What We Are Experiencing Is Not De-Dollarisation But De-Fiatization

By Benjamin Picton, Senior Market Strategist At Rabobank

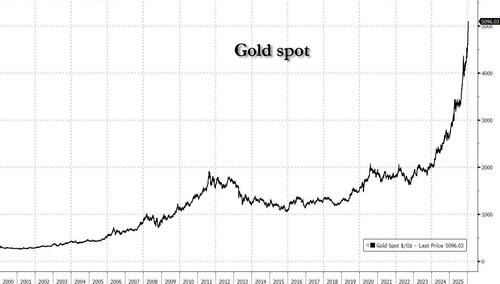

J.P. Morgan once famously remarked that “gold is money, everything else is credit.” That dictum was apparently forgotten during the 1980s & 1990s as gold’s share of central bank reserves steadily declined and gold prices – for most of that period – did the same.

That period was the most recent era of high financialization, where Hollywood movies like Wall Street, Trading Places, Barbarians at the Gate and even Pretty Woman glorified the swashbuckling lifestyle of financiers. It was also the era of the leveraged buyout, the rise of the MBA, the retail day-trader speculating in the dotcom boom and the germination of the idea (in the Anglosphere, at least) that you too can get rich through landlording – effectively transforming housing from a consumption good to a financial asset. This was also the era of the imperialism of the US Treasury Bond.

With the benefit of hindsight, it is reasonably clear from the data that this period ended with the popping of the dotcom bubble, but the final eulogy was not read until the financial crisis of 2008 when the excesses of high financialization were truly laid bare. This imbued the arguments of non-market economies like China that American system was decadent and sclerotic – and that the their system was superior – with apparent credibility. Along with military misadventure in the Middle East this constituted a heavy blow for the soft power and prestige of the United States.

While it is typical to think of the financial crisis is an epochal ending, gold’s share of central bank reserves hit its nadir around the year 2000. That was also the approximate highwater mark for US Treasury bonds’ share of global reserve assets. Many Western central banks – the last sellers of scale – had recently offloaded their holdings at low, low prices in the late 1990s having been taken in by fashionable ideas that gold was a “barbarous relic” and that the creation of the fiat monetary system and floating exchange rates in 1971 made holding gold a quaint anachronism.

Fast forward to today and gold is now trading well above $5000/oz. Silver is trading well above $100/oz. The financial has given way to the material and the fashionable narrative is now ‘sell America’ and de-Dollarisation. Dollar assets’ share of total central bank reserves has been in slow decline for years, but some commentators are now pronouncing the death of the Dollar system as Donald Trump’s abrasive style of foreign policy offends traditional allies. In seeming support of the sell America narrative, the Bloomberg Dollar spot index is down 1.14% year to date.

However, on the other side of the ledger we continue to see strong demand at US Treasury auctions and SWIFT data shows that the use of the US Dollar in international payments is actually increasing, mostly at the expense of the Euro. The Chinese Renminbi has seen a modest rise in its use in payments, but small declines in its already low share of central bank reserves. Even the increased use in payments is exaggerated somewhat by transactions between mainland China and Hong Kong. At only 3-4% of total payments versus more than 50% for the Dollar, it would seem to us that the demise of the Dollar in favor of other currencies is much exaggerated.

Speaking to the media at Davos, hedge fund manager Ray Dalio argued that what we are experiencing is not de-Dollarisation, but de-fiatization. That is, flight from fiat currencies in favor of real assets or – as J.P. Morgan might have advised – real money in the form of gold and silver. Ray pointed out that “in a war-like environment” countries don’t want to hold each other’s debt for fear of sanctions (Russia presents a cautionary example), while other investors don’t want to hold financial claims for fear of debasement through deficit spending by national governments and debt monetization – quantitative easing – by central banks. Under this scenario, it is rational to hold neutral money with no counterparty risk, no risk of debasement and less scope for the imposition of capital controls. The last sellers of scale (central banks) became the first buyers of scale in 2024 and 2025, but the trade has broadened out to other buyers.

The debasement of fiat currencies is now easy to spot. Aside from gold and silver regularly re-setting all-time highs the Bloomberg commodity index has surged to sit at its highest level since mid-2022. Brent crude prices have risen for the last five weeks straight and Henry Hub natural gas prices have surged more than 65% year-to-date. These types of moves signal a scarcity of the material relative to the financial. Consequently, long yields have remained elevated (or surged, in the case of Japan) and the Reserve Bank of Australia – who took the ‘gently, gently’ approach on fighting inflation – may soon become the first G10 currency-issuing central bank (aside from Japan) forced to hike rates. The AUD has recently been surging in anticipation.

As Dalio explained to Bloomberg, the flipside of a trade imbalance is a capital imbalance. This is because the capital account is – by definition – the inverse of the current account (which includes the trade balance) in the balance of payments. With the USA running record current account deficits in early 2025, it’s a matter of mathematics that foreign investors have to buy US Treasuries for that deficit to be financed. For the US to make progress on reducing its trade deficit (as it has recently), it must also make progress on reducing its capital account surplus. That means fewer Dollars for the rest of the world who – as detailed above – rely on Dollars to conduct trade.

This is the Triffin Dilemma, which also describes why China – with its immense and growing trade surplus – cannot supplant the Dollar’s global role with the CNY. How are you going to get CNY into the hands of other countries unless China runs a trade deficit? Logically – though its appeal as a store of value may be diminishing – the Dollar must remain the global reserve currency because there is no viable alternative. Central governments will not return to a gold standard for the same reason the last vestiges of the gold standard were abandoned in the first place: it would constrain governments’ freedom to engage in deficit spending and create inflation.

Very clearly the world is erecting new barriers to the free movement of goods. With the US embracing a re-invigorated Monroe Doctrine under its new National Security Strategy, it now views the economic affairs of its neighbours in the Western Hemisphere as issues of interest for the United States. This is obvious in the case of Venezuela, and also in the case of the Panama Canal, and was again highlighted over the weekend when President Trump threatened to impose 100% tariffs on all Canadian goods if Canada were to do a trade deal with China.

Canadian PM Carney became the darling of Davos by delivering a speech articulating the changes in the world order and attempting to rally middle powers to band together and stand against great power coercion. Carney was delivering jabs at the United States, but the credibility of his message may have been diminished somewhat by his actions in signing an agreement with China to reduce Canada’s 100% tariff on Chinese EVs in exchange for a reduction in Chinese tariffs on Canadian canola and seafood products.

Speaking to ABC’s This Week, Treasury Secretary Scott Bessent explained the tariff threat by making it clear that Canada’s deal was not acceptable from the perspective of the USA. “We have a highly integrated market with Canada… Goods can cross the border six times during the manufacturing process. And we can’t let Canada become an opening that the Chinese pour their cheap goods into the U.S.”

For now, the geostrategic competition between China and the United States continues to be prosecuted as a trade war but investors may do well to heed Dalio’s warning that punishment in the form of a global capital war is on the horizon. For details on how one part of that might look, see our thoughts on US Dollar stablecoins here.

Tyler Durden

Mon, 01/26/2026 – 12:10ZeroHedge NewsRead More

R1

R1

T1

T1