Conference Board Consumer Confidence Crashes To 12 Year Lows

After Boomers and Gen X dragged The Conference Board Confidence measure down to eight month lows to end 2025, expectations were for a rebound to start 2026.

But, reality was far worse with the headline plunging from 94.2 (revised up from 89.1) to 84.5 (well below the 91.0 expected) – the lowest since May 2014.

The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – plummeted by 9.9 points to 113.7 in January (from an upwardly revised 123.6).

The Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions – tumbled to 65.1 (from 74.6).

Source: Bloomberg

The Expectations Index has now tracked under 80 for 12 consecutive months, the threshold below which the gauge signals recession ahead.

“Confidence collapsed in January, as consumer concerns about both the present situation and expectations for the future deepened,” said Dana M Peterson, Chief Economist, The Conference Board.

“All five components of the Index deteriorated, driving the overall Index to its lowest level since May 2014 (82.2)—surpassing its COVID-19 pandemic depths.”

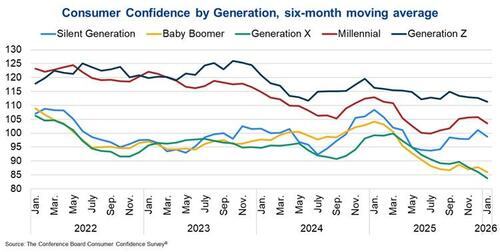

Among demographic groups, confidence on a six-month moving average basis dipped for all age groups in January, although consumers under 35 continued to be more confident than consumers age 35 and older.

Confidence among all generations trended downward in the month, but Gen Z remained the most optimistic of all generations surveyed.

By income, confidence on a six-month moving average basis ticked downward for all brackets, and consumers earning less than $15K remained the least optimistic among all income groups.

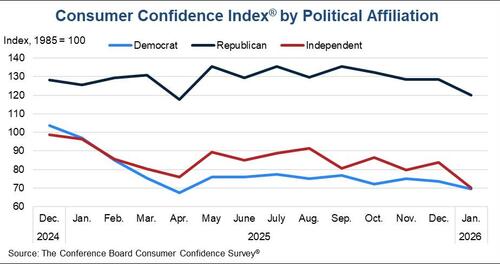

Consumer confidence continued to fade in January among all political affiliations, with the sharpest decline among Independents.

Peterson added:

“Consumers’ write-in responses on factors affecting the economy continued to skew towards pessimism. References to prices and inflation, oil and gas prices, and food and grocery prices remained elevated.

Mentions of tariffs and trade, politics, and the labor market also rose in January, and references to health/insurance and war edged higher.”

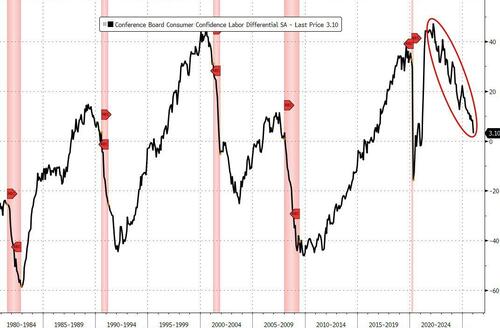

Finally, under the hood, The Conference Board survey shows the trend of a weaker labor market continued to accelerate…

Source: Bloomberg

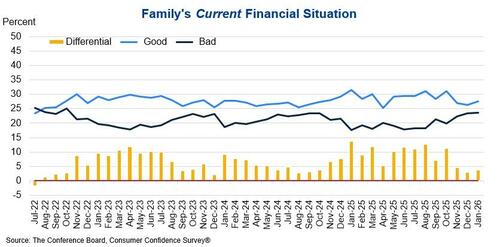

One slight silver lining was that, on net, consumers’ views of their Family’s Current Financial Situation improved slightly in January, after a plunge into negative territory in December was revised upward to reveal a small net positive.

So, the stock market soars near record highs, GDP is ripping, but consumer sentiment is collapsing?

Tyler Durden

Tue, 01/27/2026 – 10:10ZeroHedge NewsRead More

R1

R1

T1

T1