Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Winter storm Fern is mostly over, its resulting damage, however, will linger for a long time.

To assess the economic impact of the brutal winter storm, BofA chief economist Aditya Bhave looked back at Winter Storm Viola, which hit the US in February 2021. Both storms put roughly half the country under a winter weather advisory. Consumer spending fell by 0.9% m/m in February 2021, after a 1.3% increase in January. However, this swing probably wasn’t entirely due to Viola: January 2021 spending was also boosted by the passage of the CAA in December 2020, and favorable seasonal adjustments.

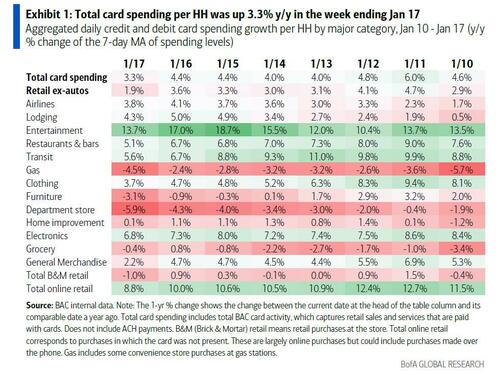

In his analysis Bhave used the latest BofA aggregated credit and debit card data (report available to pro subs) to zoom in on the effect of Viola. Total card spending was down 3.7% y/y in the week ending February 19, 2021, compared to a trend of about +6% y/y in prior weeks.

Accounting for a pickup in card spending growth in the weeks after the storm, the BofA economist estimates that at least 0.6% of spending was lost over a one-month period due to Viola. That’s a little more than a quarter of the Jan-Feb swing in total consumer spending, and works out to about a 0.5% drag on Q1 2021 GDP growth.

The slowdown in total spending due to Viola might have been larger than the impact on BAC card spending, because cash transactions would most likely have taken a bigger hit. Moreover, some of the rebound in spending growth after Viola might have happened for other reasons. Finally, the bank’s estimate above only looks at spending: other components of GDP would also have been affected by Viola.

Accounting for these factors, Bank of America thinks the headwind to Q1 2021 GDP growth from Viola might have been as large as 1.5%, which means that with strategist consensus expecting a roughly 1.5%-2% growth in Q1 before the winter storm, the US economy may be stagnant in the first quarter.

That said, the analogy isn’t perfect as Viola caused significant damage in the South, with extended disruptions to the power grid in Texas. It now appears that Winter Storm Fern won’t be as disruptive, partly because the region is now better prepared. But Fern has resulted in a lot more snowfall in the Northeast, which has a larger concentration of higher-income HHs. So it isn’t clear whether Fern will cause more or less economic damage than Viola.

In any case, BofA’s initial estimate is that the drag on Q1 2026 growth will be in the range of 0.5-1.5%.

The good news is that the bank does not expect any lasting impact on the trajectory of the economy. This means there is as much upside to 2Q GDP growth as there is downside to 1Q.

Tyler Durden

Mon, 01/26/2026 – 21:20ZeroHedge NewsRead More

R1

R1

T1

T1