US Home Prices Surged In November As Mortgage Rates Tumble

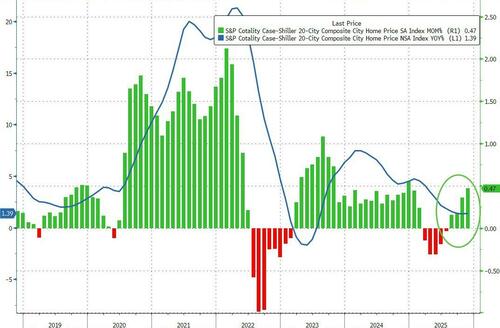

For the fourth straight month, US home prices rose on a MoM basis in November (according to the admittedly lagged and smoothed Case-Shiller data released today). The 0.47% MoM rise is the hottest since Dec 2024

Source: Bloomberg

On a year-over-year basis, there is a very modest inflection higher in the price appreciation (up from +1.32% to +1.39%).

“November’s results confirm that the housing market has entered a period of tepid growth,” said Nicholas Godec, CFA, CAIA, CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices.

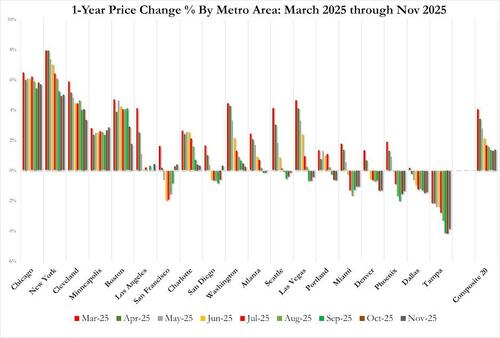

Regional patterns continue to illustrate a stark divergence.

Chicago leads all cities for a second consecutive month with a 5.7% year-over-year price increase, followed by New York at 5.0% and Cleveland at 3.4%.

These historically steady Midwestern and Northeastern markets have maintained respectable gains even as overall conditions cool.

By contrast, Tampa home prices are 3.9% lower than a year ago – the steepest decline among the 20 cities, extending that market’s 13-month streak of annual drops.

Other Sun Belt boomtowns remain under pressure as well: Phoenix (-1.4%), Dallas (-1.4%), and Miami (-1.0%) each continue to see year-over-year declines, a dramatic turnaround from their pandemic-era strength.

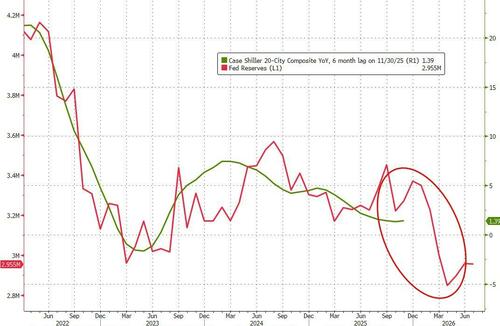

Declining mortgage rates suggest the rebound in aggregate prices could be about to explode…

Source: Bloomberg

However, home price appreciation does seem to track very closely with bank reserves at The Fed (6mo lag), which implies prices are going continue to lag for the next few months…

Source: Bloomberg

Still, November’s data is not exactly what President Trump is looking for from ‘lower rates’ helping his ‘affordability’ message.

Tyler Durden

Tue, 01/27/2026 – 09:05ZeroHedge NewsRead More

R1

R1

T1

T1