Despite 2 Dovish Dissents, Fed Holds Rates As Expected; Upgrades Growth, Lowers Labor Risks

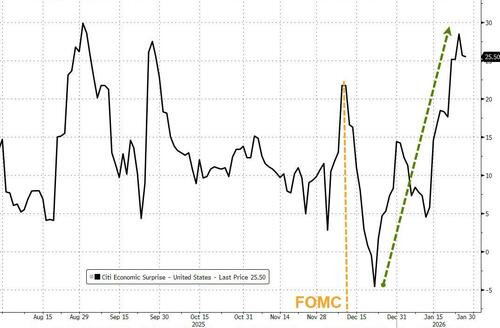

Since the last FOMC meeting on Dec 10th (which resulted in a dovish-er than expected 25bps rate cut and statement), US macro data has surprised significantly to the upside…

Source: Bloomberg

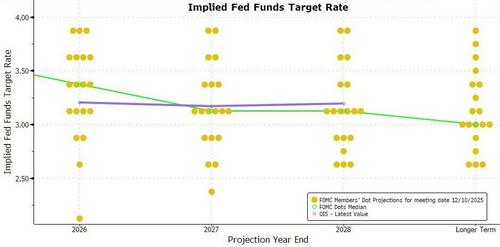

…prompting a plunge in the market’s Fed rate-cut expectations (now below 2x 25bps cuts for the year)…

Source: Bloomberg

The market is now more only modestly more dovish than The Fed’s dots for 2026 (but the market is also not pricing in any more moves from The Fed after that)…

Source: Bloomberg

All of which has sent the dollar tumbling and gold exploding higher (while stocks rallied and bonds sold off)…

Source: Bloomberg

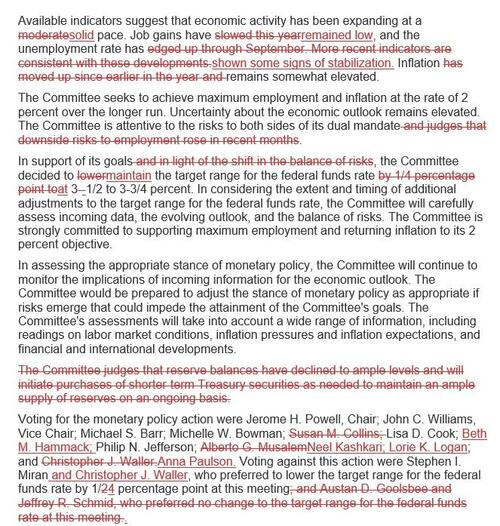

Heading into today’s FOMC statement (and presser), a dramatically wide consensus expects a “boring” and “uneventful” dovish hold with an upgrade to growth, and less downside risk to employment.

…and that’s EXACTLY what we got.

-

*FED VOTES 10-2 TO HOLD BENCHMARK RATE IN 3.5%-3.75% RANGE

-

*FED SAYS GOVERNORS WALLER, MIRAN DISSENT IN FAVOR OF 25 BPS CUT

-

*FED: UNEMPLOYMENT RATE HAS SHOWN SOME SIGNS OF STABILIZATION

-

*FED SAYS ECONOMIC ACTIVITY HAS BEEN EXPANDING AT A SOLID PACE

Will Powell drop any hints about his future on The Fed? Or about his potential replacement (with Rick Rieder now the unexpected favorite across prediction markets)?

Read the full redline of the FOMC Statement below:

Tyler Durden

Wed, 01/28/2026 – 14:00ZeroHedge NewsRead More

R1

R1

T1

T1