Manufacturing): A 310,000 sq. ft. manufacturing facility in Stillwater, Oklahoma, designed for large-scale production of sintered Neodymium Iron Boron (NdFeB) magnets.

-

Circular Economy: Integration of recycling capabilities to recover materials from end-of-life magnets and production swarf, creating a sustainable closed-loop system.

Remaining Steps for Full Vertical Integration

While the LCM acquisition closes a major gap, several components are still required to fully realize the end-to-end domestic strategy.

1) Mining and Processing Development

-

Technical Milestones: The company must still complete the Pre-Feasibility Study (PFS) and a Definitve Feasibility Study (DFS) for the Round Top project. Commercial production at the Texas mine is not expected to begin until late 2028.

-

Separation Scaling: While separation has been proven at the Wheat Ridge lab, USAR needs to scale these technologies to handle 8,000 metric tons per annum of concentrates.

2) Manufacturing and Infrastructure

-

Domestic Metal-Making: While LCM provides metal-making in the UK, USAR still needs to “return this capability home” by establishing rare earth metal-making facilities within the United States.

-

Capacity Expansion: Full commissioning of the Stillwater magnet facility is scheduled for Q1 2026. The company plans to scale magnet production from an initial 1,200 tpa to a target of 5,000 tpa, which requires additional capital and equipment installation.

-

European Expansion: Plans to build a 3,750 mtpa metal and alloy plant in France are underway but require further development and construction.

How the company is addressing the premier bottlenecks identified:

USAR is scaling its operations through a combination of proprietary technological development at its Wheat Ridge facility and a massive $1.6 billion government-backed investment to establish domestic metal-making capabilities.

Scaling Separation Processes to 8,000 Metric TPA

To transition from bench-scale testing to a commercial capacity of 8,000 metric tons per annum (tpa) of concentrates, the company is implementing the following steps and technologies:

Continuous Demonstration and Digital Twin Technology

-

USAR is collaborating with the U.S. Department of Energy to leverage digital twin technology and process modeling to advance separation at the Wheat Ridge lab.

-

The company plans to operate a Hydromet demonstration facility in Colorado for 2,000 to 4,000 continuous hours starting in early 2026.

-

This demonstration plant will run five parallel solvent-extraction (SX) circuits to generate the operational data required for commercial plant design.

-

The scaling strategy involves moving from batch testing to continuous testing by significantly increasing the volume of rock processed to create enough bulk leach solution.

Process Optimization and Engineering Partners

-

The company has selected Fluor Corp. and WSP Global Inc. as EPCM partners to advance the Definitive Feasibility Study (DFS) and manage large-scale infrastructure delivery.

-

Research at the Colorado Facility is specifically focused on refining separation processes that minimize the use of organic solvents, aiming for a lower waste profile than traditional methods.

-

Engineering work is currently focused on “fine-tuning” the separation of bulk gallium, as well as heavy and light rare earths, into distinct concentrate streams.

Establishing Domestic Metal-Making

USAR is addressing the lack of domestic rare earth metal-making by integrating the expertise of its Less Common Metals (LCM) acquisition directly into its U.S. operations.

Integration at Stillwater, Oklahoma

-

USAR intends to return metal making to the United States by integrating LCM’s capabilities into its Stillwater, Oklahoma facility.

-

The Stillwater site is being developed to house the largest metal-and-alloy-making and strip-casting capability outside of China.

-

The facility will produce essential feedstocks for magnets, including NdPr, dysprosium, terbium, and samarium cobalt metals.

-

The company aims to reshore approximately 10,000 tonnes per year of heavy rare earth metal and alloy production capacity to the U.S.

Strategic Support and Workforce Development

-

A $1.6 billion Letter of Intent with the U.S. government and $1.5 billion in private investment are earmarked to accelerate the build-out of these domestic capabilities.

-

To address the shortage of skilled labor in the U.S., USAR is launching an apprenticeship program to train domestic metal makers and transfer expertise from the UK-based LCM team.

-

The domestic metal-making operations will utilize a “circular” approach, incorporating both mined feedstock from Round Top and recycled materials (such as magnet swarf).

Important Notes on Management

New CEO: Barbara Humpton had a distinguished 14-year tenure at Siemens before joining USAR last October.

-

She served as President and CEO of Siemens USA starting in 2018, overseeing the company’s largest market with more than $20 billion in annual revenues.

-

Siemens Government Technologies: Prior to her role as U.S. CEO, she was the President and CEO of Siemens Government Technologies, where she focused on implementing products and services for federal government agencies.

-

Previous Executive Roles: She served as a Vice President at Booz Allen Hamilton and held the position of Vice President and Director at Lockheed Martin Corporation.

-

Board Memberships: She serves on the Board of Directors of the Federal Reserve Bank of Richmond and is the Chair of the Board for the Center for Strategic and Budgetary Assessments (CSBA).

-

Industry Influence: She has held board seats at the National Association of Manufacturers (NAM) and the Economic Club of Washington, D.C.

Rob Steele (CFO): Appointed in March 2025, Steele brings over 30 years of experience in investment banking and has led over $28 billion in capital raises.

Dr. Alex Moyes (VP of Mining): Appointed in October 2025, Moyes holds a PhD in Mining and Minerals Engineering and previously led critical minerals planning at Ramaco Resources.

Board Composition: The board includes experienced figures such as Michael Blitzer (Chairman and SPAC veteran) and General Paul Kern (Ret.), who formerly served as Commanding General of the Army Materiel Command.

More in the Tight Spreads substack.

Tyler Durden

Mon, 01/26/2026 – 11:25ZeroHedge NewsRead More

R1

R1

T1

T1