Tether To Become “Gold Central Bank” In Post-Dollar World, CEO Ardoino Says

Authored by Danny Park via TheBlock.co,

-

Tether CEO Paolo Ardoino told Bloomberg that he expects the company to become one of the largest gold central banks in the world.

-

The company plans to start trading its gold reserves for additional profit.

-

Tether owns around 140 tons of gold, worth around $23 billion, stored in a nuclear bunker in Switzerland.

Tether CEO Paolo Ardoino said the stablecoin giant is on track to become one of the largest gold central banks in the world and plans to actively trade its reserves, Bloomberg reported Tuesday.

Ardoino told Bloomberg in an interview that he expects the company’s role in the gold market to expand as geopolitical rivals to the U.S. will likely launch a gold-backed alternative to the dollar.

The CEO previously said that gold is “logically a safer asset than any national currency.”

Ardoino reportedly said Tether intends to continue reinvesting its massive earnings into gold.

The company is buying one or two tons of gold per week, and will maintain this pace for “definitely the next few months,” he said.

The stablecoin giant has amassed close to 140 tons of gold, held at a “James Bond-esque” nuclear bunker in Switzerland built during the Cold War.

Bloomberg reported that this is the largest known gold reserve in the world outside of those held by central banks, ETFs, and commercial banks.

“Tether maintains approximately 130 metric tons of physical gold, and the gold backing every XAUT token is held separately, making it eligible for physical delivery redemption,” a spokesperson for Tether told Cointelegraph.

With the recent surge in gold and other metal prices, Tether’s gold holdings are worth over $23.3 billion. As of today, gold’s price stands at approximately $5,234 per troy ounce, continuing its strong rally.

Entering the trading arena

Moving beyond simple reserves, Tether aims to take on banking giants JPMorgan and HSBC by entering the gold trading arena.

“We are soon becoming basically one of the biggest, let’s say, gold central banks in the world,” Tether CEO Paolo Ardoino said.

Ardoino told Bloomberg that Tether is currently assessing the market and potential trading strategies, with plans to actively trade its gold reserves to capture arbitrage opportunities.

The company needs “the best trading floor for gold in the world” in order to continue buying bullion in the long term and to capitalize on potential market inefficiencies, Ardoino said, adding that it is still analyzing the market and potential trading strategies would be structured so the company “remains very long physical gold.”

“Our goal is to have a steady, stable, long-term access to gold,” Ardoino said.

Tether recently recruited two senior HSBC gold traders to spearhead its expansion into the bullion market.

Tether has also aggressively expanded its equity portfolio, acquiring stakes in Canadian-listed firms like Elemental Altus Royalties and Gold Royalty Corp., as precious metals post their strongest rally since the 1970s.

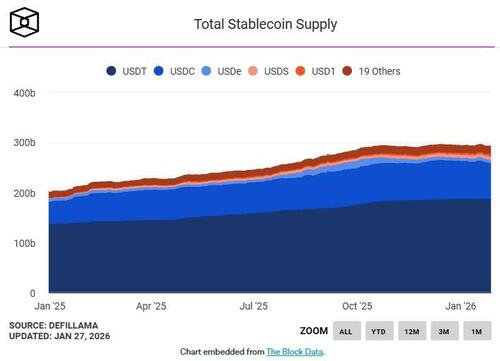

Tether’s staple product, USDT, dominates the global stablecoin market, with over $186 billion in circulation, according to The Block’s crypto price page.

By backing USDT with U.S. dollars, the stablecoin’s success provides Tether with the capital to reinvest in assets like gold to capture further interest and profit.

It also issues Tether Gold (XAUT), which holds over 50% share of the gold stablecoin market with a $2.62 billion market capitalization.

Just earlier this week, Tether officially announced the launch of USAT — its U.S. dollar-pegged stablecoin that is available to U.S. customers, unlike USDT.

This launch follows the appointment of Bo Hines to Tether’s USAT team, bringing expertise and connections from his former role as the White House crypto policy advisor.

Tyler Durden

Wed, 01/28/2026 – 14:45ZeroHedge NewsRead More

R1

R1

T1

T1