US Producer Prices Unexpectedly Surged In December

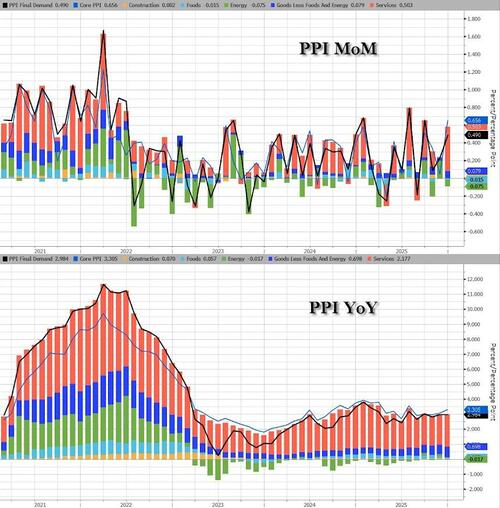

Following the cooler than expected Consumer Price Inflation, Producer Prices came in considerably hotter than expected at the headline level in December. PPI rose 0.5% MoM (vs +0.2% MoM exp), lifting headline PPI to +3.0% YoY.

Source: Bloomberg

Services costs dominated the rise in the headline PPI (not Goods – which would be affected by tariffs).

Source: Bloomberg

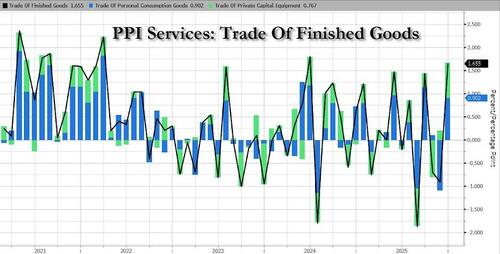

Final demand services: The index for final demand services advanced 0.7 percent in December, the largest increase since moving up 0.9 percent in July. Two-thirds of the broad-based December rise in prices for final demand services can be traced to a 1.7-percent jump in margins for final demand trade services. (Trade indexes measure changes in margins received by wholesalers and retailers.) The indexes for final demand services less trade, transportation, and warehousing and for final demand transportation and warehousing services also moved up, 0.3 percent and 0.5 percent, respectively.

- Product detail: Over 40 percent of the December increase in prices for final demand services can be traced to a 4.5-percent rise in margins for machinery and equipment wholesaling. The indexes for guestroom rental; food and alcohol retailing; health, beauty, and optical goods retailing; portfolio management; and airline passenger services also advanced. Conversely, prices for bundled wired telecommunications access services fell 4.4 percent. The indexes for automotive fuels and lubricants retailing and for long-distance motor carrying also moved lower.

Services costs jumped as a measure of trade profit margins surged by the most since mid-2024.

Source: Bloomberg

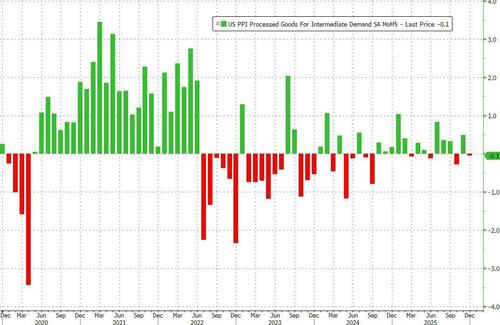

Final demand goods: Prices for final demand goods were unchanged in December following a 0.8-percent increase in November. In December, a 0.4-percent advance in the index for final demand goods less foods and energy offset declines in prices for final demand energy and for final demand foods, which fell 1.4 percent and 0.3 percent, respectively.

- Product detail: Within final demand goods in December, the index for nonferrous metals moved up 4.5 percent. Prices for residential natural gas, motor vehicles, soft drinks, and aircraft and aircraft equipment also increased. In contrast, the index for diesel fuel dropped 14.6 percent. Prices for gasoline, jet fuel, beef and veal, and iron and steel scrap also decreased.

Source: Bloomberg

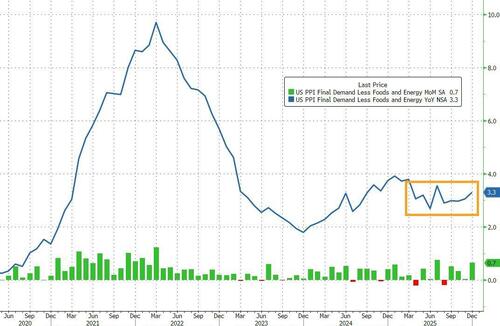

Interestingly, PPI Energy costs dipped (as did CPI), but remain notably elevated from six months ago, despite the price of energy actually being dramatically lower.

Source: Bloomberg

The problem for the incoming Fed Chair is though, as the chart shows, energy costs have started to rise rapidly since the last macro data.

Core PPI (ex Food and Energy) surged even more – up 0.7% MoM (vs +0.2% MoM exp), pulling the core up 3.3% YoY…

Source: Bloomberg

That is the biggest MoM jump since July 2025 (and second biggest MoM jump since March 2022) and the YoY figure is inflecting higher.

While elevated relative to the Fed’s mandate, there remains no sign of the runaway tariff hyperinflation that Democrats had ‘priced in’ to their survey responses (and establishment economists were convinced were imminent).

Tyler Durden

Fri, 01/30/2026 – 08:44ZeroHedge NewsRead More

R1

R1

T1

T1