WTI Holds Gains After Winter Storm Sparks Biggest Total Inventory Draw Since October

Oil prices hit a fresh four-month high this morning after President Trump threatened another attack on Iran, urging Tehran to negotiate a nuclear deal.

“Hopefully Iran will quickly ‘Come to the Table’ and negotiate a fair and equitable deal,” Trump said in a post on his Truth Social network, adding that “the next attack will be far worse!” than the one that took place last year.

Prices pared gains somewhat after Iran’s mission to the UN repeated in a post on X that it stands ready for dialogue based on mutual respect and interests, but said it will “defend itself and respond like never before,” to US aggression.

API

-

Crude -247k

-

Cushing -92k

-

Gasoline -415k

-

Distillates +2.01mm

DOE

-

Crude -2.295mm (+1.95mm exp)

-

Cushing -278k

-

Gasoline +223k

-

Distillates +329k

Total crude and fuel stockpiles fell last week for the first time since early December led by a surprise crude draw (bigger than the small one reported by API)…

Source: Bloomberg

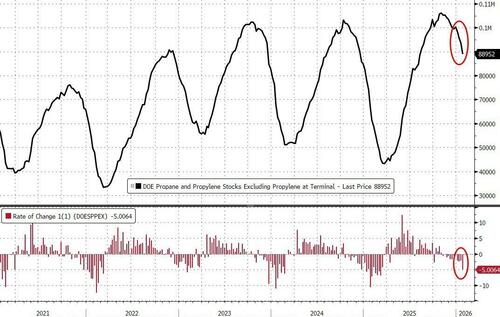

Bloomberg reports that the 6 million barrel draw (which was the biggest since October) was led by a decline in crude inventories and also the biggest drop in propane inventories since early last year ahead of the big freeze.

Crude production fell to 13.7 million barrels a day last week, down by 36,000 barrels a day from the previous week. The drop may reflect the initial impact of the winter storm that hit the US in recent days and came as the number of rigs drilling for oil edged higher for a second week, with 1 unit put into operation last week, according to Baker Hughes.

Source: Bloomberg

WTI is holding on to early gains after the surprise draw…

Finally, circling back to the start, the potential risk to Iranian supplies has injected a premium into oil prices and led futures to start the year on a strong footing, up more than 10% this month, despite forecasts for a glut. That has also kept the cost of bullish options high relative to bearish ones.

“Market sentiment appears to be gradually turning more positive, as the bearish oversupply narrative so prevalent in the second half of 2025 weakens,” Standard Chartered analysts including Emily Ashford wrote in a note.

“We envisage an uptick in volatility and increasing focus on both supply and demand risks.”

The prompt spread for both oil benchmarks — the difference between their two nearest contracts — has widened in a bullish backwardation structure over the course of this month, indicating tighter supply.

Tyler Durden

Wed, 01/28/2026 – 10:42ZeroHedge NewsRead More

R1

R1

T1

T1